The results for RealRate’s 2023 ranking for U.S. Savings are now available and ranked by financial strength!

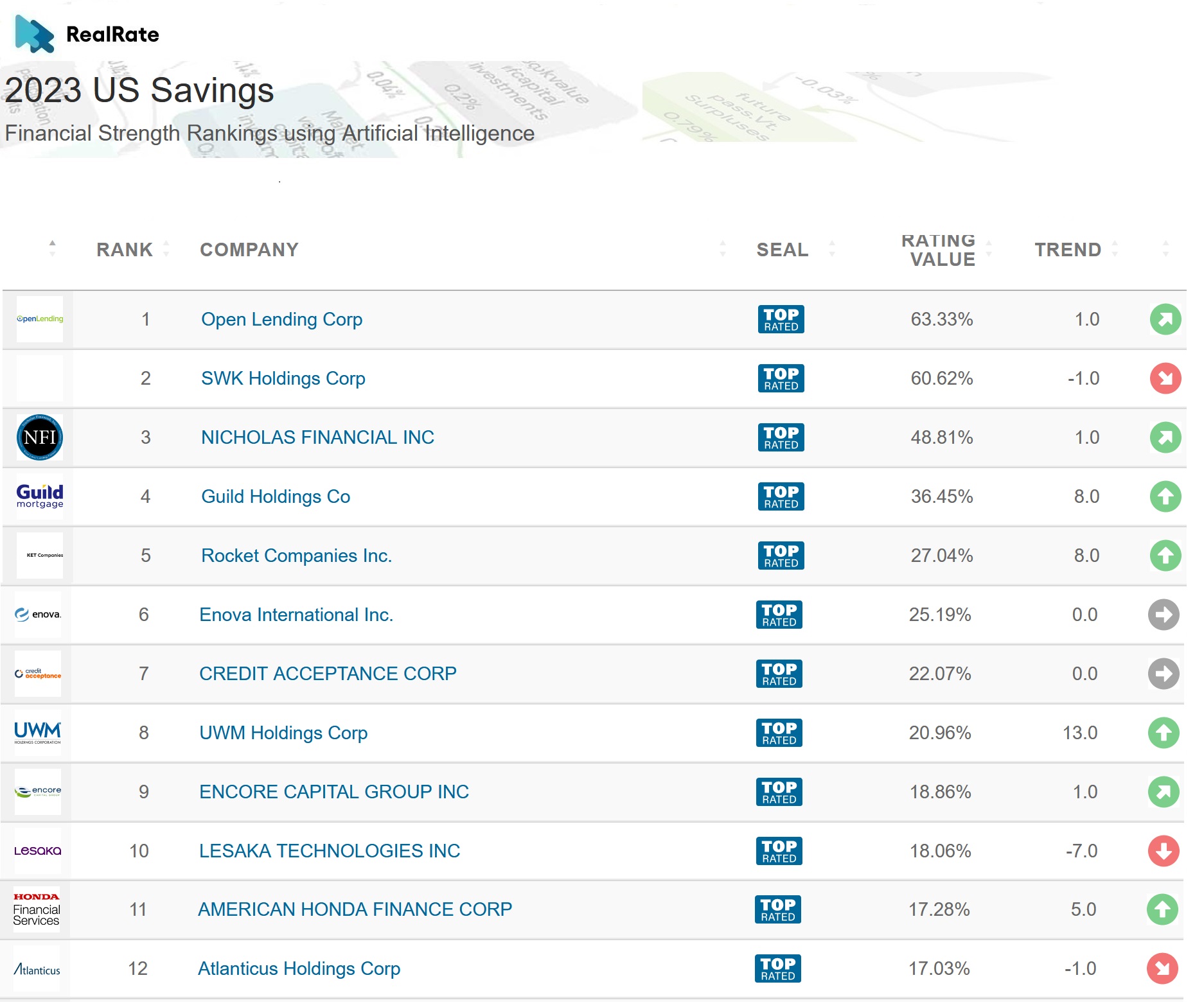

The Top 12 Savings companies are as follows:

Source: https://realrate.ai/rankings/

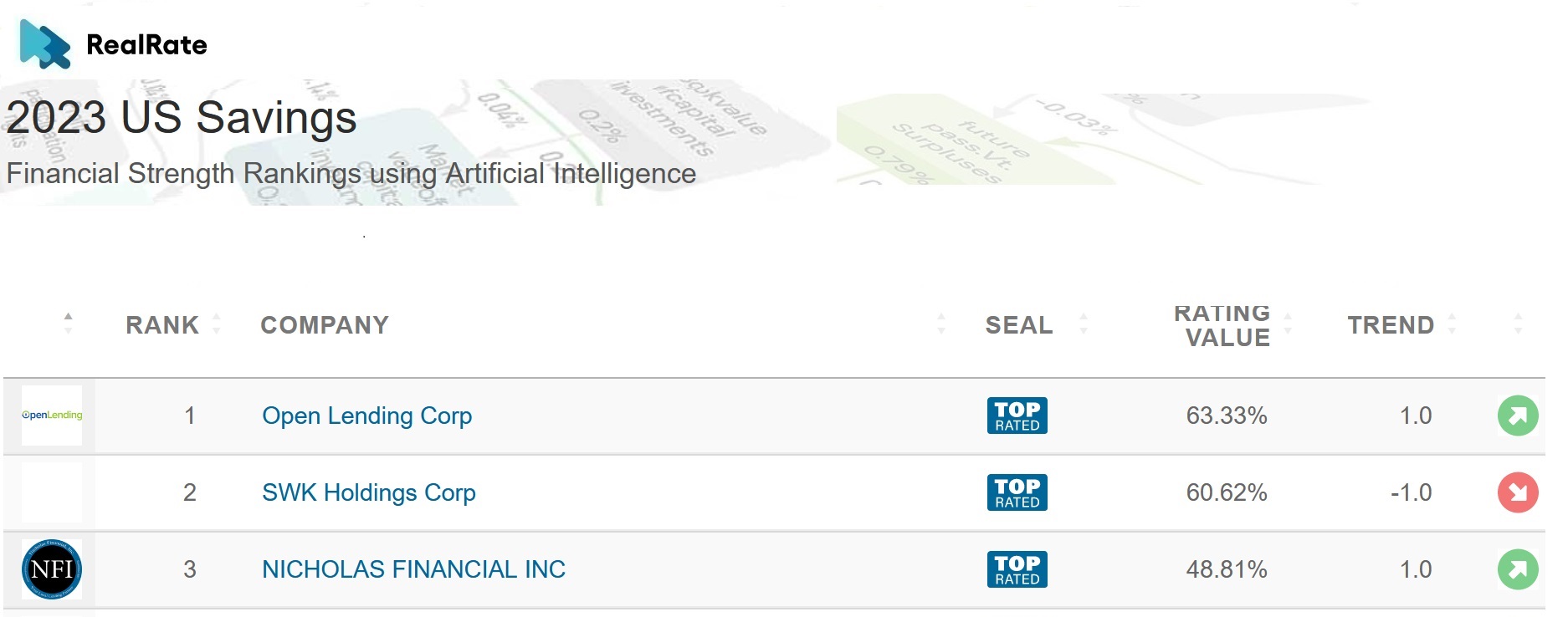

The top 3 Savings companies in order are Open Lending Corp., SWK Holdings Corp., and Nicholas Financial Inc.

They had Economic Capital Ratio figures of 63%, 61%, and 49%, respectively.

Open Lending did well due to its strong Other Revenues variable, which increased its Economic Capital Ratio figure by 59%. SWK Holdings and Nicholas Financial did well due to the Other Assets variable. This increased the companies’ Economic Capital Ratio scores by 98% and 47%, respectively.

Open Lending and SWK Holdings swapped places in the last year and Nicholas Financial was 4th last year.

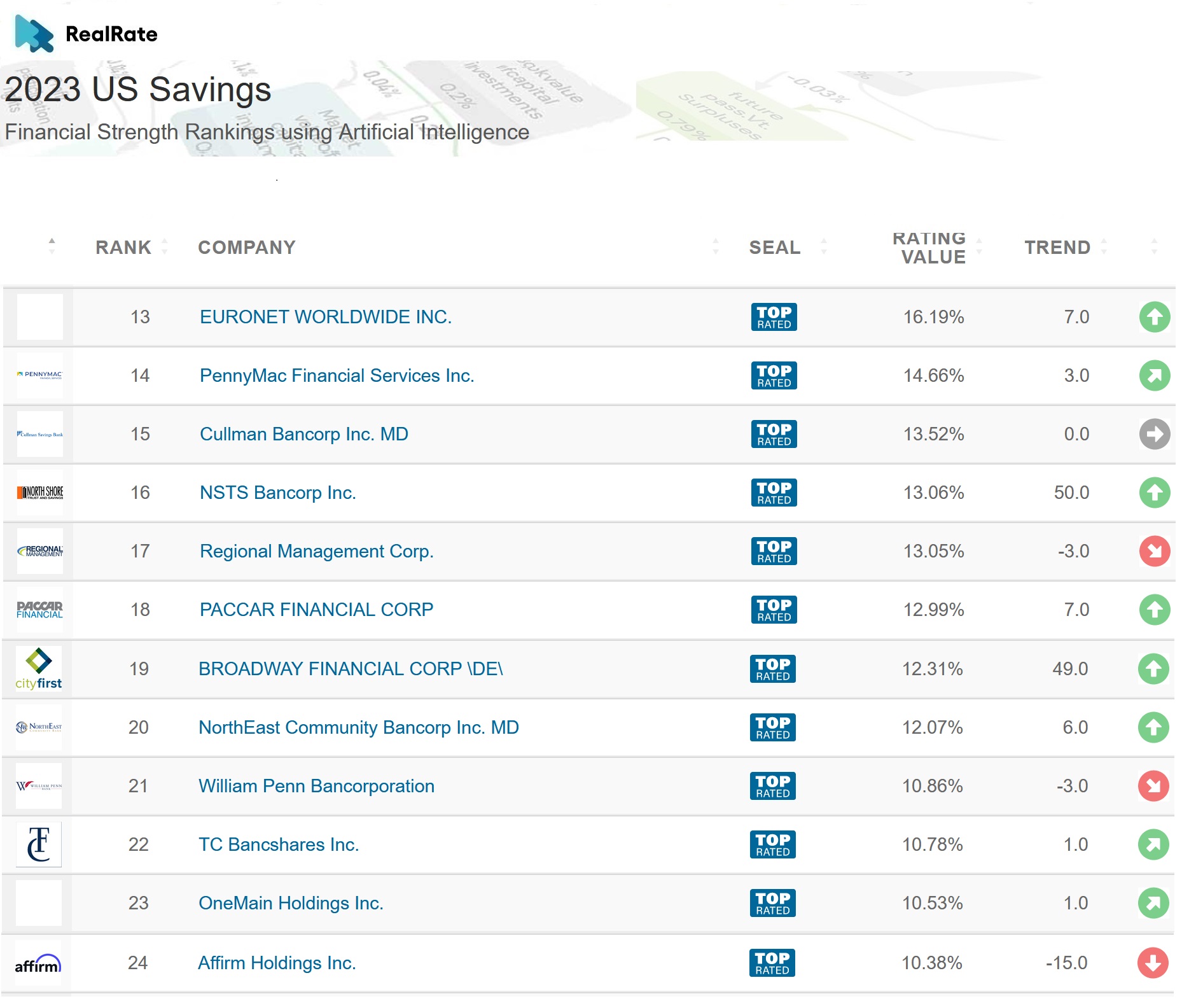

From a total of 96 Savings companies, 24 received our ‘Top Rated’ award.

Source: https://realrate.ai/rankings/

Source: https://openai.com/dall-e-3/

The next 12 Savings companies are as follows:

Source: https://realrate.ai/rankings/

The American savings industry encompasses a wide array of financial institutions, from traditional banks to online savings platforms. In recent years, revenue figures have surged, with total savings deposits reaching approximately $10 trillion.

This growth is driven by competitive interest rates, digital banking innovations, and increased consumer awareness of financial planning.

The incredible thing we do here at RealRate is to deliver fair and independent ratings, bringing together expert knowledge with innovative artificial intelligence.

It is our AI model that computes the all-important Economic Capital Ratio figure. This is completely unbiased and uses only audited public data. We are not part of any savings company.

We are fair and explainable, avoiding any conflicts of interest.

Image Source: https://openai.com/dall-e-3/