BTCS, Destiny Media Technologies, and GRID Dynamics Surge to the Top in RealRate’s Rankings

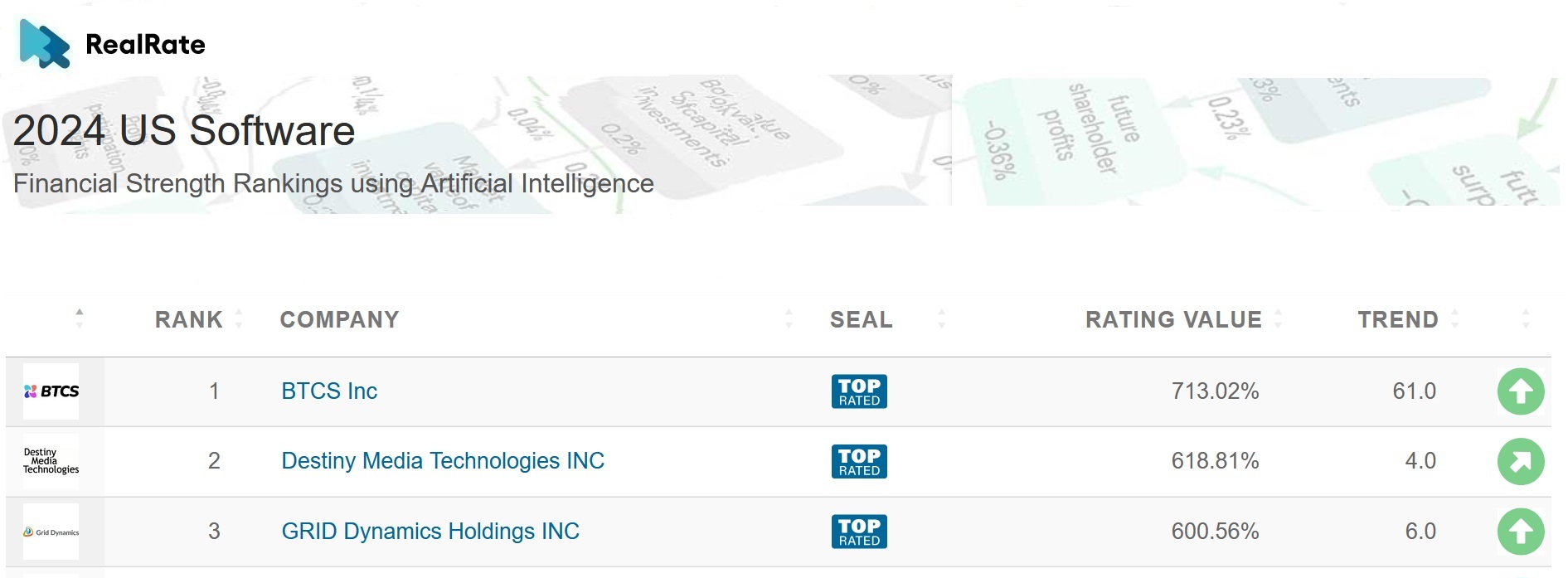

RealRate’s AI-powered ratings for 2024 crowned three standout companies in 2024:

Source: https://realrate.ai/ranking-area/2024-us-software/

RealRate’s 2024 Economic Capital Ratio (ECR) rankings spotlight the most financially robust firms. ECR measures a company’s economic value relative to its assets, enabling comparability across companies of all sizes.

BTCS Inc., a blockchain technology-focused company, leads the pack with an ECR of 713%. Its financial strength comes from extremely low liabilities and a large equity buffer compared to its total assets. Its main asset was a strong Stockholders Equity score, which increased its ECR by 335 percentage points.

Destiny Media Technologies, a digital media distribution provider, ranks second with an ECR score of 619%. It benefits from an efficient balance sheet, showing elevated levels of equity and minimal debt, which RealRate’s model rewards significantly. Its strongest score was Liabilities, which increased its ECR by 285 percentage points.

GRID Dynamics Holdings Inc., a digital transformation services provider, rounds out the top three with an ECR of 601%. Strong fundamentals and consistent earnings help maintain its prominent position. Likewise, its strongest score was Liabilities, which increased its ECR by 285 percentage points.

The average ECR for the entire ranking is 358%.

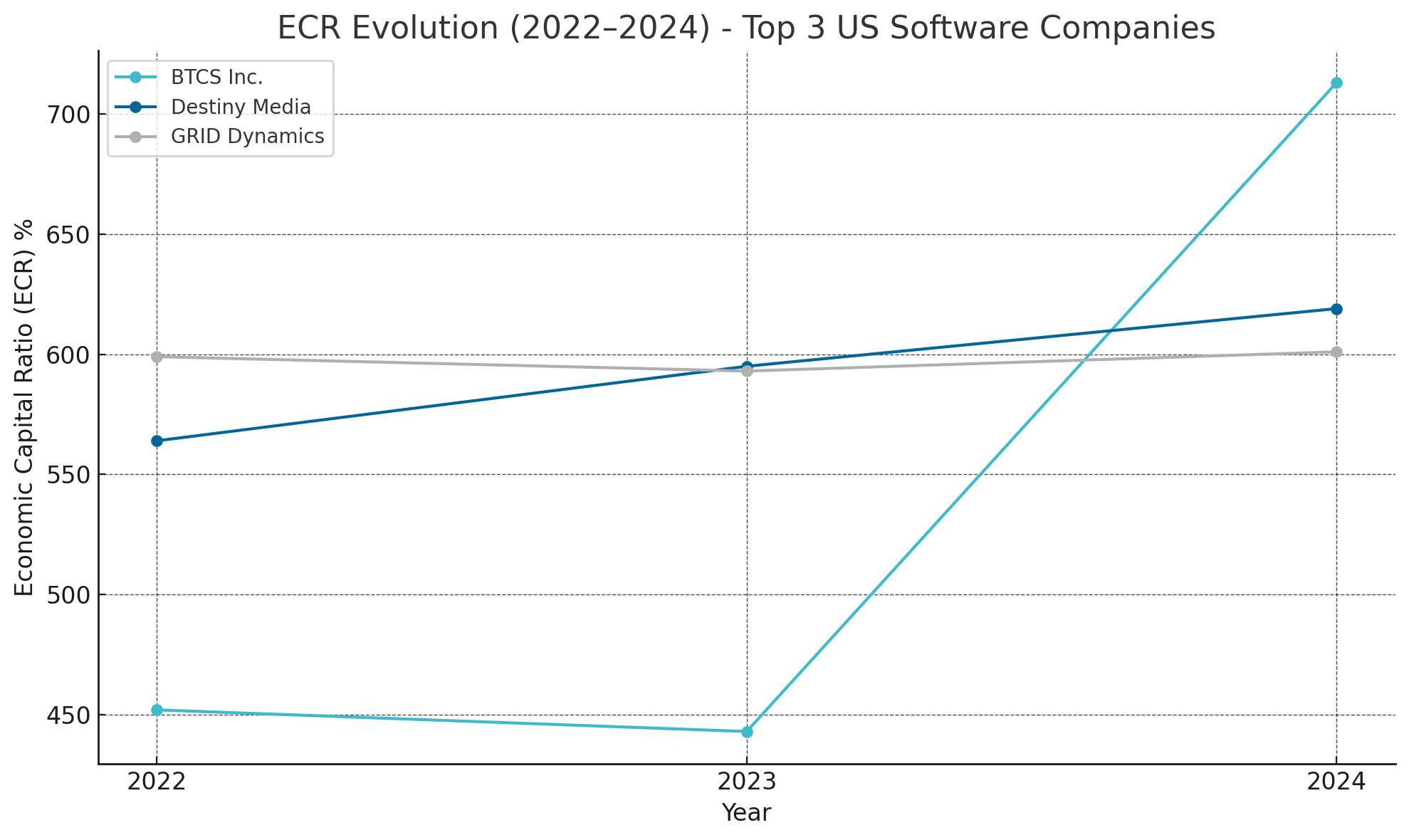

Here is the first graph showing the ECR evolution (2022–2024) for BTCS Inc., Destiny Media, and GRID Dynamics. You can see their steady improvement, culminating in their top ranks for 2024.

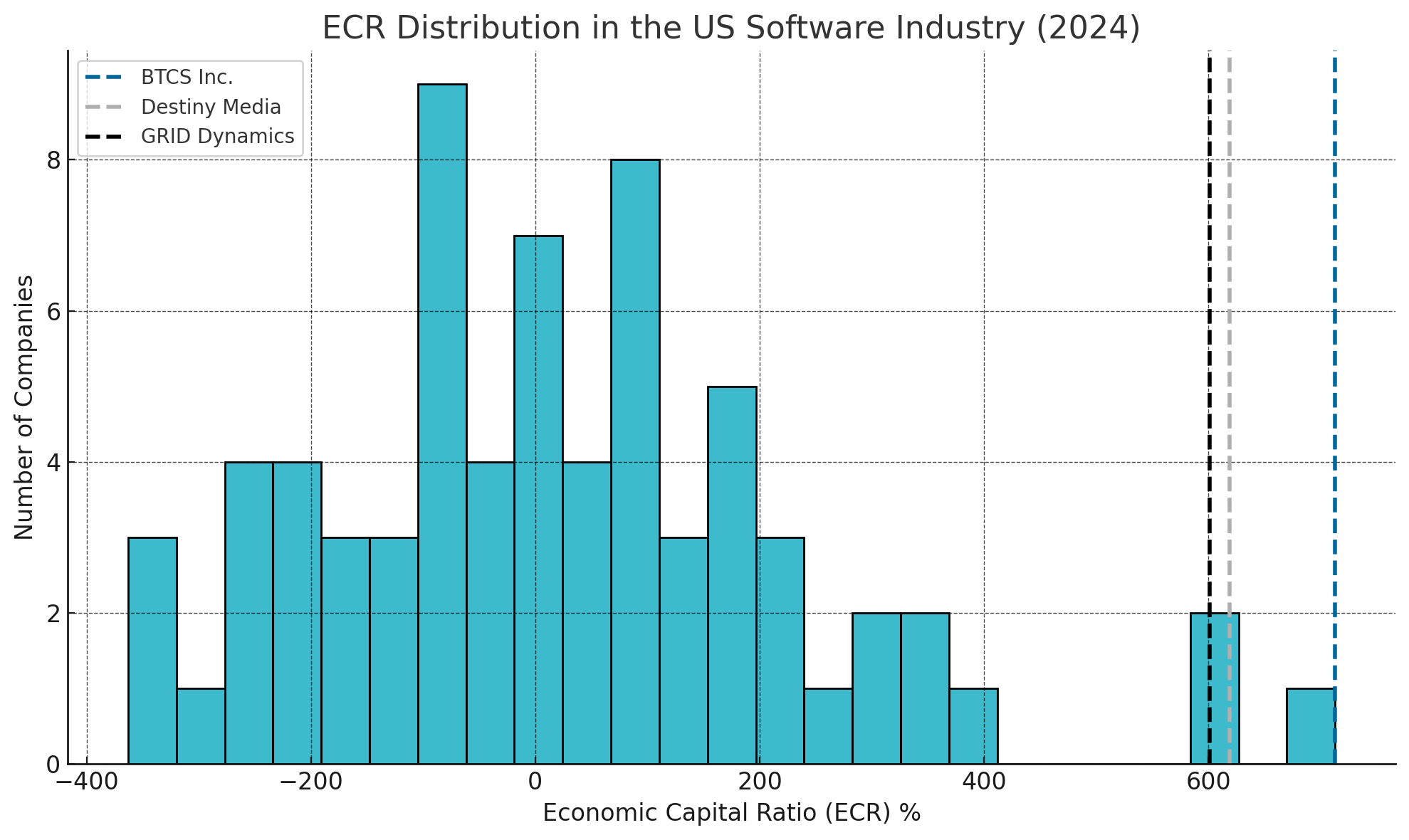

Here is the histogram illustrating the ECR distribution for the U.S. Software industry in 2024. You can clearly see how BTCS Inc., Destiny Media, and GRID Dynamics stand out as financial outliers far above the industry average.

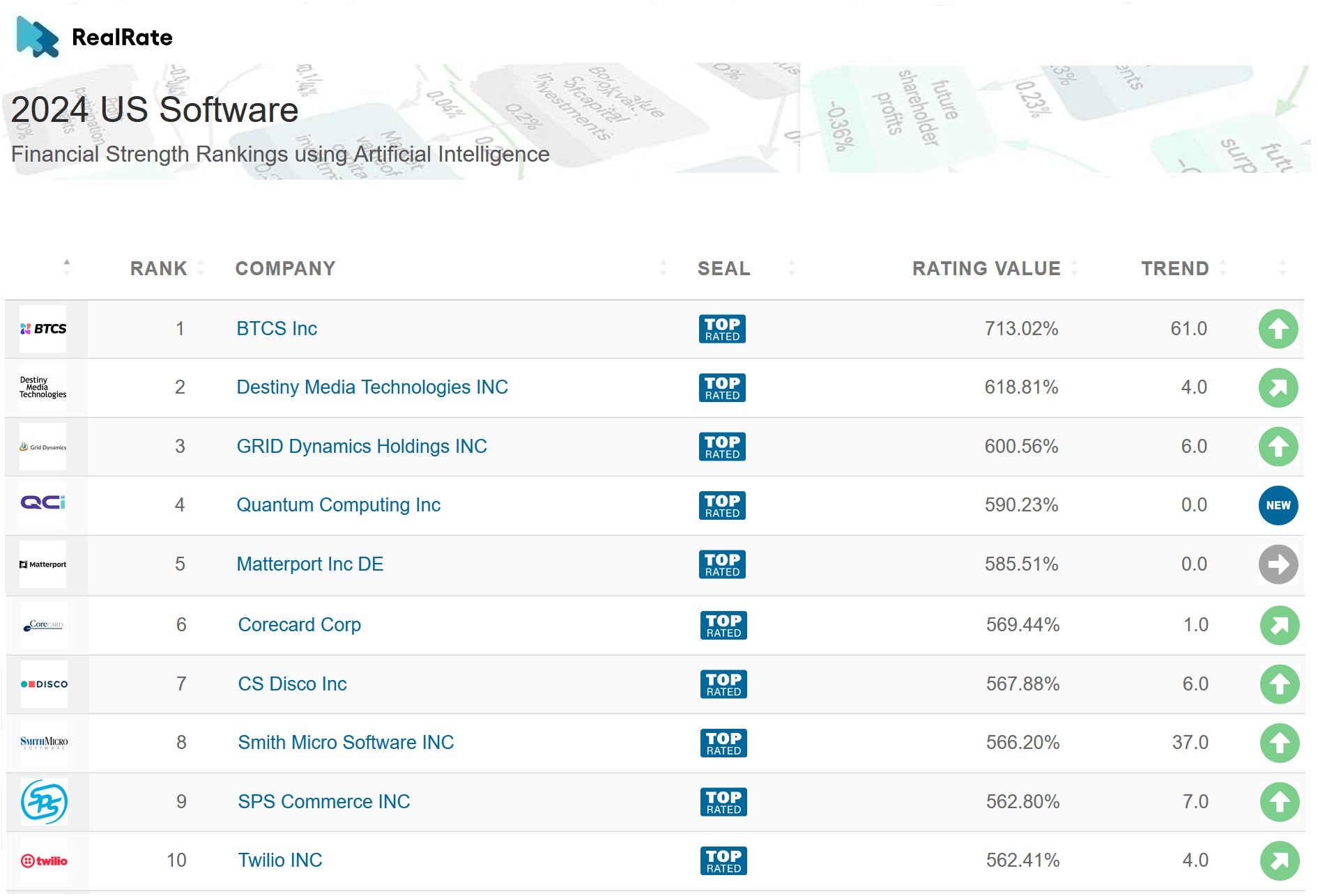

The Top 10 companies are as follows:

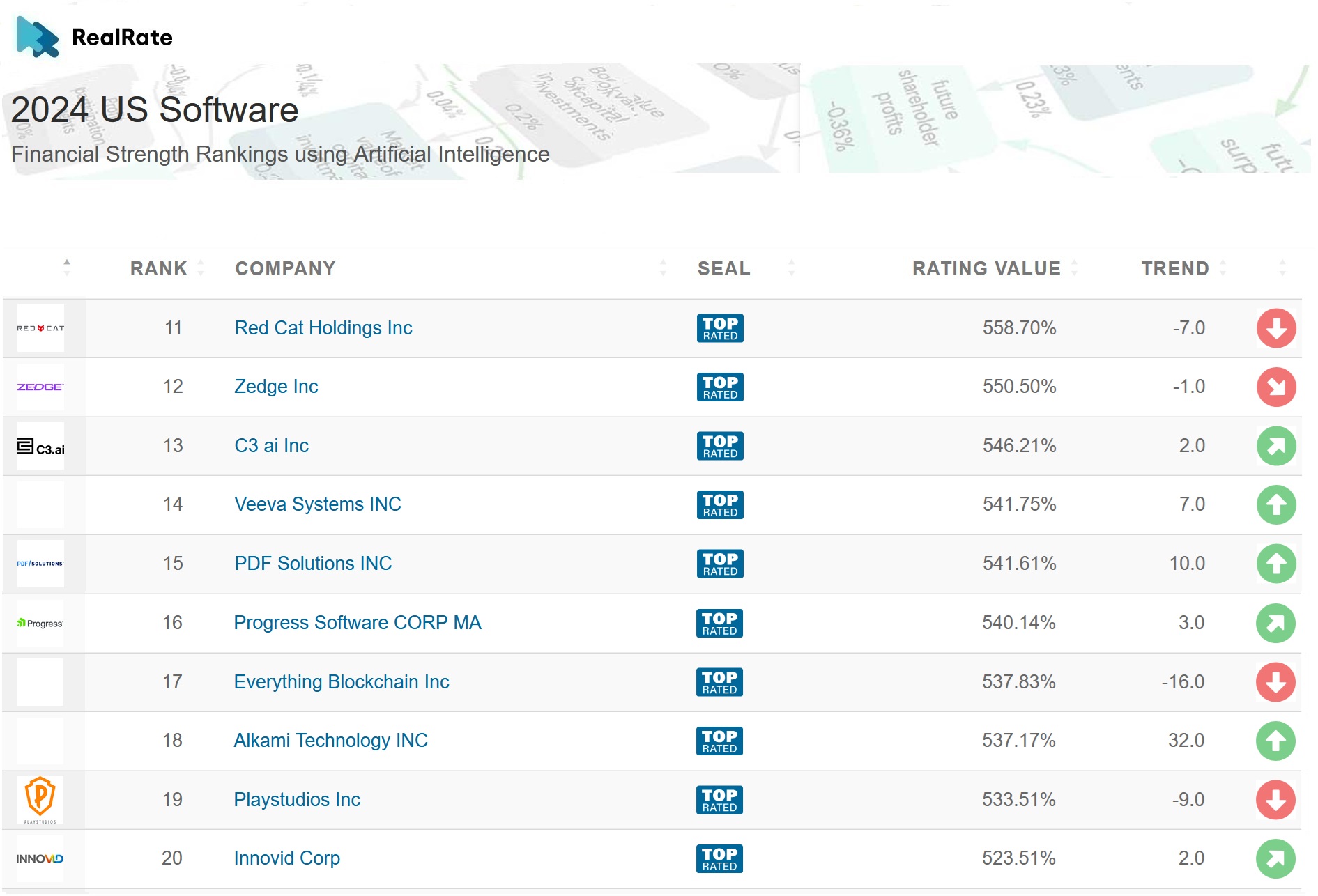

The next 10 companies in the ranking are:

The complete ranking includes 156 Software companies, of which 39 achieved the sought-after ‘Top-Rated’ seal.

What Changed Since Last Year?

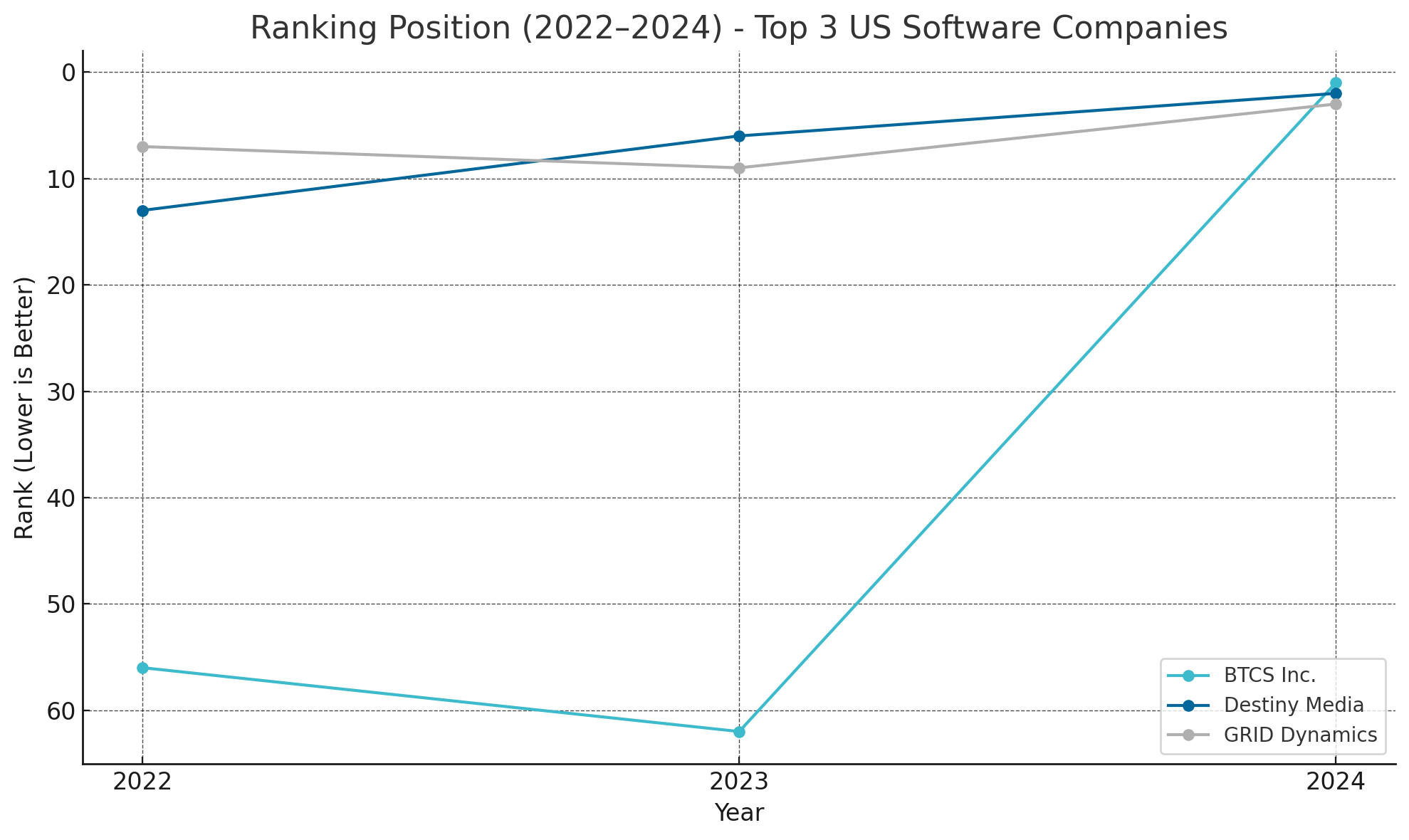

BTCS Inc. has delivered the most dramatic transformation in the rankings. Leaping 61 places from #62 in 2023 to #1 in 2024, BTCS benefitted from maintaining extremely low liabilities and boosting its equity capital. Its blockchain-focused business model operates with minimal debt exposure, which supercharged its ECR to 713%.

Destiny Media Technologies also rose rapidly—from #6 in 2023 to #2 in 2024, after ranking #13 in 2022. This growth reflects continued improvements in capital structure and consistent revenue growth with minimal costs. The company’s lean operational model has kept expenses low while improving profitability.

GRID Dynamics Holdings Inc. climbed from #9 in 2023 to #3 in 2024, building on steady fundamentals. Ranked #7 back in 2022, its movement shows stable management of balance sheet assets and increasing competitiveness in the digital transformation space.

Multi-Year Ranking Evolution

Here is the second graph showing the ranking positions (2022–2024) for BTCS Inc., Destiny Media, and GRID Dynamics. All three show a clear upward trend, with BTCS climbing to the #1 spot in 2024.

The three companies illustrate different growth trajectories but converge at the top in 2024 through superior capital efficiency.

Notable Movers

VPR Brands LP climbed 102 positions from 184 to 82 due to its excellent Liabilities.

Carecloud Inc. lost 64 positions, from 24 to 88, due to its poor Assets score.

Quantum Computing Inc. entered the 2024 ranking at rank 4, making it the best newcomer.

Industry Overview

The average ECR across the industry is 358%, with a broad spread ranging from +713% (BTCS Inc.) to 37% (Webstar Technology Group Inc.). Industry-wide totals remain strong: over $500 billion in revenue and over $500 billion in shareholder equity.

Financial Drivers of the Top 3

- BTCS Inc.: Its strongest factor was minimal current liabilities, boosting the ECR. Intangible assets contributed slightly negatively.

- Destiny Media: Gained from lean operations and high equity levels. Selling costs were minimal, adding to efficiency.

- GRID Dynamics: Showed strength in asset quality and maintained low operating expenses, contributing to a high ECR.

Conclusion

RealRate’s 2024 rankings spotlight firms that are not just growing but doing so with financial discipline. BTCS Inc. made the year’s most dramatic leap by optimizing its balance sheet. Destiny Media and GRID Dynamics showed steady ascents, driven by revenue growth, lean costs, and asset efficiency. These companies prove that in today’s software economy, robust capital management can separate leaders from laggards, and, as software demand continues to grow, these firms are poised to capitalize on future opportunities.

The U.S. Software industry generated over $489 billion in 2023, reflecting strong momentum driven by AI, cloud computing, and SaaS expansion infused digital transformation. According to RealRate’s 2024 Economic Capital Ratio (ECR) rankings, financial strength is becoming a key differentiator. ECR, which compares a firm’s economic capital to its assets, offers a fair cross-size assessment of solvency and balance sheet quality.

The American software sector is thriving. In 2023, it posted $489 billion in revenue. Fueled by digital innovation, demand for SaaS, and AI-driven transformation, the sector is expected to surpass $510 billion in 2025.

RealRate’s financial strength rankings reflect this dynamic landscape, where capital efficiency and balance sheet quality set leaders apart.

Amid this rapid growth, three companies have stood out for exceptional financial resilience: BTCS Inc., Destiny Media Technologies, and GRID Dynamics Holdings Inc.