Financial Health of Germany’s Construction Sector – 2024 Rankings and Insights

The financial health of German construction industry 2024 has been analyzed by RealRate’s 2024 Financial Strength Rating, revealing striking winners and losers. RealRate’s Economic Capital Ratio (ECR) – a measure of a company’s economic value divided by its total assets – allows big and small builders to be compared on equal footing. An ECR above 100% means a firm’s equity far exceeds its assets (a sign of exceptional strength), whereas a negative ECR indicates liabilities outweigh assets (a dire warning sign). In a year marked by economic challenges, the average ECR for German construction companies stands at about 107%, but the range is wide – from robust positives to alarming negatives. This article highlights the top performers of 2024, analyzes trends over recent years, and explains what drives financial success (or struggle) in the construction sector. We also explore how factors like equity, debt, revenue, and costs each contribute to a company’s score, using RealRate’s latest data and graphs.

Top 3 Construction Companies of 2024 – Financially the Strongest

RealRate’s 2024 ranking assessed 84 German construction firms by financial strength. The Top 3 companies this year – each earning a “Top Rated” award – truly stand out for their stellar ECR values:

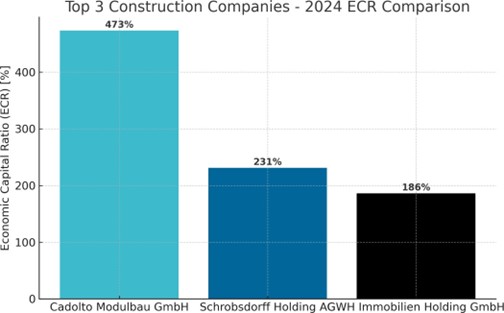

Figure 1: The top three German construction companies in 2024 by Economic Capital Ratio (ECR). Higher ECR indicates greater financial strength (equity relative to assets). Cadolto Modulbau leads by a wide margin.

• 1. Cadolto Modulbau GmbH – ECR 473% (Rank 1): Cadolto, a specialist in modular construction, emerged as the clear champion in financial strength. An ECR of 473% means Cadolto’s equity is nearly 4.7 times its total assets, an astounding figure. This suggests the company built up a huge cushion of equity – largely thanks to extraordinary profits in the latest year – making it extremely robust. Cadolto leaped to first place from a much lower rank previously, indicating a remarkable turnaround (as recently as a few years ago it was near the bottom of the rankings!). Its 2024 performance reflects exceptional profitability and prudent financial management.

• 2. Schrobsdorff Holding AG – ECR 231% (Rank 2): Last year’s number one, Schrobsdorff Holding, now holds second place. An ECR of 231% is still impressively high – the company’s equity more than doubles its assets. Schrobsdorff is a general contractor known in Berlin, and its solid ranking underscores a very strong balance sheet with low debt levels. However, its ECR dipped from the astronomical heights of the previous year (when a one-off gain had propelled it above 10,000% – a figure so high it skewed last year’s industry average!). In 2024, Schrobsdorff’s finances normalized: it still enjoys healthy equity and profit, but higher costs have trimmed its margins. The firm remains financially sound, just not as “off-the-charts” as before.

• 3. GWH Immobilien Holding GmbH – ECR 186% (Rank 3): Climbing into the top three is GWH Immobilien Holding, a real estate and construction group. With an ECR of 186%, GWH’s equity is about 1.86 times its assets – a strong indicator of stability. GWH improved from 7th place last year to 3rd this year, reflecting improved financial metrics and possibly more conservative financing. The company’s strengths lie in its solid equity base and manageable liabilities. While its profit levels are good (and boosted its ECR), they were not as spectacular as Cadolto’s – hence the gap between rank 3 and the leaders. Still, GWH’s consistent balance sheet strength has earned it a well-deserved top spot among the elite.

These top three firms vastly outperform the average company. For perspective, the industry average ECR is 107%, and many companies are clustered near that or lower. The Figure 1 bar chart above shows just how far ahead Cadolto in particular is – its bar towers above the others. This means Cadolto currently holds an enviable financial “safety net” compared to peers.

Analysis of Strengths and Weaknesses of Top Companies

Digging into RealRate’s analysis of financial statements, we can identify the key factors that boosted the top companies’ ECRs. RealRate’s model evaluates multiple balance sheet and profit-and-loss variables for each firm, calculating how each one deviates from the industry average and thus increases or decreases the company’s ECR. A positive “effect” means that aspect is better than average (helping the score), while a negative effect means it’s a relative weakness (dragging the score down). Here are the primary strengths of the top 3 companies:

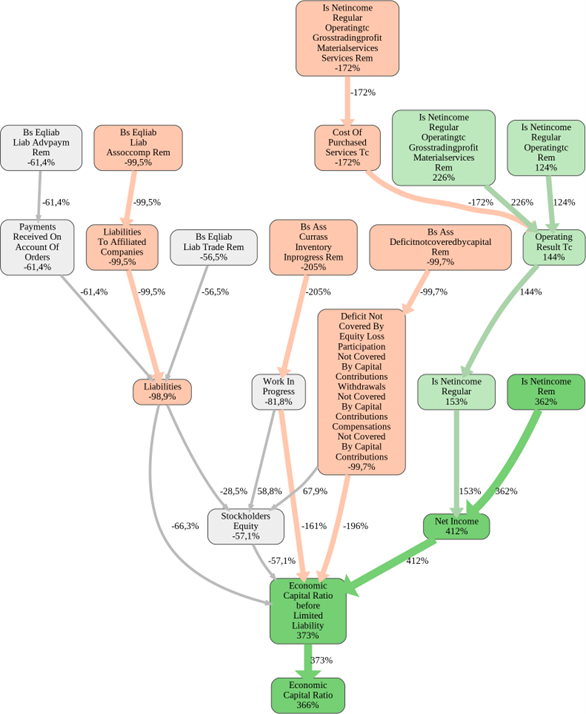

Cadolto Modulbau GmbH:

It will come as no surprise that Cadolto’s greatest strength was its Net Income. According to RealRate, Cadolto’s net income was so high that it increased the company’s ECR by a whopping 412 percentage points above the norm. In other words, profitability was off the charts – a huge competitive edge. Cadolto likely enjoyed a surge in revenue from completed modular building projects, combined with controlled costs, yielding an exceptional profit. This profit directly bolstered equity (as retained earnings), hence the sky-high ECR. Additionally, Cadolto’s operating result (profit from operations) was extremely strong, indicating core business efficiency. In summary, Cadolto did what every company aims to do – generate extraordinary profit relative to its size.

For Cadolto, the biggest weakness was “Work in Progress” inventory, specifically ongoing projects on the balance sheet. Cadolto had a large amount of unfinished construction work (projects in progress) and associated advance payments from clients. In accounting, customer prepayments are recorded as liabilities (since the work isn’t complete yet), and work in progress is an asset. In Cadolto’s case, the advance payments were so large that they effectively reduced the net asset value. RealRate notes that “Inventories (Work in Progress) minus Payments Received” dragged Cadolto’s ECR down by 205 percentage points. Essentially, if you strip out the effect of those giant advance payments, Cadolto’s ECR might have been even higher. This is typical in construction – companies often finance projects via customer deposits, which temporarily inflate liabilities. For Cadolto, it’s a weakness in the model’s eyes because it means not all assets are funded by equity. Of course, once those projects are finished, revenue is recognized and those liabilities disappear – as they likely did, fueling Cadolto’s profit! But at the snapshot in time, it was a negative factor.

Figure 2 : Cadolto Modulbau GmbH’s financial graph

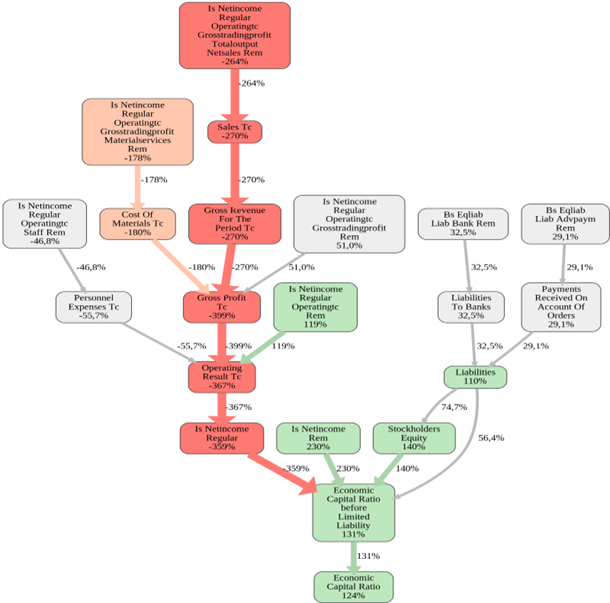

Schrobsdorff Holding AG:

For Schrobsdorff, the biggest strength was also Net Income, contributing about +230 percentage points to its ECR. Schrobsdorff has been consistently profitable; even after its extraordinary prior year, it maintained solid earnings. Another strength is Stockholders’ Equity itself – Schrobsdorff carries a high equity buffer (built over years of retained profits). This firm has comparatively low debt and high reinvested earnings, so equity forms a big chunk of its financing. That translates into a higher ECR inherently. We also see Schrobsdorff benefitting from strong cash reserves and moderate receivables – indicating good liquidity management. Overall, Schrobsdorff’s financial strength is rooted in steady profitability and a conservative balance sheet.

Figure 3 : Schrobsdorff’s detailed financial analysis graph

For Schrobsdorff, their gross profit margin was the biggest weakness, cutting the company’s ECR by 399 points. It was below the industry’s average, significantly knocking down its ECR even though they managed to maintain profitable.

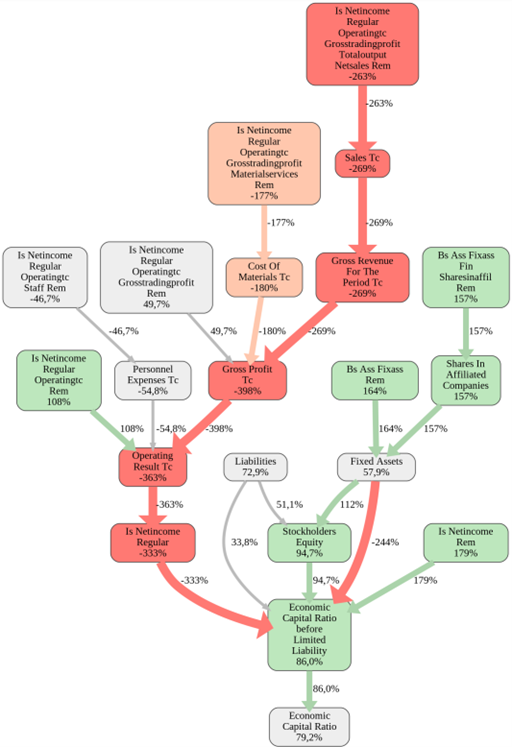

GWH Immobilien Holding GmbH:

GWH’s top strength, like the others, is Net Income. It added roughly +179 points to GWH’s ECR, meaning the company’s profit was well above the average proportionally. GWH isn’t as profit-driven an outlier as Cadolto, but it reliably earns more than it spends. Equally important, GWH’s Liabilities are relatively low – in fact, having lower debt than peers gave it a +73% ECR boost due to reduced financial risk. GWH also benefits from significant long-term investments (it has substantial assets like shares in affiliated companies, which RealRate noted as a strength). These investments likely yield returns or underpin its equity. In essence, GWH’s balanced approach of solid profits, low debt, and strategic assets makes it a financially sturdy player.

However, major negative factor for GWH is also Gross Profit Margin, cutting its ECR by 398 points. This indicates that high construction costs (materials, subcontractors, etc.) eroded their margins. In the construction business, tight margins are common, especially with rising material prices in recent years. Even though Schrobsdorff and GWH remained profitable overall, their cost of materials was high relative to revenue, resulting in lower gross profits than some peers. This is a vulnerability: if a company’s projects are not priced to sufficiently cover costs, or if unexpected cost overruns occur, gross profit suffers. If Schrobsdorff and GWH had average industry margins, their ECRs would be even higher than they are.

It’s evident that profitability (high netincome) is the common theme among all top performers. In RealRate’s model, profit-related metrics have the largest impact on ECR – a big net profit directly raises equity, which directly improves ECR. Companies that managed to stay very profitable in 2024 shot up the rankings. On the other hand, common weaknesses of the industry include low profit margins, high personnel expenses, high debt levels, and low cash reserves. In RealRate’s model, having higher liabilities than the industry norm is a big negative – it directly reduces ECR. Many companies that scored poorly have heavy debt loads or thin equity, making their ECR low or even negative.

Financial Profiles of the Top 3 – A Closer Look

Let’s delve a bit deeper into the balance sheet and profit & loss details of the top three companies, as these underline why they outperformed their peers:

• Cadolto Modulbau GmbH: In absolute terms, Cadolto’s latest financial statements show moderate total assets backed by very high equity and an exceptional profit. Cadolto’s assets include a large amount (tens of millions of euros) of “Work in Progress” inventory – ongoing modular construction projects that were not yet completed by the balance sheet date. Against this, Cadolto had received around the same magnitude in customer advance payments (recorded as liabilities) for those projects. This essentially means clients have paid Cadolto upfront for work it will finish next year – a common practice in modular construction contracts. While this boosts cash, it also inflates liabilities temporarily. Even so, Cadolto’s total liabilities (including those advances) were overshadowed by its equity. The company’s equity shot up thanks to a record net profit (likely in the range of many millions of euros). To illustrate, Cadolto’s net income for 2024 alone was so large that it accounted for a +366 percentage point swing above the industry’s equity level. In plain language, Cadolto made more profit in one year than many competitors have in five, dramatically strengthening its capital base. On the cost side, Cadolto managed its cost of materials and services well – evidently, the profit margins on its projects were very high (perhaps due to efficient production of its modules or economies of scale on big contracts). Its overhead (like staff costs) was kept reasonable relative to revenue. So Cadolto combined healthy project management (so costs didn’t overrun) with strong demand (full order books and clients willing to prepay), yielding a banner financial year.

• Schrobsdorff Holding AG: Schrobsdorff’s balance sheet is characterized by high equity, moderate assets, and very low debt. The company appears to follow a conservative financing approach – much of its assets (such as machinery, real estate, or project receivables) are financed by equity capital rather than loans. In 2024, Schrobsdorff’s revenues were solid (though perhaps slightly down from the previous year’s peak), and its net profit was healthy albeit not extraordinary. The profit was enough to further bolster its equity. However, Schrobsdorff’s expense profile revealed increased costs: notably, material costs rose significantly, which ate into its gross profit margin. We see evidence of rising prices for construction materials and subcontractors affecting Schrobsdorff’s bottom line. Additionally, personnel expenses for Schrobsdorff were somewhat high – not unusual for a large contractor managing multiple projects. These costs collectively meant that while Schrobsdorff remained profitable, the profit margin tightened compared to before. Importantly, Schrobsdorff did not take on much new debt (its liabilities effect remained positive in RealRate’s analysis at +110%, meaning it still has less leverage than the average competitor). All in all, Schrobsdorff’s profile is of a well-established builder with strong fundamentals: ample equity (the ultimate safety buffer in construction), consistent if unspectacular profit, and prudent debt levels. Its slight dip in rank reflects that it did not repeat an extraordinary one-time gain, and a few peers managed to outshine it on margins this year.

• GWH Immobilien Holding GmbH: GWH’s financials reflect its nature as part of a larger real estate conglomerate. It holds substantial fixed assets and investments – for example, GWH has stakes in affiliated companies and properties, which contribute to its stability. These long-term assets show up on its balance sheet and are partly why GWH had a 157% positive effect from “shares in affiliated companies” in the RealRate model. In terms of operations, GWH had annual revenues in the hundreds of millions (estimated), with a corresponding high cost base. Its cost of materials and purchased services for projects were large (typical for any general contractor), which led to the gross profit weakness noted earlier. However, GWH offset thinner margins with volume – it likely completed many projects, securing enough gross profit in absolute terms. GWH’s net income for 2024 was solidly positive, adding to equity. The company’s equity was also perhaps augmented by retained earnings from prior years and possibly asset revaluations (common in real estate holdings). Importantly, GWH’s liabilities are moderate. It likely uses some debt financing (as most companies do), but not excessively. The RealRate data showed a +72.9% effect from low liabilities – indicating GWH has a comfortably low debt-to-asset ratio compared to peers. This reduces financial risk (especially vital in a rising interest rate environment). GWH’s cash flow management also seems prudent – it had a positive effect from cash on hand, meaning it maintains good liquidity to weather construction’s ups and downs. In short, GWH’s profile is that of a steady, financially conservative operator: it might not have the eye- popping profits of Cadolto, but it also steers clear of heavy debt or cash crunches, which positions it in the upper echelon year after year.

Understanding the Model’s View – Industry-Wide Insights

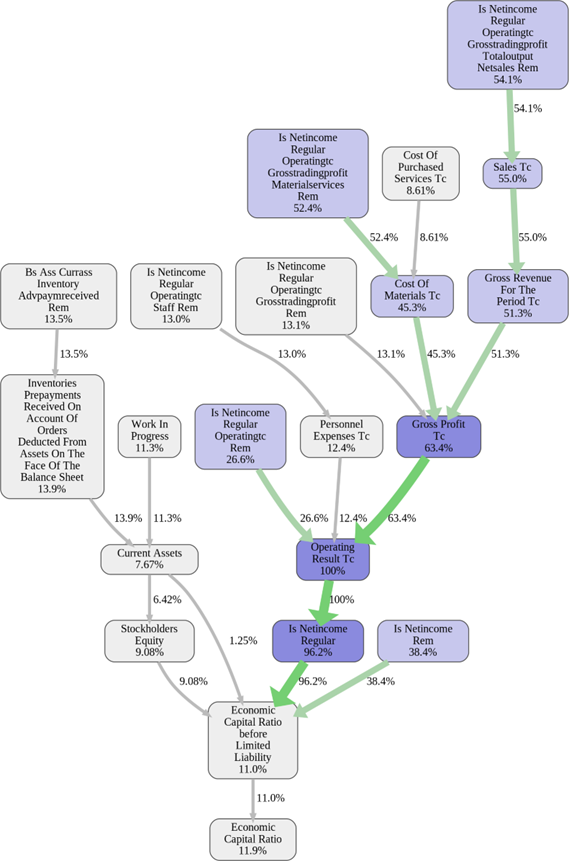

RealRate’s AI-driven rating model for construction companies reveals which financial indicators matter most across the board. The feature importance analysis for 2024 shows that the model leans heavily on profitability metrics to determine the rankings.

Figure 5 : Industry’s Feature Importance Graph

In fact, the most influential factor in the model is the Operating Result (operating profit). This single metric was given the highest importance score (normalized to 100%). It means that how much profit a company makes from its core operations – after accounting for construction costs and overhead – is the strongest predictor of its financial strength rating. Companies that maximize their operating profit (as a percentage of assets) tend to score best. Close behind, other profitability measures like Gross Profit (63% importance relative to the top) and Net Income (around 52%) also carry significant weight. Revenue (sales) figures and related output measures have importance in the mid-50% range as well. Essentially, the model is telling us that earning power is king. Construction firms that generate higher profits and margins relative to their size dramatically outscore those that don’t.

On the other hand, balance sheet measures – while still considered – have comparatively lower importance in the model. For instance, Stockholders’ Equity itself had about 9% importance, and Current Assets like cash or inventory were around 11–14%. This might seem counterintuitive at first (since ECR is literally an equity ratio), but it makes sense: most construction companies have equity somewhere in the same ballpark range, and what differentiates them year-to-year is profit volatility. The RealRate model appears to capture that dynamic. High equity is often a result of accumulated past profits, so it correlates with profitability anyway. Debt levels (liabilities) do matter, but often indirectly – excessive debt hurts profitability (due to interest and financial strain) and vice versa.

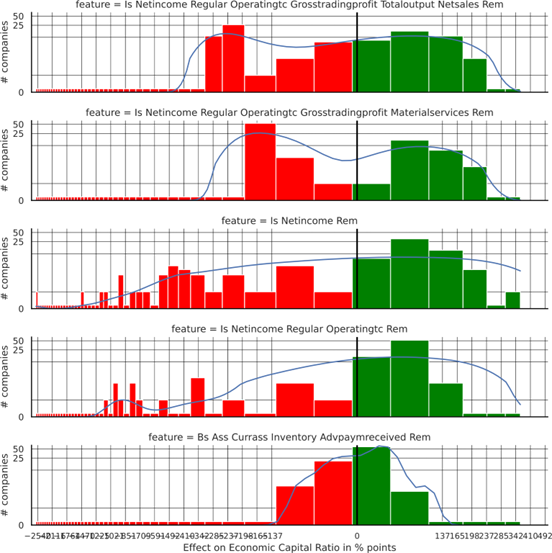

To visualize the distribution of these features industry-wide, RealRate provides a feature distribution chart. In this bar-chart-like visualization, each key financial variable is plotted showing how companies spread around the average. For example, one can see how many firms have higher or lower gross profit margins or unusual levels of work-in-progress inventories. Companies like Cadolto show up as outliers on these distributions (with, say, extraordinarily high net income effect). Most companies cluster closer to the center on each metric. The chart generally reveals that only a handful of firms excel or lag dramatically on any given factor, while the majority are middling. It’s an insightful snapshot of where most construction firms stand on equity, debt, costs, and income. For instance, one bar in the feature distribution might correspond to “Liabilities effect”: we observe that the vast majority of companies have a small negative liabilities effect (meaning they carry typical debt), but a few have extremely high debt (far left outliers) and a few have exceptionally low debt or net cash (far right outliers). Such visuals underscore why the top companies are top – they reside on the far positive end of the most important spectrums (especially profit).

Figure 6 : Industry’s feature distribution chart

Conclusion

The RealRate 2024 ratings for Germany’s construction industry provide a fascinating look at which companies are structurally sound and why. In an industry known for tight margins, heavy upfront costs, and reliance on steady cash flow, it is perhaps reassuring that the top performers achieved their strength through classic business fundamentals: earn more than you spend, keep debt in control, and build up equity capital. Cadolto Modulbau’s stunning victory this year highlights how explosive growth and profit can translate into financial might – yet it also raises the question of whether that performance is repeatable or a one-off peak. Schrobsdorff Holding and GWH Immobilien, on the other hand, demonstrate the value of consistency and solid foundations, which tend to keep a company near the top even as conditions change.

For the broader sector, the RealRate analysis uncovers a dual reality. On one hand, a few firms are extremely healthy, effectively insulated from financial distress by their strong balance sheets. On the other hand, many construction companies remain undercapitalized or low-margin, operating one downturn away from potential trouble. The spread in ECR – some well above 100%, some around 0% or negative – is a call for prudent risk management. Companies with low ECRs may need to raise fresh equity or improve profitability to survive long-term. The high standard deviation in financial strength suggests that industry consolidation or further differentiation could occur, where the strong get stronger and the weak struggle or exit.

In simple terms, the winners in construction finance are those who master the balancing act of projects and money: they deliver projects profitably, convert those profits into equity, and use that equity to buffer against future storms. RealRate’s visual tools – from feature distributions to correlation plots – confirm that profit is the keystone. Higher income not only boosts a company’s own books but also its standing among peers. Meanwhile, controlling costs and debt is the necessary counterpart to not give away those hard-earned gains.

As we look ahead, it will be interesting to see if Cadolto can maintain its top spot or if others will catch up. Will new challengers emerge with the next big infrastructure boom or housing cycle? If there’s one lesson from the recent years, it’s that fortunes can flip quickly. Today’s number 107 can be tomorrow’s number 1, and vice versa. The 2024 rankings remind all construction companies – big or small – that financial strength is an ongoing project. It requires laying a solid foundation (equity), building efficiently (managing costs), and aiming ever higher (growing profits). Those that do so will stand tall in the face of economic weather, just like the buildings they construct.