A Resilient Industry with Surging Revenues: The German risk life insurance sector – providers of term life and related policies – remains robust, writing over €3 billion in annual premiums and managing roughly €20 billion in assets. Eight key insurers form this market, paying out billions in claims each year to protect families’ financial security. Despite economic headwinds and rising claims costs, these insurers collectively maintain solid capital buffers and profitability. Yet, as the latest 2025 financial strength ratings show, size alone doesn’t guarantee stability. In fact, some of the smallest insurers are topping the charts in financial health, while one of the largest lags behind. RealRate’s innovative AI-driven rating model has analyzed each company’s financial statements to rank them by Economic Capital Ratio (ECR) – a measure of a company’s economic value relative to its total assets.

Ranking Highlights – 2025’s Strongest vs Weakest Insurers

RealRate’s 2025 ranking of German risk life insurers (financial year 2024 data) crowns Dialog Leben as the strongest company. Dialog Leben (Dialog) clinches Rank #1 with an ECR around 51%, meaning over half its balance sheet is backed by economic capital. Close behind, Delta Direkt Leben (Delta Direkt) holds Rank #2 with about 35% ECR – a steep drop from its previous leading position. In third place is Deutsche Lebensversicherungs AG (DLVAG) at roughly 32% ECR. By contrast, the industry’s largest player by assets, Cosmos Leben, is stuck at the bottom (Rank #8 with an ECR below 6%), highlighting that bigger isn’t always better in terms of financial strength. Only the top two companies earned RealRate’s coveted “Top-Rated” status, reflecting exceptional capital robustness.

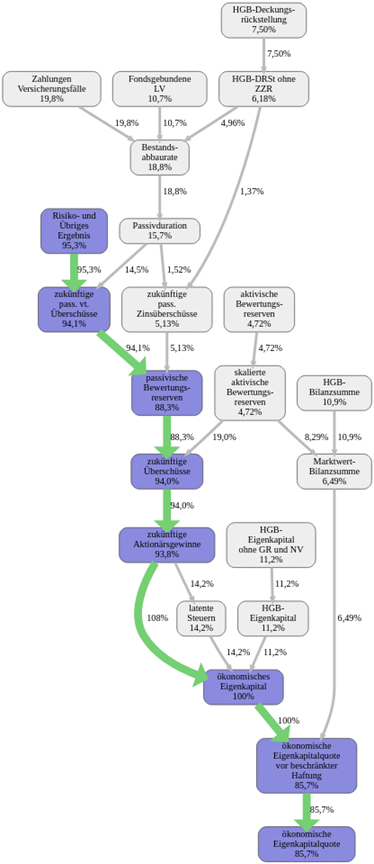

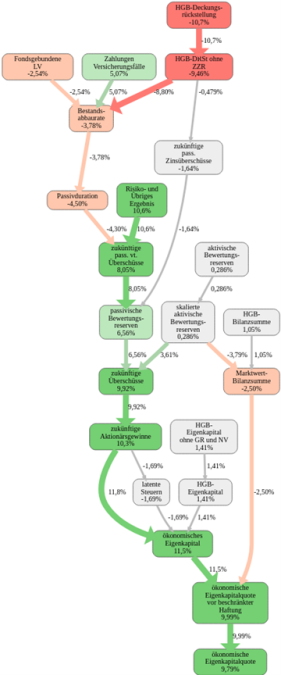

Figure 1: Feature Distribution of financial drivers. Each bar represents an industry variable’s impact on ECR across all insurers – green to the right indicates positive effects, red to the left indicates negative effects. Far out bars mean greater importance of that factor; roughly half of companies fall on each side of zero per variable.

Despite their smaller size, Dialog and Delta Direkt have consistently outperformed peers in these rankings. Dialog climbed from 2nd place last year to 1st, overtaking Delta Direkt, which had been #1 for several years. Meanwhile, Credit Life (Credit Life AG) inched up from last to 7th, and Cosmos Leben remained stuck in last place. These shifts underscore how good management and prudent finances can elevate an insurer’s strength quickly, while complacency can cause others to slip. “It’s not about how big your balance sheet is – it’s about how solid and efficient it is,” notes a RealRate analyst. Strong profitability and adequate equity can propel even a modest-sized insurer to the top, whereas massive liabilities or thin capital can drag a giant to the bottom.

What Drives Financial Strength? Key Factors at a Glance

RealRate’s model evaluates dozens of financial inputs for each insurer – from capital and reserves to earnings and expenses – to calculate the Economic Capital Ratio. In simple terms, higher assets and profits boost the economic capital, while higher liabilities and costs erode it. The Feature Distribution plot above illustrates how each factor influences ECR across the industry. For example, “HGB-Bilanzsumme” (statutory total assets) has a predominantly red (negative) impact – large asset size tends to hurt ECR if not matched by sufficient equity. Conversely, “Risiko- und übriges Ergebnis” (risk & other profit) and “zukünftige Überschüsse” (future profit participations) skew green (positive) – higher profitability and future surplus funds strongly improve ECR. The wider a bar, the more critical that variable is to financial strength differences. Half of the companies lie to the green side and half to the red for each factor, since effects are measured relative to the industry average. This means companies outperforming the average in a given metric enjoy a positive ECR effect (green), while those underperforming see a negative effect (red).

Figure 2: Feature Importance graph (industry-wide). This bar chart ranks the most influential financial variables on insurers’ economic health. Higher numbers and darker colours indicate a greater impact on ECR. We see that future profit participation reserves, risk result/profit, and hidden reserves are among the top drivers of financial strength.

The Feature Importance chart above highlights which variables matter most for the model. Future profit participation reserves (funds set aside to pay policyholder bonuses over time) emerge as a top driver – indicating that insurers who have built up substantial surplus reserves gain a big boost to their capital ratio. Also high on the list are the risk result (underwriting profit) and hidden valuation reserves (unrealized gains in investments). These factors essentially capture profits and extra capital buffers, which directly fortify an insurer’s economic capital. On the flip side, large insurance liabilities like the deckungsrückstellung (technical reserves for policies) weigh heavily and can weaken an insurer’s position if not counterbalanced by assets and equity.

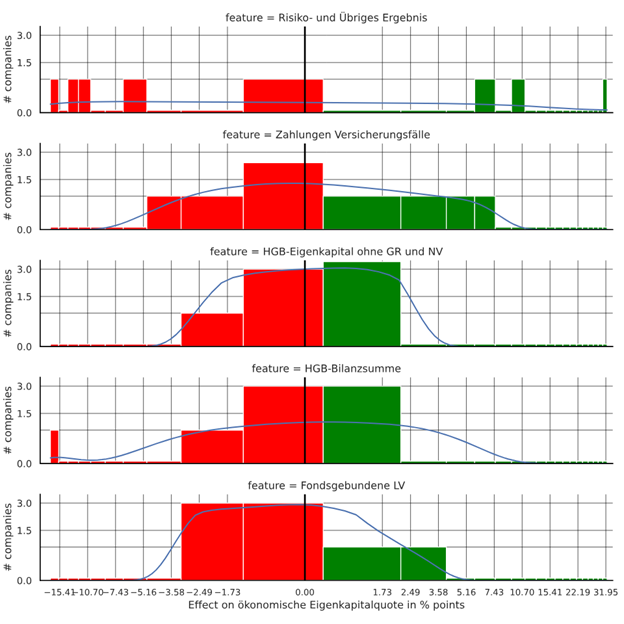

Figure 3: Industry Regression Plot (Actual vs Predicted Valuations). Each dot represents an insurer; the line indicates the model’s prediction vs actual market valuations. A tight clustering along the line signals a strong correlation.

RealRate validates its model by comparing the predicted economic value of each insurer (based on financials) with any observed market valuation (for example, stock market value or book value proxies). The regression scatter plot above shows a generally positive correlation – points cluster near the diagonal line – suggesting the model’s calculated ECR aligns with how the market values these companies. In layman’s terms, insurers that RealRate scores higher do tend to be valued higher by the market, reinforcing confidence that the ECR-based rankings reflect real-world strength. A few outlier dots straying from the line indicate instances where the model predicts a higher or lower value than observed, which can spur deeper analysis. Overall, the trendline’s upward slope confirms that strong financial fundamentals (high ECR) go hand-in-hand with higher company valuations, just as one would expect.

Champions of Financial Strength: Dialog Leben and Delta Direkt Leben

Let’s dive into the top two companies to see why they outshine their peers. Both Dialog and Delta Direkt are relatively small, specialist life insurers, yet their balance sheets pack a punch in quality.

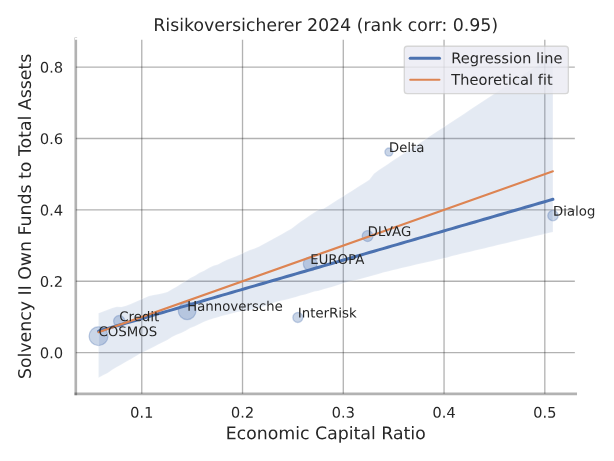

Dialog Leben (Rank #1) – “The Steady Climber”. After hovering in second place for several years, Dialog surged to the top this year with an ECR of 51%, far above the 25% industry average. That means Dialog’s economic capital (assets minus liabilities, adjusted for market values and future obligations) equals about half its total assets – a remarkably solid cushion. Why is Dialog so strong? According to RealRate’s analysis, Dialog’s greatest strength is its hefty future surplus reserve. In other words, Dialog has accumulated substantial funds from past profits (zukünftige Überschüsse) earmarked for policyholders, which aren’t yet paid out. This boosts its ECR by roughly 33 percentage points – giving Dialog a huge head start over competitors with smaller surplus reserves. Essentially, those unutilized profits act like additional equity, bolstering solvency. Dialog’s risk and other profit is another major positive – it consistently earns healthy underwriting profits, adding about 32 points to ECR. On the flip side, Dialog’s weakest point is its large total assets relative to the industry. Its asset base (around €0.94 billion) is significant given its modest equity, and without commensurate capital it would drag down the ratio (a –16 point effect). Fortunately, Dialog’s strong earnings and surplus funds more than offset the size of its balance sheet. The net result is an ECR that sits 26 percentage points above the market average, securing its #1 position.

Figure 4: Dialog Leben Causal Network (“Why is Dialog #1?”). This is a causal graph of Dialog’s financial variables affecting its ECR. Green arrowsshow positive contributions, red arrows show negative contributions.

In the above network diagram, we see how Dialog’s financial factors interplay: Profits and surplus funds feed into equity (lots of green), whereas its large asset base and required reserves exert downward pressure (red arrows). Dialog’s equity and reserves structure is carefully managed – it has about €25 million in statutory equity (shareholders’ capital) which is relatively low, but this is augmented by over €40 million in available surplus reserves and further backed by hidden reserves and future profit streams. Dialog actually recorded no net profit in the latest year (its annual bottom-line result was roughly break-even), yet its past profitability and prudent provisioning keep it financially robust. Over time, Dialog’s total strengths have come down from earlier peaks – it had exceptionally high surplus buffers a few years ago – but still comfortably exceed its weaknesses (red area). This trend underscores that while Dialog’s advantage over peers has narrowed slightly, it remains a beacon of stability thanks to disciplined financial management. Customers of Dialog can take comfort that the company has ample economic capital, meaning it can honor claims and policies even under adverse conditions.

Dialog Leben’s rise to number one showcases how a focus on building surplus, controlling costs, and maintaining moderate liabilities yields a winning formula in financial strength.

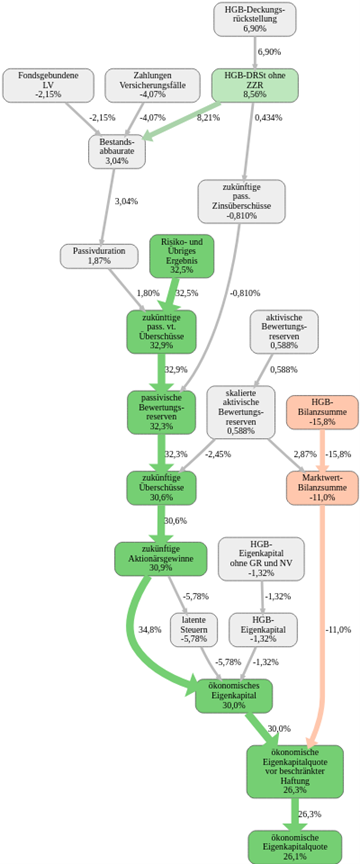

Figure 5: Delta Direkt Causal Graph. Delta’s financial factor network has a different profile than Dialog’s. Here, the green nodes for “economic capital” and equity are smaller but still positive, whereas the red nodes for reserves (HGB-Deckungsrückstellung, etc.) are prominent. The final ECR node shows a solid positive outcome, though reduced from prior years as some green arrows weakened and red arrows grew.

Delta Direkt Leben (Rank #2) – “Small but Mighty . Delta Direkt, a tiny niche insurer (the smallest in this group by assets), has long punched above its weight. With only around €220 million in assets – merely a fraction of Cosmos’s size – Delta nevertheless ranked #1 for multiple years, until now. Its current ECR is about 35%, still impressive and roughly 10 percentage points above the industry average, but a sharp decline from the prior year’s ~55%. What happened? RealRate’s model pinpoints that Delta’s biggest strength has been its economic capital (ökonomisches Eigenkapital) – effectively the real, tangible equity in the business. Being conservatively run, Delta historically maintained a high equity-to-assets ratio. In 2024, this factor still boosted Delta’s ECR by ~12 percentage points – indicating Delta holds significantly more true equity (adjusted for market values) than the average insurer, relative to its size. This strong capital base had kept Delta at the top. However, Delta’s greatest weakness is its technical reserves (“HGB-Deckungsrückstellung”), which reduced its ECR by about 11 points. As a life insurer, Delta must set aside large reserves for future policy benefits; recently these liabilities have grown or weighed heavier relative to its assets. Essentially, Delta’s obligations have caught up somewhat with its assets, shrinking its capital ratio. The company’s ECR fell from 54.7% to 34.5% as its surplus capital was partially eroded by increases in reserves and perhaps profit declines. Indeed, Delta’s profit margins have tightened – while still positive, its risk/other profit is no longer offsetting the liability growth as much as before.

Overall Industry Outlook – Stability with Subtle Shifts

Taken together, RealRate’s analysis portrays a financially sound industry, with average ECR around 25% and a moderate spread (standard deviation ~14%). Most insurers have kept their ECR fairly steady, with only a few notable swings. The average ECR dipped by about 3 percentage points from the previous year, suggesting a slight industry-wide capital ratio decline – likely due to factors like higher reserves (from low interest rates and regulatory changes) and market volatility affecting asset values. Even so, half of the firms maintain ECRs above ~23%, indicating ample buffers. Only one – Cosmos Leben – falls drastically below, at about 5.7% ECR, which is a potential concern. Cosmos’s low ratio stems from its huge legacy book of policies (nearly €15 billion in assets) coupled with relatively low economic equity – essentially a heavy ship with insufficient ballast. While Cosmos’s absolute equity is large in euros, it’s small relative to its vast obligations, giving it a thin capital margin.

Meanwhile, mid-tier players like Europa Leben (Europa), InterRisk, and Hannoversche Leben show solid ECRs in the mid-20s, near the average. They haven’t moved much in rank, reflecting stable financial management. Credit Life stands out as a positive mover – climbing off the bottom over the past two years. It benefited from an improvement in “latent taxes” (deferred tax assets), which RealRate flagged as “excellent” in boosting its capital position. In fact, Credit Life’s latent tax asset contributed significantly to its ECR (a unique strength), helping it leap from rank 8 to 7. While still below average in overall ratio (~7.8%), it’s trending up. This kind of improvement underscores how managing the balance sheet creatively – like recognizing deferred tax assets or unlocking hidden reserves – can strengthen an insurer’s standing.

In contrast, Cosmos Leben’s slip (from rank 7 to 8 last year) was due to a “bad ökonomisches Eigenkapital” – essentially inadequate economic equity – which continues to plague it. It’s a cautionary tale that even industry giants must keep bolstering capital and profits to stay resilient. RealRate’s model recalibrations and back-testing ensure that these rankings are up-to-date, making past press statements outdated. For example, previous years’ announcements lauded Delta Direkt as #1, but with new data and model updates, Dialog now rightfully earns the top laurels.

Conclusion – Financial Fitness Matters More Than Size

The RealRate 2025 ratings reveal a clear lesson for Germany’s life risk insurers: financial fitness matters more than sheer scale. Dialog Leben’s ascent to #1 and Delta Direkt’s long run near the top show that lean, well-capitalized specialists can outperform much larger competitors in financial strength. Building up surplus funds, maintaining robust profit margins, and keeping liabilities in check are key to a high ECR. Conversely, companies that allow liabilities to swell without proportional capital (like Cosmos) or see profits dwindle can quickly find their rankings falling.

For consumers and policyholders, these rankings are a reassuring indicator of each insurer’s robustness. A higher-ranked company like Dialog is well-equipped to meet future payouts and withstand economic stress, whereas a low-ranked one might be more vulnerable in extreme scenarios. Fortunately, all firms here meet regulatory solvency requirements; the RealRate ranking differentiates who is merely compliant from who is truly secure. In a world of uncertainty – from pandemics to economic swings – an insurer’s financial strength is more crucial than ever. The 2025 results are overall positive: most German risk insurers have stable or improving capital ratios, and even those who slipped (Delta) remain strong in absolute terms.

Looking ahead, will Dialog hold onto the crown? Can Delta rebound with strategic adjustments? And will giants like Cosmos take steps to shore up their capital? The competitive pressure is on, and that’s good news for the insuring public. It incentivizes all companies to manage risk prudently and keep their balance sheets healthy. As RealRate’s independent AI-driven analysis shows, the winners will be those who treat financial strength not as a regulatory box-tick, but as a core mission. With innovative tools shining light on true economic capital, the industry is moving toward greater transparency and resilience – ensuring that when life’s uncertainties strike, insurers will be ready to pay out and protect as promised.