In 2024, Austrian insurance companies wrote approximately €21.4 billion in gross premiums, against about €18.7 billion in claims and benefits. The sector employs around 27,500 people nationwide. This mature market shows steady growth, with strong demand across life, health, and property/casualty lines. The latest financial strength ratings suggest that being big is not the only recipe for stability – some regional insurers are outperforming the country’s largest carriers.

Top 3 Insurers Shine in 2025 Rankings

A new AI-driven rating of Austrian insurers for 2025 has yielded a surprise: three regional mutual insurance companies – Grazer Wechselseitige, Niederösterreichische, and Oberösterreichische – have claimed the top spots for financial strength. RealRate, an independent rating agency using artificial intelligence, computes an Economic Capital Ratio (ECR) for each insurer. This ECR represents the company’s economic value (capital) divided by its total assets, allowing a fair comparison of solvency across big and small firms. The higher the ECR, the stronger the insurer’s capital position relative to its size. By this measure, Austria’s regional insurers have outpaced the bigger national players in the 2025 ranking.

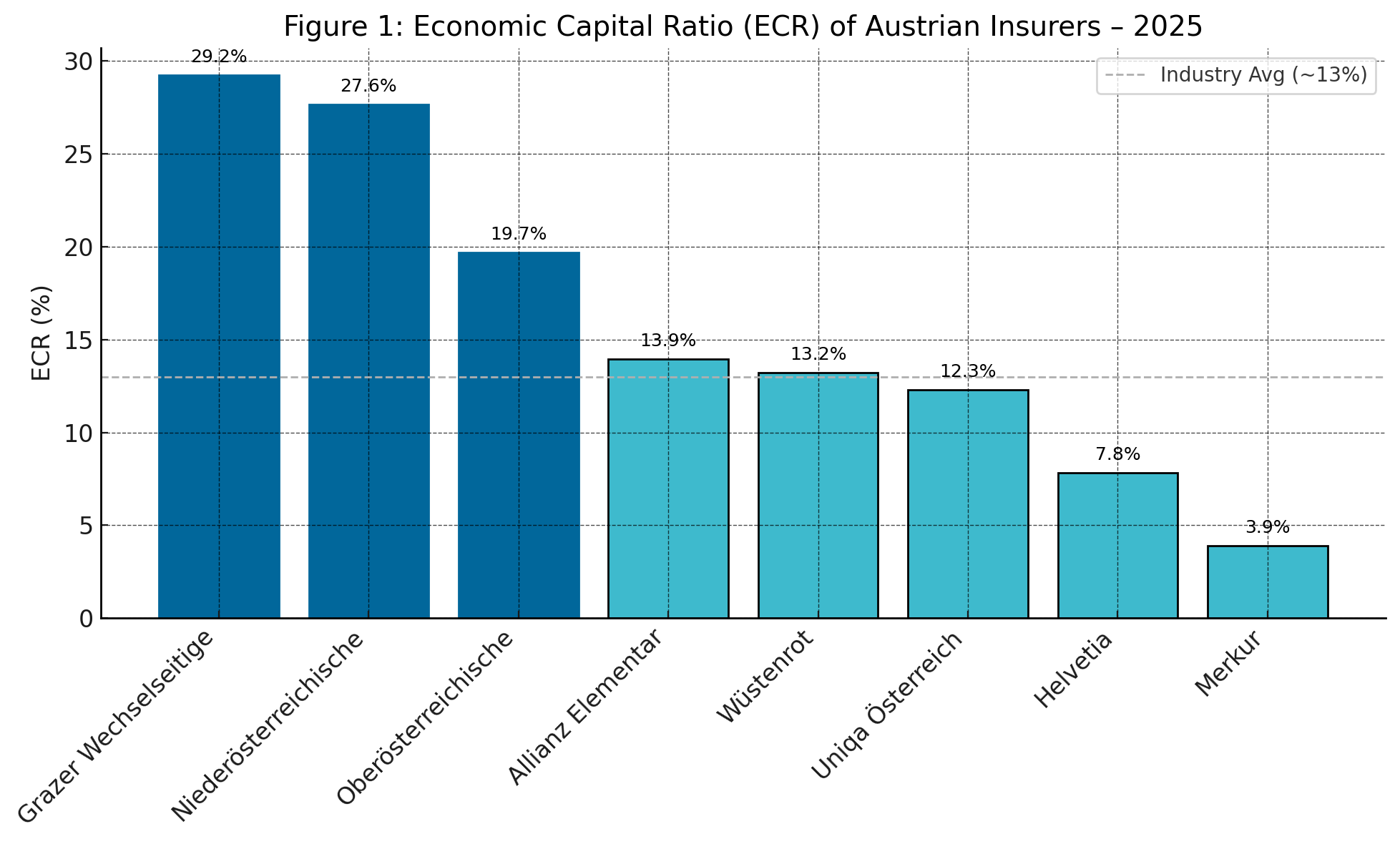

Grazer Wechselseitige Versicherung AG (known as GRAWE) leads the pack with an ECR of 29.25%, narrowly ahead of Niederösterreichische Versicherung AG (27.64%). These two have a commanding lead over the rest of the field – their capital strength is roughly double the industry’s average. In third place is Oberösterreichische Versicherung AG at 19.68%, still well above most competitors. All three are mutual insurers rooted in Austria’s provinces, and they have now proven to be the financially strongest in the nation according to RealRate’s metrics. This marks a remarkable showing for companies outside the Vienna-based giants: the top three have maintained their #1, #2, and #3 ranks from the previous year, confirming their continued dominance in financial robustness.

Figure 1: Economic Capital Ratio (ECR) of Austrian insurers in 2025. The top three regional insurers (rank 1–3) show markedly higher ECRs than the rest. This indicates substantially stronger capital positions relative to assets.

The bar chart above (Figure 1) illustrates the gap between the leading trio and the remaining insurers in the 2025 ranking. Grazer Wechselseitige and Niederösterreichische stand out with ECRs in the high 20s, while even a well-known player like Allianz Elementar (ranked 4th) comes in at about 14%. Most other insurers, including large nationals and international subsidiaries, cluster in the single digits or low teens. Financial strength, as measured by RealRate’s ECR, clearly favors the regional champions this year.

A Changing of the Guard

The dominance of Grazer, Niederösterreichische, and Oberösterreichische represents a changing of the guard in Austrian insurance. A few years ago, the top spots were held by major nationwide insurers. For instance, in 2023 Allianz Elementar was ranked #1. However, as RealRate expanded its model to include more firms, the 2023 rankings saw the three regionals debut at 1st, 2nd, and 3rd – immediately unseating the previous leaders. They have held firm ever since.

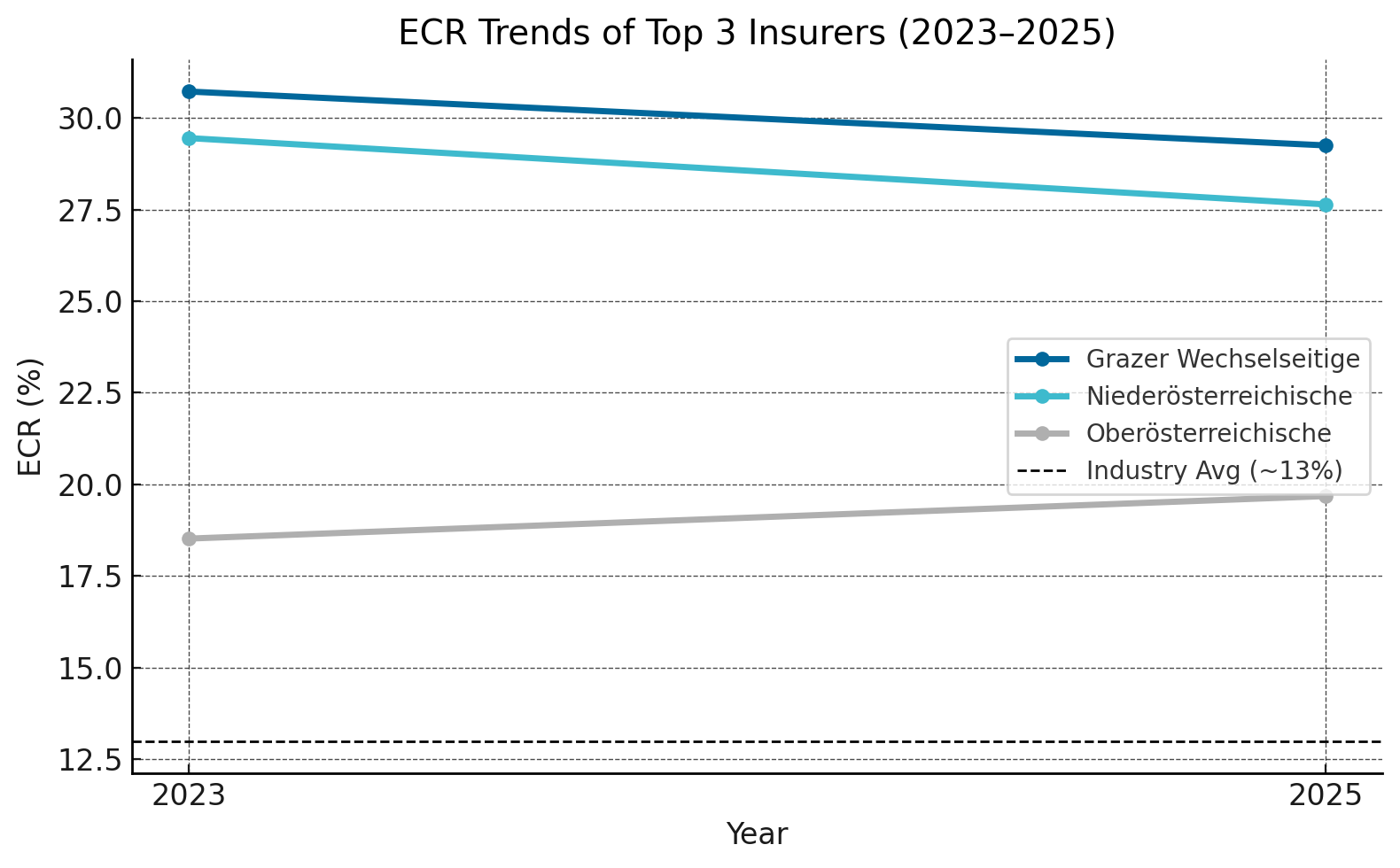

Figure 2: ECR trends for the top 3 insurers, 2023 to 2025. Grazer Wechselseitige (dark blue) and Niederösterreichische (light blue) saw a slight dip in ECR, while Oberösterreichische (gray) improved. All three remain well above the industry average (~13%).

As shown above, Grazer, Niederösterreichische, and Oberösterreichische were not included in the 2022 rating, but once they appeared in 2023, they took the top three positions straight away. They each maintained their ranks in the 2025 update (based on 2024 results). Over the past year, their ECR values saw only minor changes: Grazer’s ECR dipped from 30.7% to 29.3%, Niederösterreichische’s from 29.5% to 27.6%, while Oberösterreichische’s ECR actually increased from 18.5% to 19.7%. These slight shifts were enough to keep their order unchanged, as the gap to the fourth-ranked company remained wide.

Figure 2 highlights the stability of these leaders’ financial strength. Grazer and Niederösterreichische experienced a small decline in ECR (possibly due to higher claims or growth in assets), whereas Oberösterreichische managed a modest improvement. Overall, the industry’s average ECR edged down slightly, from about 13.4% in 2024 to 12.9% in 2025 (marketing year) based on RealRate’s dataset. Most companies’ ECR changes were within a couple of percentage points, with roughly half the insurers improving and half weakening. The spread of results is quite large – the strongest ECR (29.3%) is about seven times the weakest (3.9%). This spread is reflected in a standard deviation of around 8.6 percentage points in ECR values across the market. Despite these differences, it’s notable that no company has a negative ECR; all firms maintain a positive capital ratio, indicating a generally healthy sector. The RealRate analysis pegs the market average ECR at ~13%, suggesting that Austrian insurers overall are moderately well-capitalized.

Within this shifting landscape, a few companies have made significant moves. The most eye-catching climber is Allianz Elementar Versicherung AG, which rose from 5th place to 4th. Allianz, one of the largest insurers in Austria, improved its ECR to 13.95%, up from ~12.3% the year before. RealRate attributes Allianz’s gain to particularly strong results in its life insurance investments (notably in stocks and other non-fixed-interest securities in the life segment). On the other hand, Wüstenrot Versicherung slid from 4th to 5th place, as its ECR remained roughly flat while Allianz leapfrogged it. Among smaller players, Helvetia moved up one notch to 10th, and Merkur fell to the bottom (11th). In fact, Merkur Versicherung AG saw the largest ECR drop of any company, from 6.30% to 3.90%, causing it to sink from 10th to 11th. According to RealRate, Merkur’s decline was driven by weaker premium income in its property/casualty business. These shifts show that even mid-tier insurers are not static – management decisions and market conditions (like claim costs or investment performance) can impact their capital strength ranking noticeably from year to year.

Financial Profiles of the Top Three

Who are these three top-ranked insurers, and why are they so financially resilient? A look at their balance sheets and earnings provides context for their stellar ECRs.

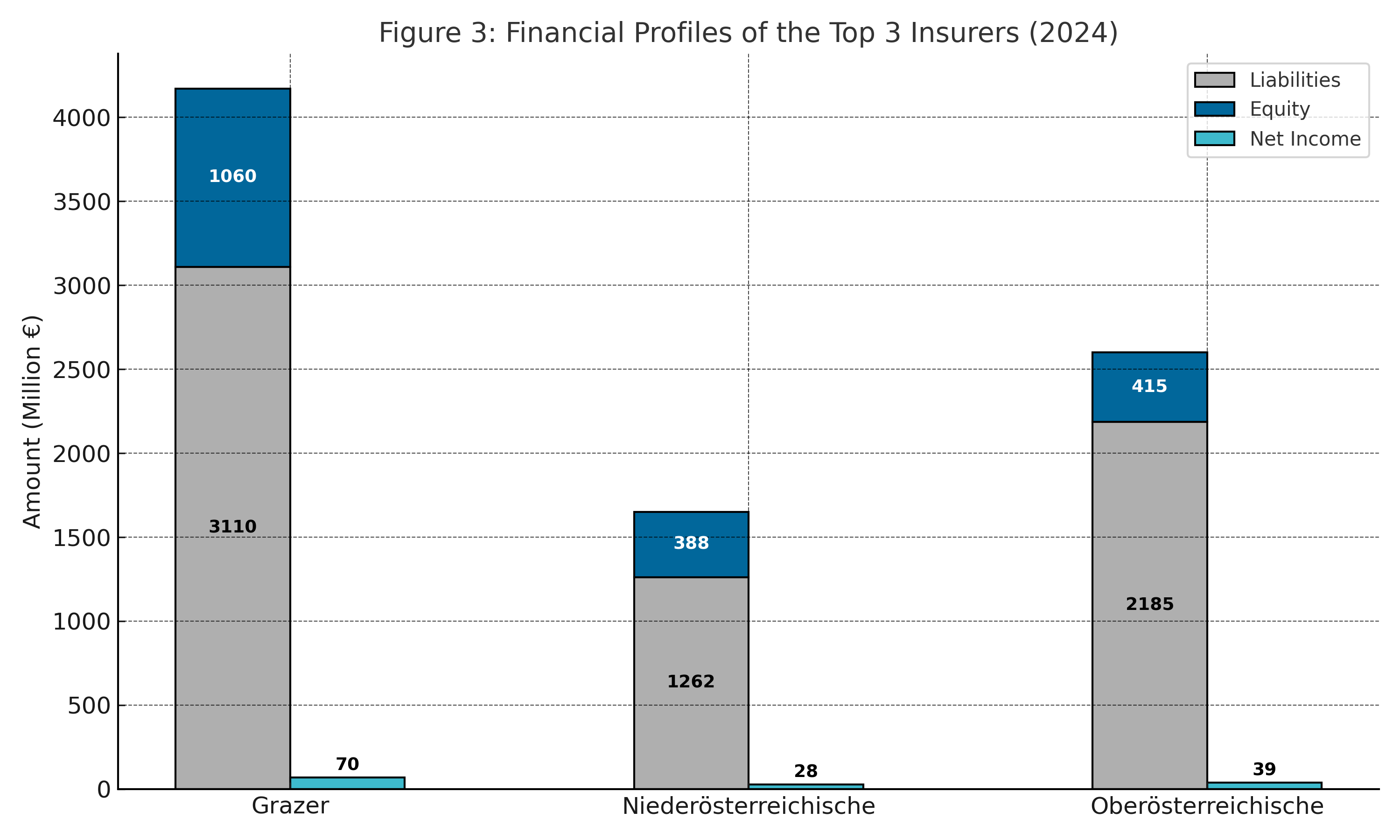

- Grazer Wechselseitige Versicherung AG (GRAWE) – Based in Graz and operating since the 19th century, GRAWE is a multi-line insurer with a substantial balance sheet. It reports total assets around €4.17 billion and liabilities of about €3.11 billion. This leaves over €1.06 billion in stockholders’ equity – a strong capital base for a company of its size. In 2024, Grazer earned roughly €70 million in net profit, bolstering its capital. Notably, the firm has significant hidden reserves in its assets portfolio (over €2.18 billion unrecognized on the books), which indicates a conservative accounting approach and additional economic value backing its obligations. All these factors contribute to GRAWE’s ECR of ~29%, meaning nearly one-third of its assets are funded by economic capital – a remarkably high ratio in this industry.

- Niederösterreichische Versicherung AG – This regional insurer based in St. Pölten (Lower Austria) is smaller in absolute size, with around €1.65 billion in assets and €1.26 billion in liabilities. Its shareholder equity stands at approximately €388 million. In the latest year it achieved a net income of about €28 million. Niederösterreichische Versicherung’s ECR of ~28% is on par with Grazer’s, despite having less than half the assets – indicating a similarly robust capital buffer. The company also carries a large amount of hidden asset value (around €670 million), which, if realized, would further boost its economic capital. In essence, this insurer’s prudent management and solid profitability have yielded a capital-to-assets ratio far above the norm.

- Oberösterreichische Versicherung AG – Headquartered in Linz (Upper Austria), Oberösterreichische sits between the other two in scale. It holds roughly €2.60 billion in assets against €2.18 billion in liabilities, leaving equity of about €415 million. The company’s net profit was approximately €39 million in the most recent year, indicating healthy operations. Oberösterreichische’s ECR near 20% is slightly lower than its peers’, but still well above average. One reason is that its balance sheet, while solid, includes fewer hidden reserves (about €177 million) and is more weighted toward fixed-income investments, which can limit upside. Even so, an ECR around 20% means a one-fifth share of its assets are backed by true economic value, a strong position that earned it the #3 rank.

In summary, all three top performers are well-capitalized, solvent insurers. They each have equity ratios (on a market-value basis) far exceeding those of larger insurers. Their mutual status (being customer-owned) may encourage conservative profit retention, explaining their thick capital cushions. Despite their moderate size in terms of premium income, they have amassed enough capital and reserves to outshine the giants when it comes to solvency metrics.

Why These Insurers Excel – Strengths and Weaknesses

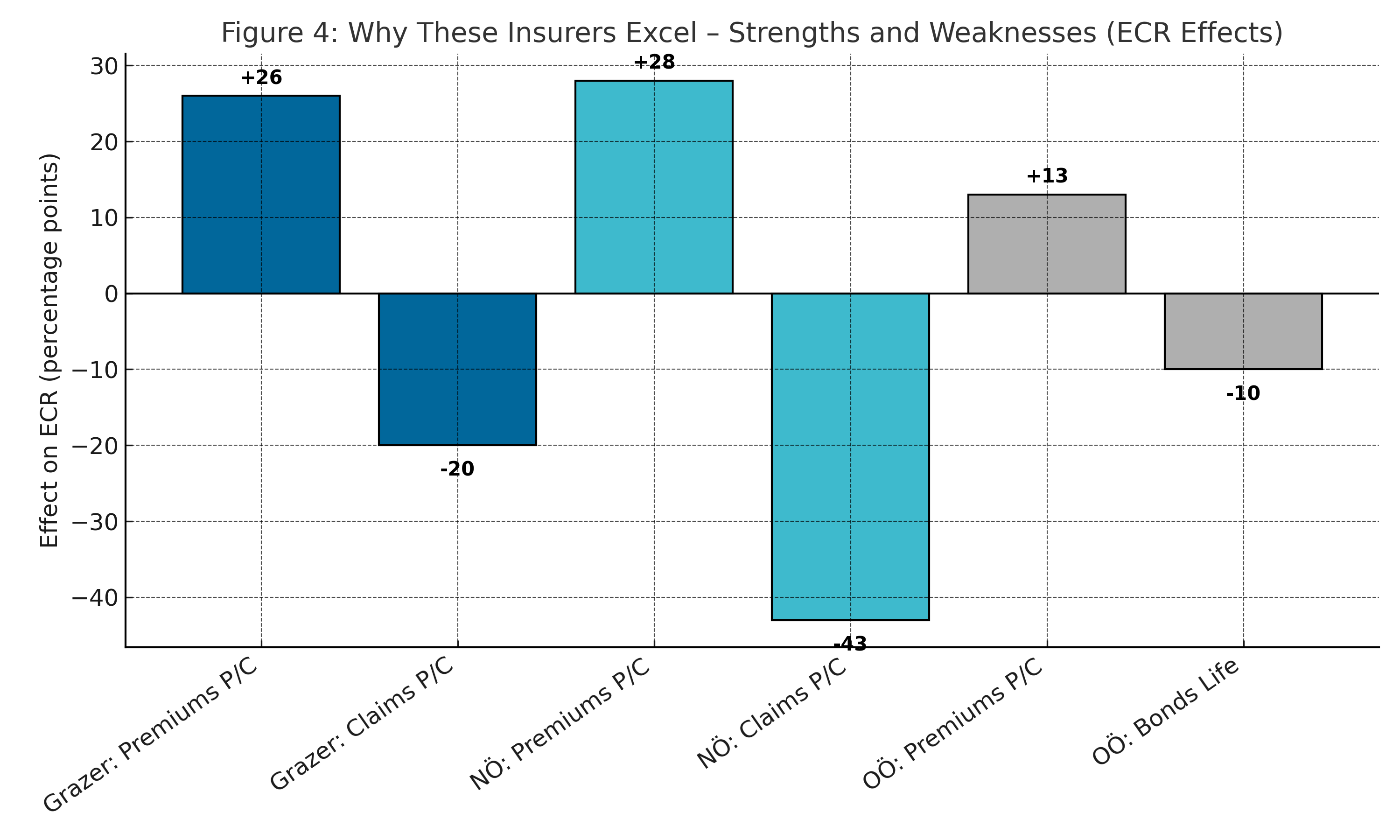

RealRate’s model doesn’t stop at ranking companies; it also identifies which factors most influence each insurer’s Economic Capital Ratio. In all three top cases, the core insurance business – particularly premium income versus claims – plays a decisive role in boosting their ECR, while certain expenses or investment choices weigh them down.

- Grazer Wechselseitige’s strengths lie in its revenue stream. Its greatest positive deviation from the market average is in “Verrechnete Prämien, Schaden”, i.e., gross written premiums in the property/casualty segment, which increases Grazer’s ECR by an estimated +26 percentage points relative to the industry. This suggests Grazer enjoys especially high premium inflows (perhaps due to a strong market share or pricing) in its P/C business, contributing significantly to capital growth. On the flip side, the biggest drag on its ECR is “Aufwendungen für Versicherungsfälle, Schaden” – essentially claims and insurance benefits paid out in P/C – which lowers its ECR by –20 percentage points compared to the average. In plain terms, Grazer had higher claim costs than the industry norm (possibly due to some large losses or a generous payout policy), partially offsetting its premium advantage. The net effect, however, is clearly positive, as evidenced by its top-ranked ECR. Grazer’s ability to generate profits from premiums while managing claims reasonably well has been key to its strong capital position.

- Niederösterreichische’s profile is even more extreme in this regard. It, too, gains the most from gross written premiums in the P/C business, which boost its ECR by a whopping +28 points above average – the largest single positive effect among all companies. This indicates that Niederösterreichische has an exceptionally strong revenue base in its main insurance lines relative to its size. However, its weakness is the cost side of the same coin: claims payments in P/C. The variable for claims expenses (“Aufwendungen für Versicherungsfälle, Schaden”) drags its ECR down by a startling –43 percentage points compared to the market. This huge negative effect suggests that the company likely faced heavy claims (for instance, from accidents or natural events in Lower Austria) that ate into its capital. Even so, because its premium effect is so large, Niederösterreichische manages to maintain a high overall ECR. In essence, it’s writing a lot of profitable business, but also paying out quite a bit – yet on balance, retaining enough to stay very well-capitalized. It’s a classic high-risk, high-reward scenario, managed successfully.

- Oberösterreichische’s strengths are similar but more moderate. Its top positive factor is again gross premiums in property/casualty, adding about +13 points to its ECR above the industry average. That’s a healthy lift, though not as dramatic as the others. Notably, Oberösterreichische’s main weakness is different: rather than claims, it’s an investment factor – “Schuldverschreibungen und andere festverzinsliche Wertpapiere, Leben”, meaning holdings in bonds and other fixed-income securities in the life insurance segment, which reduce its ECR by roughly –10 percentage points. This implies that Oberösterreichische’s life insurance portfolio is heavily invested in bonds (likely government or corporate bonds). In the current low-interest environment, such a conservative investment mix yields lower returns, thus contributing less to capital (or requiring more capital to support). Essentially, the model views Oberösterreichische as being held back by a cautious investment strategy in life insurance, even as it benefits from solid premium income in non-life. The company’s ECR improvement this year hints that some adjustments or better results occurred in this area, but it remains the primary factor keeping its ECR around 20% rather than higher.

Across all three top insurers, a common theme emerges: strong underwriting results (premiums earned) are a critical factor in their high rankings. These firms have solid customer bases and bring in substantial premium revenue relative to their size, which bolsters their capital. Conversely, managing claims costs is crucial – Grazer and Niederösterreichische had to contend with above-average claims, which they overcame through strong income. Meanwhile, prudent or aggressive investment choices can tilt the balance: Oberösterreichische’s heavy bond investments kept its ECR lower than it might have been, whereas Allianz’s shift toward more equities in its life portfolio helped boost its rank. RealRate’s explainable AI model pinpoints these effects in terms of ECR percentage points, making it clear why each insurer scored as it did.

Outlook and Industry Significance

The 2025 RealRate rankings of Austrian insurers underscore that bigger isn’t always stronger – at least not in terms of economic capital health. Regional insurers like GRAWE and its peers have leveraged their niche focus, mutual structure, and perhaps more conservative management to achieve outstanding solvency positions. They have less exposure to international volatility and appear to focus on core markets, which can translate into steadier results. In contrast, some large international groups operate with leaner capital relative to assets, which may drop their ECR despite economies of scale.

It’s worth noting that Austria’s largest insurance group, Vienna Insurance Group (Wiener Städtische), was not part of the RealRate archive data for these years – its absence in the rankings is notable, as VIG is a dominant market player by premiums. This means the playing field in this analysis tilts toward stand-alone national entities and could explain why Uniqa (which appears as Uniqa Österreich) and Allianz Elementar were the highest-ranked big-name insurers, at 6th and 4th place respectively. Even so, the fact that no international giant beat the local mutual companies in ECR is a strong statement about financial prudence and capital management.

From a consumer and policyholder perspective, these results are reassuring. A high Economic Capital Ratio implies that an insurer has ample buffer to absorb losses and pay claims – critical for long-term lines like life insurance and pensions. The top-ranked insurers having ECRs two to three times the average suggests they are extremely safe harbors for policyholders’ funds. For the industry regulators and the insurers themselves, the RealRate findings highlight the importance of sustainable underwriting and risk management. Writing profitable business (or conversely, avoiding underpriced policies) directly feeds into financial strength. Likewise, balancing investment risk and return is vital: too cautious (all bonds) and an insurer might lag in capital growth; too aggressive and they might suffer volatility – the sweet spot differs by company.

As the Austrian insurance market heads further into 2025, the competitive landscape may well be influenced by these financial strength indicators. Smaller insurers with top-tier ECRs could leverage their stability as a selling point to customers (“we are top-rated for financial security”), while larger firms might seek to bolster their capital positions to improve their standing. In any case, the RealRate 2025 rankings have shone a spotlight on Austria’s unsung insurance champions – the regional stalwarts whose prudent management and strong customer base have made them the fortresses of finance in the industry. It will be interesting to watch if they can maintain this lead in the coming years, and how the giants respond to the challenge.