A Surprising Shake-Up in Hotel Finances: RealRate’s 2025 U.S. Hotel Industry Ratings

The U.S. hotel industry has roared back to life, generating about 263 billion USD in revenue in 2024. Guest spending hit an all-time high of 758.6 billion USD, surpassing pre-pandemic levels. Amid this boom, an AI-driven financial health rating reveals unexpected winners and losers among hotel companies. RealRate’s latest 2025 ratings crown a regional casino operator as the strongest in economic health, dethroning global giants.

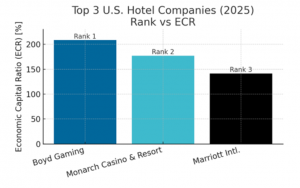

Figure 1: Top 3 U.S. Hotel Companies from (2025) RealRate Hotels Industry ranking measured by Economic Capital Ratio which is also known as one of the key indicators of a company’s financial health. In 2025 US Hotels Industry Ranking, Boyd Gaming (Rank 1) achieved the highest intrinsic financial strength (ECR 208%), followed by Monarch Casino & Resort (Rank 2, 177%) and Marriott International (Rank 3, 142%). Lower-ranked firms had substantially lower ECRs.

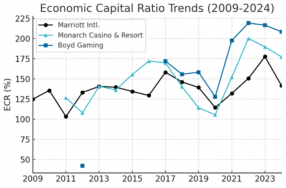

Figure 2: Economic Capital Ratio Trends (2009–2024) – Top companies’ ECR over time. Higher ECR indicates greater financial strength. Boyd Gaming (dark blue) was a late bloomer with a meteoric rise after 2016. Monarch Casino & Resort (light blue) showed strong performance with peaks in 2013 and 2016. Marriott (black) dipped in the early 2010s but rebounded in recent years.

As Figure 2 illustrates, Marriott International’s ECR journey has been a rollercoaster. In 2011, Marriott’s ECR plummeted to about 103% (rank 13 that year) from ~136% in 2010 when it was top ranked. This drop is reflecting some financial setback around 2011 which knocked Marriott far down the list. But Marriott regained ground by 2013–2014 with ECR back around 140% (returning to a top 3 rank). In the late 2010s Marriott’s ECR plateaued in the 130–150% range, until a big jump to 177% in 2023, coinciding with a post-pandemic earnings surge. By 2024, Marriott’s ECR settled at ~142%– excellent, but not enough to fend off nimbler rivals.

Monarch Casino & Resort’s trajectory is marked by spurts of excellence. Monarch hit the #1 rank in 2013 and again in 2016, with ECR peaks of ~141% and a stellar 172% respectively, indicating Monarch’s exceptional financial performance within those years. However, Monarch also saw dips as its ECR fell to ~114% in 2019, temporarily pushing its rank down to 9th in the industry. Yet, Monarch roared back, as it achieved a towering 200% Economic Capital Ratio in 2022, regaining a top rank (#3). But in 2024, Monarch’s ECR slightly decreased to 177% (rank 2) which is still an outstanding performance and well above the industry’s average.

The most dramatic rise is Boyd Gaming’s. From 2012 to 2017, Boyd’s Economic Capital Ratio shot up from a mere 42% to 172% which indicates a significant rise in financial performance. In 2012, Boyd was a minor player (rank 28) with an underperforming ECR of just 42%– suggesting its value creation was very low relative to assets at that time. But by 2017, Boyd Gaming’s ECR was in the elite club (~172%) and it rocketed to Rank #2. What happened in between? Boyd likely underwent major financial improvements – perhaps paying down debt, boosting profits, or shedding unproductive assets. Since 2017, Boyd has stayed near the top with ECR around 155–219%. In 2021, Boyd’s ECR hit 197.6%; and in 2022, Boyd reached to a remarkable ECR 219.3% which made them the only company above 200% that year. Even after a slight dip to 208.5% in 2024, Boyd still managed to claim the #1 spot in US Hotels Industry. This meteoric improvement reflects Boyd’s strong strategic transformation into a financially robust enterprise.

Top 3 Hotels of 2025: Boyd, Monarch, and Marriott Lead the Pack

- Boyd Gaming Corp – Minimum Debt, Maximum Strength

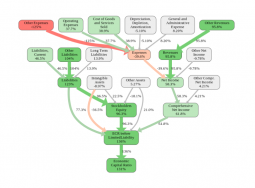

Figure3: Boyd Gaming ‘s Financial Graph (2025) – RealRate’s model of Boyd’s financial effects. Green nodes boost ECR and the red nodes decrease it. Boyd’s largest strength is its liabilities factor which is adding +123 % points to its ECR by being far better than peers. But they have also got their weakness. Their biggest weakness is “Other Expenses”, which drags ECR down by 125%.

Boyd Gaming has transformed into a financially rock soild company, thanks largely to a remarkable strong balance sheet. Boyd’s greatest strength is their low liabilities. In RealRate’s analysis, Boyd’s liabilities variable contributes +123% ECR points above the industry norm which is by far the highest positive effect among all factors. This implies Boyd carries much less debt relative to assets than typical hotels. Indeed, Boyd’s financials show only $0.62 billion in liabilities against $6.39 billions in assets. In other words, a mere 10% of Boyd’s assets are financed by debt with nearly 90% financed by equity. Such light leverage means lower interest costs and risk, boosting the company’s intrinsic value. By contrast, an average hotel’s balance sheet is about 78% assets supported by value ECR while Boyd’s is 208%, meaning their equity value is more than double of balance sheet assets.

Boyd also benefits from solid opearation. It earned $3.93 billion in revenue with $557 million in net income, indicating healthy profit margins. Notably, Boyd’s net income to assets ratio is strong and its comprehensive income is similarly high whihc is reflecting their consistent performance. These factors contribute to an ECR of 208% far above industry average.

However, Boyd is not perfect. RealRate identified “Other Expenses” as Boyd’s greatest weakness, knocking –125 points off its ECR. Boyd had a hefty $2.47 billions in “Other Expenses” on its books, which is extremely high relative to its size, and it is much higher than industry average. This unusual expense significantly reduced Boyd’s ECR which otherwise could have been above 300%. If Boyd manages to control these high costs moving forward, it could maintain its top spot with ease.

2. Monarch Casino Resort – Prudent Debt, Strong earnings but some cost issues

Monarch Casino & Resort (Rank 2) shares a similar strength with Boyd which is low debt levels. Monarch’s liabilities provide about +100 ECR points compared to industry’s average competitor. Their balance sheet shows $173.8 millions in liabilities with $691.6 millions in assets, meaning only 25% of assets are funded by debt and other 75% with equity. This conservative structure is far better than most rivals and nearly as good as Boyd’s. The result is a high intrinsic stability. Monarch ECR stands at 177%, roughly around 99% points above the industry average which is an indication of a robust performance.

Monarch’s operations are also as nearly profitable as Boyd’s. It pulled $522 millions in revenue with $72.8 millions in net income in the last year. Monarch’s strength has been consistent with efficiency and growth as seen by its ECR peaks in past years when it even outranked bigger firms. Where Monarch struggles is expense control. RealRate flags overall “Expenses” as Monarch’s biggest weakness, costing –75 ECR points. Indeed, Monarch’s total expenses ($449 million) nearly match its Revenue (522 million), leaving a modest profit margin. Compared to the industry, Monarch’s expense ratio is higher, dragging down its intrinsic score. Nonetheless, Monarch’s ECR of 177% is exceptionally high and its rank has improved from #5 to #2 over the last few years.

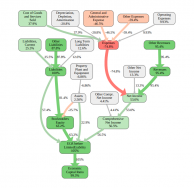

Figure 4: Monarch Casino & Resort Financial Graph (2025) : Monarch’s ECR is bouyed strongly by its liabilities profile (+100 points above average) and hurt by high Expenses (-75 points)

Figure 5: Marriott International Financial Graph (2025); Marriott’s strengths and weaknesses in RealRate’s model. Their notable strength is “Other Revenues”, adding +100 points while “Other Expenses” being the outsized negative factor, reducing ECR by a wooping 318 % points.

Marriott International (Rank 3) is by far the largest company in the top three, and its financial profile reflects both its scale advantages and big business challenges. On the plus side, Marriott enjoys diversified revenue streams from its numerous brands and services. RealRate identifies “Other Revenues” as Marriott’s greatest strength, contributing +100% ECR points above the average. And they indeed had $25.1 billion in revenue last year. Their balance sheet is also healthy : $17.53 billion in stockholder’s equity vs $8.65 billion in liabilities. Debt funds only about 33% of Marriott’s assets ($26.2B) which is a conservative leverage ratio for a huge company.

However, Marriott’s downside comes from extraordinary costs. According to RealRate, their “Other Expenses” are the biggest drag of the company’s ECR by knocking down –318% points. It implies Marriott incurred some extremely large expenses that competitors did not. In financials, Marriott indeed shows “Other expenses” of $21.73 billion which is nearly as high as its revenue. Otherwise, Marriott’s ECR could have been over 460%, significantly far higher than industry average. This shows that the company’s business is very strong but significant high costs are weighing down its intrinsic financial value.

Conclusion

RealRate’s 2025 findings hightlights a few insights about financial success in hotel industry. Light debt load provides companies with heavy advantage: Companies with low debt relative to assets are consistently rewarded with higher ECRs. Companies in hotel industry always must monitor and take control of their expenses.

As travel continues its upswing into 2025, we can expect intense competition within the industry. Companies that maintain financial discipline will have the edge in expanding, investing and competing in economic turns. RealRate’s innovative AI –driven ratings, focusing on economic capital, give us a unique window into that discipline. This year, it reveals a truth which is the largest hotel empires are not guaranteed for the top financial spots. Instead, it is the efficient and well-balanced companies that actually earn the gold medal. And as the hospitality landscape evolves, those are the companies likely to deliver value not only to guests but also to stakeholders, sustaining success in the years ahead.