Capital Vitality: Small Insurer Tops the 2025 Ranking

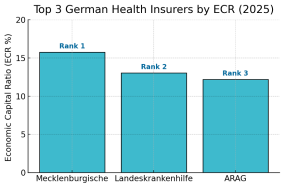

Germany’s private health insurance sector had a shake-up in 2025 as an AI-driven rating model ranked insurers by financial strength – and the results upended traditional assumptions. A lesser-known regional player, Mecklenburgische Krankenversicherung, emerged as the top-rated health insurer in Germany, beating out far larger rivals. Hot on its heels were Landeskrankenhilfe and ARAG Krankenversicherung, two companies that likewise aren’t the very biggest by premium volume, yet demonstrated exceptional financial robustness. These top three firms achieved Economic Capital Ratios (ECR) well above their peers, indicating strong capital buffers relative to their size.

To put things in perspective, Mecklenburgische Kranken – the 2025 Rank #1 – scored an ECR of about 15.8%, roughly double the industry’s average. In practical terms, that means Mecklenburgische’s cushion of economic capital is extraordinarily high for its size. Landeskrankenhilfe (LKH), ranked #2, and ARAG Kranken, ranked #3, posted ECRs of 13.0% and 12.2% respectively. All three leaders far exceeded the market’s mid-single-digit norms. Figure 1 highlights the ECR standings of these top performers, underlining just how much they stand out from the pack. Their high ECRs signal that these companies have solid financial foundations – a combination of ample equity, reserves, and prudent risk management – relative to the amount of insurance business (assets and obligations) they carry.

Figure 1: Top 3 German health insurers by Economic Capital Ratio (ECR) in 2025. Mecklenburgische Krankenversicherung leads with an ECR of ~15.8%, followed by Landeskrankenhilfe (13.0%) and ARAG Kranken (12.2%). Each bar’s label indicates the company’s ranking. Higher ECR denotes greater financial strength relative to assets.

It’s worth noting that these front-runners are not the largest insurers by revenue. In fact, the German market’s giants – such as Debeka, DKV, or Allianz’s health arm – did not make the top three in this new rating. This underscores a key insight of RealRate’s AI-driven analysis: financial fitness matters more than sheer size. The ratings focus on how well an insurer’s capital and earnings can cover its risks and obligations. Thus, a mid-sized mutual company like Mecklenburgische can outperform a behemoth if it has exceptional capital adequacy.

A Multi-Billion Euro Market, With Varied Health

The German private health insurance industry is a multi-billion euro market, critical to the nation’s healthcare financing. In 2024, the 33 insurers assessed in the RealRate model together collected around €35–40 billion in earned premiums. This immense scale, however, comes with wide variation in financial health. On average, insurers operated with an ECR of roughly 8% – but individual results ranged from the high teens into the low single digits. In fact, a few insurers fell well below 5% ECR, highlighting potential vulnerabilities. Overall, financial strength across the market remains solid (the average 8% ECR suggests the typical insurer has €8 of economic capital per €100 of assets), but the new ratings show that some firms are much better capitalized than others despite doing business in the same market.

Rankings Rollercoaster: Drastic Ups and Downs

The 2025 ranking revealed not only new leaders but also dramatic year-on-year shifts for certain companies. The RealRate model, updated with fresh data and refined analytics, essentially recomputed past years’ rankings – leading to some eye-opening movements. For example, Landeskrankenhilfe (LKH) skyrocketed in the rankings: it was a modest 27th place the previous year but leapt to 2nd place in 2025. This meteoric rise by 25 positions is nearly unprecedented and suggests that LKH’s financial fundamentals improved significantly (or were previously undervalued) – likely through bolstering its capital reserves and benefitting from favorable market changes (like higher interest rates unlocking future surplus funds). Similarly, Debeka Krankenversicherung, long known as Germany’s largest private health insurer by customers, jumped from 28th up to 6th place – a 22-spot climb – after the new model adjustments recognized improvements in its economic capital position.

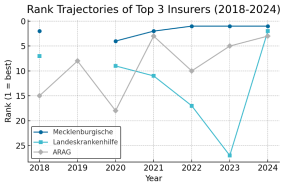

On the flip side, some insurers plunged. Envivas – a niche health insurer that was ranked #3 last year – fell all the way to 20th. And in a whiplash turn of fortunes, Gothaer Krankenversicherung went from a solid #11 in the prior ranking down to 31st in 2025. (Gothaer had actually surged upward the year before, only to crash back down with the latest evaluation.) Such volatility underscores how sensitive the ECR-based ratings are to changes in balance sheet strength: an insurer that depletes some reserves or takes on additional liabilities can see its ranking drop sharply. Conversely, injecting capital or releasing hidden reserves can vault a company upward. Figure 2 illustrates the ranking trajectories of the top 3 insurers over recent years, which reflect both steady leadership and sudden leaps. Mecklenburgische (blue line) has been near the top for years, holding the #1 spot since 2022. ARAG (gray line) had a seesaw pattern – as high as 3rd, down to 10th, then back to 3rd – while LKH (teal line) hovered in the upper-middle ranks before its dramatic jump to #2 this year. Not every company’s ride was as wild, but these examples show that fortunes can change quickly in the private health insurance field when measured by economic capital strength.

Figure 2: Rank trajectories of the top 3 insurers from 2018 to 2024. (Lower rank number is better; the y-axis is inverted so Rank 1 appears at the top.) Mecklenburgische (blue) maintained a top position in recent years. ARAG (gray) showed a volatile path, peaking at 3rd, dipping, and returning to 3rd. Landeskrankenhilfe (teal) surged from mid-pack in 2022 to near the top in 2024 (note: no rank for LKH in 2019, as data was unavailable that year). Such swings highlight the impact of changes in financial fundamentals.

Beyond the top 3, a few notable trends emerged. Several mid-sized and smaller insurers climbed the ranks, suggesting that mutual insurers and regionals often have robust buffers. For instance, providers like Bayerische Beamtenkrankenkasse and INTER Kranken improved their standing, reflecting steady if unspectacular strength. Meanwhile, a couple of big-name players landed in the lower tier: Allianz’s health insurance arm was down at rank 29, and ERGO Kranken at 32. The new entrant Ottonova, a digital-focused startup insurer, debuted at the bottom (#33) with an ECR around only 2.5%. This isn’t unexpected – as a young company, Ottonova is still building up capital and scale. The overall picture is that established firms with decades of accumulated reserves generally outrank newcomers, but excellent financial management can vault a company ahead regardless of age or size.

Why Are Some Insurers Healthier? Key Drivers in the Model

What factors give one insurer a higher Economic Capital Ratio than another? The RealRate AI model crunches a wide range of financial inputs, but at its core, two principles determine ECR: having more capital and profits (good), versus having larger liabilities or costs (bad). In other words:

- Equity and reserves boost ECR. Every euro of additional equity (assets minus liabilities) directly improves an insurer’s economic capital. Insurers that have consistently retained earnings or injected shareholder capital enjoy a big advantage. Similarly, hidden reserves and future profit participations – essentially expected gains that haven’t yet been paid out – count as positive economic value. These are common in life/health insurers as “Überschüsse” (surpluses) set aside for the future. Companies with large surplus funds or discretionary reserves therefore get a higher ECR.

- High liabilities drag ECR down. A large insurance portfolio (and the associated claims reserves) can actually dilute the capital ratio if not matched by equally large capital funds. For example, simply being huge (having tens of billions in obligations) doesn’t guarantee a high ECR; what matters is the proportion of those obligations covered by economic capital. That’s why some market giants rank average or low – their absolute capital might be high, but relative to massive balance sheets, it’s not enough to stand out.

- Strong earnings help, high costs hurt. Profitability plays a role too. Insurers that consistently generate positive net income add to their capital and improve ECR. Lower expense ratios and disciplined claim management (i.e. fewer or well-priced claims) lead to better profits. Conversely, if an insurer has high operating costs or recent losses, its equity can erode, weakening the ECR. For instance, Landeskrankenhilfe had a net loss in the latest year (around €30 million), which slightly held back its ECR – though not enough to knock it from second place, since other strengths overwhelmed that one-off cost.

In the RealRate model’s output, each insurer’s financial variables are analyzed for their effect on the final ECR. The most influential features are those reflecting capital strength and future profitability. In particular, economic equity (the actual capital buffer an insurer holds) and future surplus funds (expected profits and reserves that will bolster equity over time) dominate the importance ranking. These factors can swing an insurer’s ECR by several percentage points. By contrast, features related to minor expenses or industry-wide constants carry far less weight (their bars barely register). Simply put, the model cares most about core solvency metrics – how much real net worth and sustainable surplus an insurer has – and less about incidental items. This aligns with the intuitive drivers of insurer health.

Another way to understand the landscape is to see where each insurer stands on these critical variables. For instance, the “future surplus” reserve (funds set aside for policyholders’ future benefit) is modest for most companies, but a few have extraordinarily high values, reflecting decades of accumulated profits not yet paid out. Those few (including LKH and ARAG) reap a big ECR benefit from that. Similarly, economic equity (capital) is moderate for the majority, but one or two insurers (like Mecklenburgische) have comparatively outsized capital relative to their book of business – giving them a distinct edge. On the flip side, some costs or liabilities might be unusually high for certain insurers, dragging their ratios down. Notably, nearly all insurers have at least some positive equity and profit, which is good news, but the ones at the top of the ranking simply have much more of these good ingredients (or much less of the bad) than their competitors.

So how did the top three achieve their superior positions? Each has a distinct financial profile, but all excel in having more “assets minus liabilities” than peers. Let’s briefly examine their strengths and weaknesses:

- Mecklenburgische Krankenversicherung (Rank 1) – Strengths: This midsize regional insurer’s greatest strength is its sheer economic capital. Mecklenburgische has built up a solid equity base over time; in fact, relative to its size, it holds one of the highest capital buffers in the market. According to the analysis, this factor alone added roughly 8.4 percentage points to its ECR above the industry norm. Additionally, Mecklenburgische benefits from prudent cost management and adequate reserves – it has no major weak spots in profitability. Weaknesses: The model identified the insurer’s total balance sheet size (HGB Bilanzsumme) as a slight weakness – essentially indicating that Mecklenburgische’s asset base, though not huge, is something they must carefully manage so it doesn’t outgrow their capital. This factor was estimated to reduce its ECR by about 2.1 points relative to the benchmark (a smaller impact compared to its strengths). The end result is an ökonomische Eigenkapitalquote (economic capital ratio) of about 16% for Mecklenburgische, the highest of all, and about 7.8 percentage points above the market average. In plain terms, Mecklenburgische has nearly double the relative capital of the typical insurer – a phenomenal cushion that explains its #1 rating.

- Landeskrankenhilfe V.V.a.G. (Rank 2) – Strengths: LKH is a mutual insurer (the V.V.a.G indicates a mutual society), and its mutual structure has historically emphasized policyholder dividends and reserves. Its standout strength turned out to be its “future surplus” funds – the expected surplus benefits owed to policyholders. Essentially, LKH has accumulated a very large pot of participations for its members, which in economic terms counts as a form of reserve capital. This boosted LKH’s ECR by an impressive +9.8 percentage points above the norm, by far the biggest single factor in its favor. In addition, LKH’s hidden valuation reserves (for example, unrealized gains on investments) and other buffers are strong, further shoring up its economic equity. Weaknesses: LKH’s weakest point was its deferred taxes (latente Steuern). Large future profits mean future tax liabilities; for LKH, the size of these deferred taxes slightly erodes its net economic value, costing roughly –1.1 percentage points off its ECR. The company also reported a net loss in the latest year (partly due to reserve strengthening), but this was a manageable hit. All told, Landeskrankenhilfe’s economic capital ratio came out around 13%, which stands about 5.3 points above the market average. The company’s strategy of building up surpluses for policyholders has paid off in making it one of the financially strongest insurers, second only to Mecklenburgische. LKH’s rise also illustrates how a mutual can leverage long-term stability to outshine many shareholder-owned firms in pure balance sheet health.

- ARAG Krankenversicherung (Rank 3) – Strengths: ARAG’s health insurance unit (part of the broader ARAG insurance group) leveraged excellent investment and surplus management to climb into the top three. Its biggest strength in the model was the size of its future profit surplus as well, which contributed about +6.2 percentage points to its ECR above average. ARAG has maintained robust investment returns and added to its reserves steadily, so it scores well on both profitability and capital growth. It also has solid valuation reserves and risk provisions, contributing to a high economic equity. Weaknesses: Similar to LKH, ARAG’s notable weakness was deferred tax liabilities, shaving roughly 1.0 percentage point from its ECR. This indicates that part of ARAG’s handsome investment gains will eventually go to the taxman, slightly reducing net capital. Aside from that, ARAG did not have major deficits – its cost ratio and claims experience are reasonably good, with no extraordinary strains. ARAG ended up with an economic capital ratio of about 12%, roughly 4.4 points above the industry average. This is a strong showing, especially considering that a few years ago ARAG’s rank had dipped; the latest figures demonstrate a rebound in its financial fortitude, powered by those unrealized profits and steady capital accumulation.

It’s fascinating that each of these top insurers got to the top via a different path – one through pure equity buffer (Mecklenburgische), another through massive policyholder reserves (LKH), and the third through a combination of investment gains and prudent growth (ARAG). Yet they all converged on the same outcome: a high ECR that signals resilience. If an economic downturn or a surge in claims were to hit the industry, these companies are positioned to absorb the shock far better than most.

What about the rest of the pack? Many well-known insurers sit in the middle of the ranking with adequate but unremarkable ECRs. For instance, HanseMerkur, Signal Iduna, Continentale, and others scored in the 6%–9% range, indicating solid capitalization more or less on par with the market average. They have enough capital to satisfy regulators and policyholders, but not so much as to merit top accolades by RealRate’s measure. On the lower end, companies like DKV (rank 28, ~5.6% ECR) and Allianz Kranken (rank 29, ~5.5% ECR), despite their huge premium volumes, apparently carry proportionally higher liabilities or lower surplus, dragging down their ratios. It must be said that even the lowest-ranked still meet regulatory solvency requirements – the RealRate model is stricter, aiming to distinguish the truly robust from the merely sufficient.

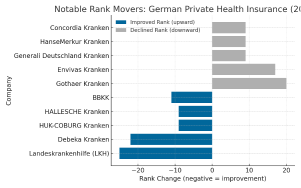

The RealRate 2025 analysis of the German private health-insurance sector reveals several companies with remarkable ranking shifts based on their Economic Capital Ratios (ECR):

- Top Improvers:

- Landeskrankenhilfe (LKH) soared 25 ranks to 2nd place, driven by strengthened equity and high future surpluses.

- Debeka Kranken improved 22 ranks, reflecting strong balance-sheet recovery and consistent profit growth.

- HUK-COBURG and HALLESCHE Kranken both advanced 9 ranks, benefitting from better underwriting performance and lower claim ratios.

- BBKK (Bayerische Beamtenkrankenkasse) gained 11 ranks, supported by stable operating income.

- Biggest Decliners:

- Gothaer Kranken dropped 20 ranks, showing pressure from reduced profitability and higher liabilities.

- Envivas Kranken fell 17 ranks, largely due to declining ECR linked to higher costs.

- Generali, HanseMerkur, and Concordia each slipped 9 ranks, reflecting thinner equity margins and weaker capital ratios.

Negative values on the graph indicate improvement (higher ranking), while positive values signal decline. This visualization underscores how smaller insurers like LKH and Debeka have leveraged efficient capital management to outperform larger incumbents. Conversely, insurers with rising claim costs or thin equity buffers saw ECR deterioration and slipped down the ranks.

In essence, the movers’ distribution confirms a tightening landscape: agility in capital and risk management increasingly defines success in Germany’s private health-insurance market.

Outlook: Financial Fitness as a Differentiator

The 2025 results make one thing clear: financial fitness is becoming a key differentiator among health insurers. In a market often dominated by discussions of premium prices and customer service, the RealRate AI rating shines a light on the less visible aspect – the balance sheet health that ensures an insurer can keep its promises in the long run. This could influence consumer and broker perceptions, and possibly even spur some companies to shore up their capital positions to improve their standing. After all, a higher rating isn’t just bragging rights; it signals to policyholders that their insurer is ultra-secure.

For now, Germany’s healthiest private health insurer is a relatively small player that managed its finances exceedingly well. Mecklenburgische’s triumph, LKH’s surge, and ARAG’s consistency show that prudent management and long-term thinking pay off. The ongoing challenge for all insurers will be navigating the economic environment – interest rate changes, medical inflation, and regulatory shifts – while maintaining or improving their economic capital. Those who can will likely find themselves topping future rankings as well. And for consumers, this new transparency is a reminder: when choosing an insurer, it’s wise to look not just at premiums or brand, but also at the company’s financial strength. In insurance, as in health, what’s under the hood truly matters.