How a tiny advisory firm vaulted to the top, as established players jostle in a $400 billion industry.

Industry Context: The U.S. management consulting sector has grown into a behemoth generating roughly $400 billion in annual revenue by 2025. Steady demand for digital transformation, strategy, and compliance advice has fueled this growth, making consulting a cornerstone industry in the modern business landscape.

Top Financial Performers of 2025

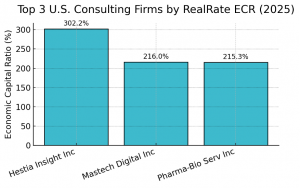

The latest RealRate financial strength ratings for U.S. consulting firms (marketing year 2025) delivered a big surprise. A little-known boutique firm surged past industry stalwarts to claim the #1 spot. The RealRate Economic Capital Ratio (ECR) – a measure of a company’s true economic value relative to its total assets – is the key metric behind these rankings. Higher ECR means more financial strength, regardless of company size. The top three consulting companies of 2025 and their ECRs are:

- Hestia Insight Inc – ECR 302%, up from rank 27 last year (a meteoric 26-position jump).

- Mastech Digital Inc – ECR 216%, improving from rank 4 to rank 2.

- Pharma-Bio Serv Inc – ECR 215%, a consistent high performer (rank 2 last year, now 3).

Figure 1: RealRate’s top three U.S. consulting firms of 2025 by Economic Capital Ratio. Hestia Insight’s ECR of 302% is exceptionally high, indicating its economic value is over three times its assets. Mastech Digital and Pharma-Bio Serv follow with very strong ECRs around 215–216%, virtually neck-and-neck for second place.

This outcome marks a dramatic shake-up. Hestia Insight Inc, an AI-driven capital markets advisory focusing on healthcare and biotech, was barely on the radar last year (ranked 27th). Now it’s top-rated – an almost unprecedented leap. The company’s extraordinary rise owes much to an explosive profit performance relative to its modest asset base. In 2024, Hestia’s revenues were only about $1.25 million, but it turned this into a hefty $0.64 million net profit. Such a high profit-to-assets ratio sent its ECR soaring.

By contrast, Mastech Digital Inc, a Pittsburgh-based IT consulting and digital transformation firm, and Pharma-Bio Serv Inc, a Puerto Rico-based pharmaceutical compliance consulting firm, have been mainstays near the top. Mastech, which provides IT staffing and digital transformation services, regained a top spot (up from #4 to #2) after having been #1 in a prior year. Pharma-Bio Serv, a specialist in regulatory and quality consulting for life sciences, continues to demonstrate solid financial strength, slipping slightly from #2 to #3 but essentially tying with Mastech in ECR. Both companies have consistently high ECRs, reflecting strong fundamentals even as they jostle for position.

Ranking Trends and Notable Movements

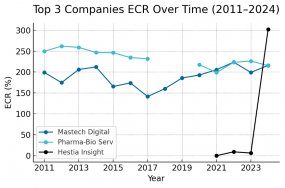

Financial strength rankings can fluctuate as company fortunes change. RealRate’s historical data reveals how the top players have evolved over time. Pharma-Bio Serv dominated the early 2010s, ranking #1 for several years on the back of ECRs around 250%. Mastech Digital steadily ascended through the 2010s, briefly reaching #1 in 2022 with an ECR of 223%. Then came 2024’s upheaval: Hestia’s leap from the bottom tier to the top.

Figure 2: ECR trends for the top 3 consulting firms over 2011–2024. Pharma-Bio Serv (light blue line) enjoyed consistently high ECRs (~230–260%) in the early 2010s, though data for 2018–2019 are not available. Mastech Digital (dark blue line) saw ECR ups and downs, dipping in the mid-2010s then rising to ~205–224% by 2022. Hestia Insight (black line) only entered the rankings in 2021 – and remained low until its astonishing jump to 302% in 2024.

Beyond the top three, other notable moves occurred in 2025’s ranking: Lightbridge Corp, last year’s #3, plummeted to #11 after its ECR fell from 204% to 133%. This loss of strength was attributed to a sharp drop in its net income. Conversely, Booz Allen Hamilton, a well-known consulting giant, climbed from #15 to #10 as its ECR improved (from 132% to 138%). The 2025 list also welcomed a newcomer: Hypha Labs Inc debuted at rank #21, making it the “best newcomer” of the year. In total, 24 consulting firms were rated (down from 30 a few years ago), indicating some consolidation in the industry as underperforming firms fell off and only one new entrant joined.

What’s striking is that financial strength doesn’t correlate directly with size. For example, Booz Allen is far larger in revenue than tiny Hestia, yet ranks far lower in RealRate’s ECR-based evaluation. This underscores RealRate’s mission: to compare big and small companies on equal footing by looking at economic value relative to assets. It’s not about sheer revenue; it’s about how effectively a company uses its resources to create value.

Why These Companies Excel – Strengths and Weaknesses

Each firm’s rating reflects a balance of multiple financial factors. RealRate’s AI-driven model examines a comprehensive set of variables (from balance sheet figures to profit margins), gauging how each one contributes to or detracts from the company’s ECR. Let’s break down the strengths and weaknesses behind the top three companies’ stellar results:

- Hestia Insight Inc (Rank 1) – Strength: Exceptional profitability. Hestia’s comprehensive net income (bottom-line profit) was extremely high relative to its assets, boosting its ECR by about 132 percentage points above the industry norm. Essentially, Hestia squeezed more economic value out of each dollar of assets than any competitor. Weakness: Heavy current assets. Interestingly, Hestia’s only notable drag was its current assets (like cash or inventory) being proportionately high, which lowered its ECR by 43 points versus the average. (High cash reserves can indicate idle assets not actively generating earnings, from a pure efficiency standpoint.) Overall, with minimal liabilities and outsized earnings, Hestia’s financial profile became top-notch.

- Mastech Digital Inc (Rank 2) – Strength: Diversified revenue streams. Mastech’s greatest advantage was its “Other Revenues,” which contributed enormously to its value. In fact, Mastech’s broad mix of service revenue added an estimated +134 percentage points to its ECR compared to the market average. This suggests Mastech generates revenue in areas that the model views as highly value-efficient (perhaps long-term contracts or high-margin tech services). Weakness: Cost of delivery. Mastech’s Achilles heel was its Cost of Revenues – the direct costs of delivering its services – which were relatively high. These costs dragged its ECR down by 119 points against the benchmark. In simpler terms, while Mastech earns a lot, it also spends a lot to earn it, partially offsetting its strengths. Even so, the company’s final ECR of 216% is about 80 points above the industry average, indicating robust net strength after all factors.

- Pharma-Bio Serv Inc (Rank 3) – Strength: Rock-solid balance sheet. Pharma-Bio Serv’s standout factor is its stockholders’ equity. The company is conservatively financed with equity (retained earnings and capital) making up the bulk of its assets. This strong equity base raised its ECR by roughly 98 points relative to peers. In 2024, Pharma-Bio Serv had ~$16 million in assets against only ~$2.6 million in total liabilities – an excellent solvency position that enhances its economic stability. Weakness: Thin margins. The biggest drag on Pharma’s rating was its Cost of Revenues, which reduced ECR by about 30 points. The firm barely broke even in its latest year (roughly a $0.78 million net loss on $10 million revenue), indicating that high costs are eating into profits. Nevertheless, because it carries very little debt and has built up equity over years of past profits, Pharma-Bio Serv’s financial strength remains about 80 points above the industry average ECR.

These profiles illustrate a broader point: financial strength can be achieved via different paths. Hestia did it through extraordinary profit efficiency. Mastech leveraged revenue growth (albeit with high costs). Pharma relied on balance-sheet prudence. All three have secured a “Top Rated” label from RealRate for their superior overall performance, albeit with different mixes of strengths and weaknesses.

Overall Industry Insights

How do these company-level dynamics translate to the market as a whole? RealRate’s model provides a bird’s-eye view of the U.S. consulting industry’s financial health and what drives it:

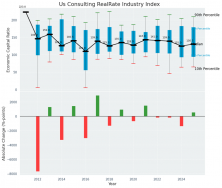

- Typical Financial Strength: The average Economic Capital Ratio across the consulting industry is around 136% in 2025. In fact, half of the rated consulting firms have ECRs between roughly 125% and 143% (with a median near 135%). This implies that most consulting firms create substantial economic value – about one and a quarter to one and a half times their assets on average. The industry’s best ECR (302%) and worst (13.8%) are extreme outliers; the majority cluster in a much tighter band. Over the past decade, the median ECR of consulting firms has remained fairly stable in the 130–140% range, even as individual companies rise and fall. This consistency suggests a mature industry where, in aggregate, improvements in some firms balance out declines in others.

Figure 3: U.S. Consulting Industry Financial Strength Index (2012–2024). The top panel shows the distribution of Economic Capital Ratios each year: blue boxes indicate the middle 50% of companies, the black line is the median, and green/red whiskers mark the 90th/10th percentile extremes. The median ECR (black line) hovers around 130–140% most years, indicating a steady central trend. The bottom panel (green and red bars) illustrates the overall annual change in ECR levels – positive in some years (green) and negative in others (red) – reflecting the net effect of industry-wide improvements or deteriorations. Overall, the financial strength of the consulting sector has been remarkably resilient over time, with no dramatic systemic shifts.

- Key Drivers of Value: RealRate’s feature distribution analysis highlights which financial metrics have the widest impact on consulting firms’ strength. Generally, profitability-related variables (like net income and revenue efficiency) and capital structure variables (like equity ratio) show the broadest swings between companies. For instance, “Other Revenues” – income outside the typical fee-for-service contracts – is a major differentiator for many firms, as we saw with Mastech. Strong comprehensive income (including one-time gains or losses) can also set leaders apart – Hestia’s case in point. On the flip side, high cost of revenue or heavy operating expenses consistently weigh down the weaker firms. The distribution of these effects is roughly symmetric: about half of companies enjoy a positive effect (above-average) on a given variable, shown as green in RealRate’s charts, and half suffer a negative effect (below-average), shown in red. The broader the distribution for a variable, the more important that factor is in distinguishing winners from laggards. In consulting, revenue mix and cost management are among the most pivotal factors – firms that innovate new revenue streams or control costs have a clear edge in ECR.

- Market Validation: An interesting byproduct of RealRate’s model is its regression plot comparing the model’s internal valuation of companies to their actual market valuations (as reflected in stock prices). The 2025 consulting regression shows a strong positive correlation, meaning that companies the model deems financially stronger generally have higher market valuations. In essence, Wall Street tends to reward the same attributes that RealRate’s AI model identifies: a reassuring sign that the model’s definition of “financial strength” aligns with real-world investor perceptions. This correlation lends credibility to the ratings – top-rated firms like Hestia, Mastech, and Pharma-Bio Serv indeed have seen their stock values respond positively in line with their robust fundamentals, whereas lower-rated firms struggle with muted valuations.

Balance Sheets and Bottom Lines: How the Top 3 Compare

Financial strength is not just an abstract ratio – it stems from concrete numbers on the balance sheet and income statement. Let’s briefly compare the scale and financial structure of the top three firms:

- Hestia Insight: By far the smallest of the trio, Hestia had total assets of about $1.15 million (with virtually no intangible assets and minimal liabilities). Don’t let its size fool you: with $1.25 million in revenue and $0.64 million net income, Hestia posted a remarkable profit margin. Its return on assets was extraordinarily high, which explains its 302% ECR. Hestia’s assets are largely current (cash or equivalents), and its equity of ~$0.94 million covers the vast majority of its funding – a very lean, debt-light setup.

- Mastech Digital: A mid-sized player, Mastech’s latest assets totaled $111 million, including significant intangibles (around $38 million, likely goodwill or intellectual property from acquisitions). It had about $24 million in liabilities, leaving a healthy equity cushion (~$87 million). Mastech generated $199 million in revenues, but its expenses were nearly $196 million, resulting in a modest net income of $3.4 million. With such slim net profits, Mastech’s high ECR might seem surprising – but it is propped up by those intangible assets (indicating future earning power) and relatively strong equity financing. Essentially, investors and the model anticipate Mastech’s earnings will grow, given its digital services focus, so its current modest profits belie a higher economic valuation.

- Pharma-Bio Serv: A smaller company, Pharma had $16 million in assets versus only $2.6 million in total liabilities – a standout solvency position (over 85% of its assets are funded by equity). Its revenue was around $10 million, with total expenses slightly exceeding that (about $10.8 million), leading to a small loss for the year. Even with profitability under pressure, Pharma’s balance sheet strength (low debt, decent cash reserves) ensures it remains financially resilient. Its high ECR indicates that despite a current lull in earnings, the company’s intrinsic value – bolstered by past profits and conservative management – substantially exceeds the book value of its assets.

In summary, Hestia, Mastech, and Pharma represent three distinct financial archetypes: the nimble niche player with sky-high margins, the growing mid-cap with intangible value, and the conservatively run firm with a fortress balance sheet. All three approaches have proven effective in yielding superior RealRate ECRs in 2025.

The Road Ahead

RealRate’s 2025 consulting industry analysis paints an encouraging picture for the sector: overall financial strength is solid, and the model’s key drivers align with sustainable business practices (innovation in services, cost efficiency, and prudent financing). The shake-up at the top – with an agile newcomer overtaking established firms – highlights how quickly fortunes can change. It serves as a wake-up call to industry giants: agility and financial efficiency can trump sheer scale.

For consulting firms across the board, the takeaway is clear. To climb in the rankings (and, by extension, improve in real financial health), firms should focus on boosting their Economic Capital Ratio – by increasing economic value (profits, equity) and/or optimizing asset use. That could mean expanding high-margin offerings, pruning unnecessary costs, or deleveraging to strengthen balance sheets. As companies adapt, we can expect ongoing rank churn: today’s leader could be tomorrow’s laggard if it becomes complacent.

The U.S. consulting industry is fiercely competitive, but that competition is driving financial improvements. Clients and investors alike can take comfort that many consulting firms are financially robust. And for those that aren’t, RealRate’s model isn’t shy about calling them out – hopefully spurring the changes needed to build a stronger consulting sector for the future. In the end, 2025’s RealRate results remind us that in consulting, as in any business, smart financial management is just as critical as savvy client advice.