The U.S. motor vehicle and parts industry is a cornerstone of the economy, contributing over $1.5 trillion to GDP and selling nearly $2.3 trillion worth of vehicles in 2024. This massive sector – encompassing auto manufacturers and suppliers – has experienced a turbulent year, with new contenders rising and stalwarts facing fresh competition. RealRate’s 2025 ratings (based on 2024 financials) reveal a dramatic reshuffling of financial strength rankings among 46 companies. A once-obscure micro-cap firm now tops the list, outperforming household-name automakers in economic robustness. Below, we break down the rankings, explain how the Economic Capital Ratio (ECR) underpins these ratings, and explore what drove the year’s biggest winners and losers.

2025 Ranking Shake-Up: Who’s on Top?

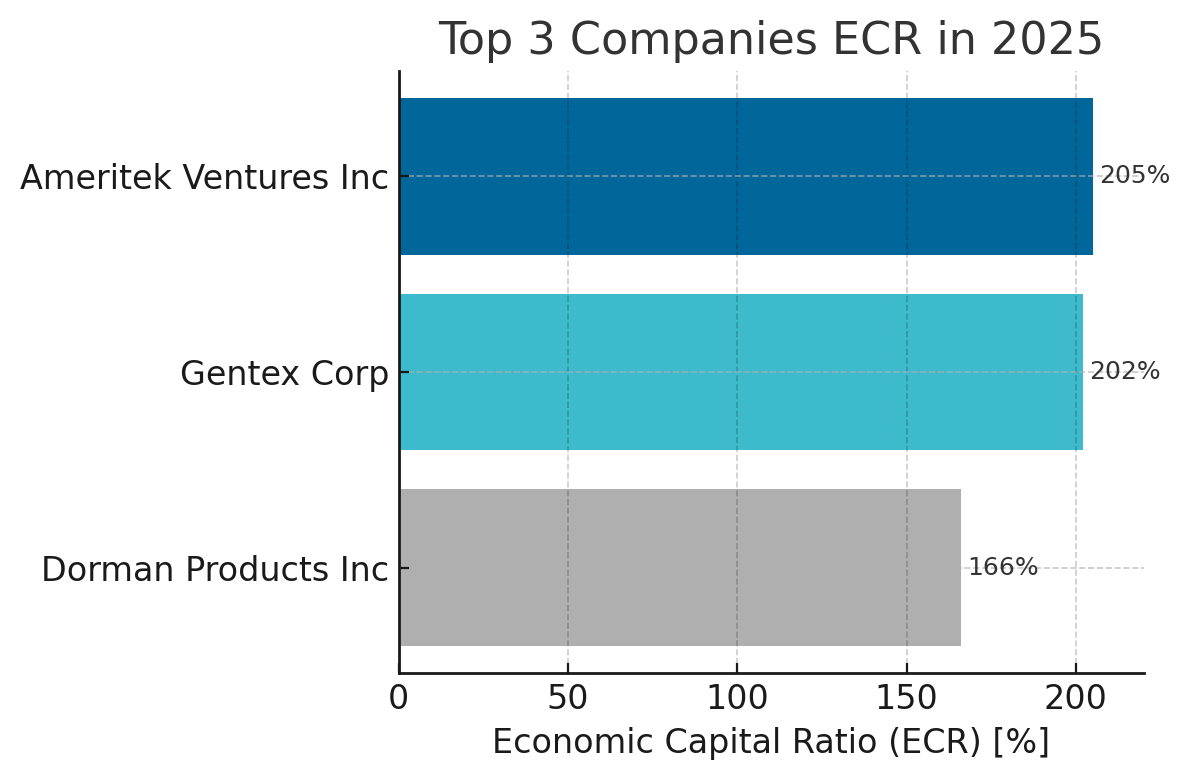

The RealRate model assesses each company’s Economic Capital Ratio (ECR) – essentially the ratio of a firm’s economic value to its total assets – to compare financial health on an even footing. An ECR above 100% means a company’s value exceeds its assets (a sign of strong balance sheets and profitability), while lower ECRs indicate weaker positions. This year’s surprise: a tiny tech firm, Ameritek Ventures Inc, vaulted to Rank 1, dethroning longtime leader Gentex Corp (now #2) and edging out Dorman Products Inc (#3). All three top contenders posted extraordinarily high ECRs around 166–205%, far above the industry’s ~97% average.

Figure 1: Top 3 companies by Economic Capital Ratio (ECR) in 2025. Ameritek Ventures Inc’s ECR surged to 205%, edging Gentex (202%) and Dorman Products (166%). Higher ECR indicates greater financial strength. Despite vastly different sizes, a small newcomer outperforms two established manufacturers.

Ameritek’s leap is astounding – just last year it ranked 43rd. Its ECR rocketed from ~67% to 205%, reflecting an exceptional improvement in economic value. Gentex, by contrast, has been a model of consistency: the Michigan-based automotive electronics supplier held the #1 spot for much of the past decade (often scoring ECR ~200% each year). Dorman, a mid-sized aftermarket parts maker, rebounded from rank 18 in 2021 to #3 now, recovering its footing after a dip during the pandemic. Together, these three illustrate how RealRate’s approach can elevate a dark horse and humble an incumbent, depending on financial fundamentals.

Profiling the Top 3: From Underdog to Top Dog

1. Ameritek Ventures Inc – A Surprising New Champion

Ameritek Ventures is a little-known tech firm that stunned the industry by vaulting from rank 43 to rank 1 in a single year. How did this minnow outshine giants? The answer lies in extraordinary profitability. In 2024, Ameritek reported net income of $4.5 million on a tiny revenue base of just $0.7 million – an unusual scenario where net income far exceeded sales. This was likely due to a one-time gain or investment windfall. Indeed, Ameritek’s Comprehensive Net Income was enormous relative to its $7.2 million in total assets, creating an ECR of 205% (meaning the company’s economic value is about double its assets!). By contrast, Ameritek carries very little debt (liabilities were under $2.5 million).

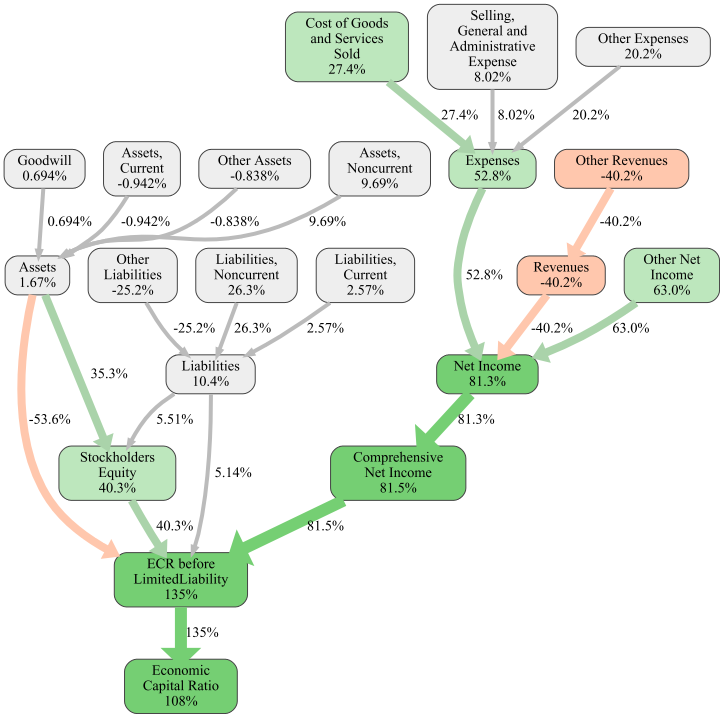

In RealRate’s analysis, Ameritek’s greatest strength is exactly that outsized profitability. Comprehensive Net Income contributed +81 percentage points to its ECR – a massive positive effect (green in Figure 2). The biggest weakness is its paltry operating revenue: “Other Revenues” dragged ECR down by 40 points (orange in Figure 2)[9]. In simple terms, Ameritek earned a high rating not through robust sales or assets, but through an anomalously high profit relative to its small size. This unique profile vaulted it to the top, but also raises questions about sustainability. Still, for now Ameritek exemplifies how a nimble firm with a windfall can beat the Detroit heavyweights at their own game.

Figure 2: Strengths and weaknesses diagram for Ameritek Ventures. Green boxes show variables raising the ECR, orange indicate factors lowering it (width denotes magnitude). Ameritek’s Comprehensive Net Income (+81.5%) was by far the biggest boost to its Economic Capital Ratio, reflecting unusual profit, while low revenues (-40.2%) weighed heavily against it. The end result was a 205% ECR (108 percentage points above the 97% market average).

2. Gentex Corp – The Longtime Leader with Rock-Solid Finances

Gentex, a maker of automotive mirrors and electronics, has dominated these rankings for years – and even in second place, it remains a “Top Rated 2025” company with stellar fundamentals. Gentex’s ECR of 202% means its economic value is roughly double its assets. What drives this strength? In short: huge equity and steady profits with very low debt. Gentex carries $2.47 billion in stockholders’ equity against $2.76 billion in assets – an equity ratio north of 89% – meaning the company is nearly unleveraged. Revenues in 2024 were $2.31 billion, with net income $404 million, a healthy ~17% profit margin. This conservative balance sheet and consistent earnings yield high economic capital.

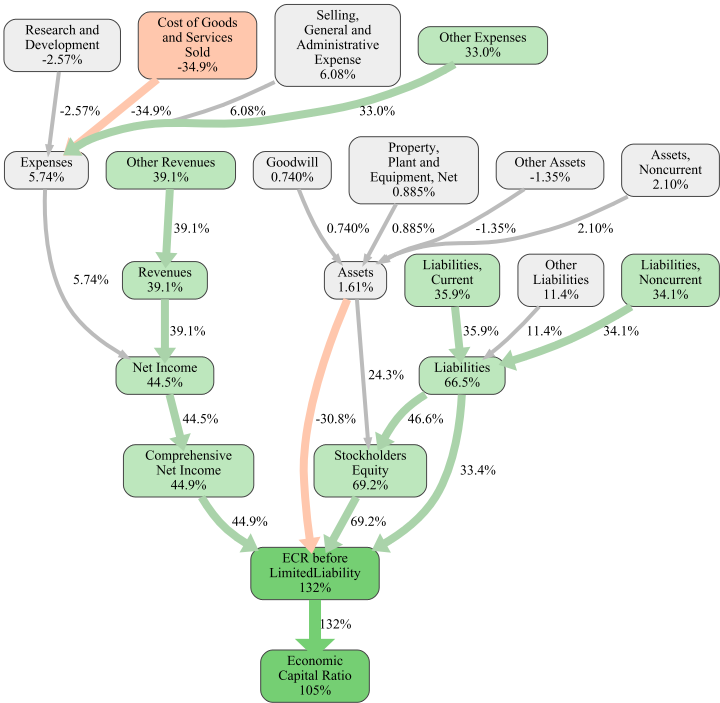

RealRate finds Gentex’s biggest strength is its Stockholders’ Equity, boosting ECR by +69% points. In other words, Gentex has far more equity (and thus buffer) than the average competitor – a testament to decades of retained earnings and low liabilities. On the flip side, Gentex’s weakest point is Cost of Goods Sold, which reduced ECR by -35% points. As a manufacturing company, Gentex’s cost of production is significant; in 2024 its cost of goods (~$1.54 billion) was a sizable portion of sales, slightly worse than peers. This manufacturing cost drag is highlighted in orange in Gentex’s chart (Figure 3). Still, other positives (green) like strong revenue and income easily outweighed it. The company’s Economic Capital Ratio ended up at 202%, about 105 points above the industry average – a testament to Gentex’s excellent financial management. In short, Gentex remains an auto-parts powerhouse, blending consistent profitability with one of the strongest balance sheets in the sector.

Figure 3: Key drivers of Gentex Corp’s rating. Gentex’s enormous equity position (+69.2%, green) and solid profits propelled its ECR to 202%. Its cost of goods sold (-34.9%, orange) was the biggest drawback, reflecting high manufacturing costs. Overall, Gentex’s strengths far outweighed weaknesses – note the thick green arrows indicating robust revenues (39.1%) and net income (44.5%) contributions.

3. Dorman Products Inc – A Comeback Story in the Making

Dorman Products, an aftermarket car-parts supplier, secured the #3 spot with an ECR of 166%. A few years ago, Dorman’s fortunes looked shakier – its rank slipped to 18th in 2021 amid supply chain woes – but it has since rebounded strongly. In 2024, Dorman posted $2.0 billion in revenue and $190 million in net income (about a 9.5% profit margin). Its balance sheet is solid: $1.86 billion in equity against $2.42 billion assets, and little long-term debt. Goodwill from acquisitions is relatively high (over $720 million), but Dorman’s core business is profitable and growing again – as evidenced by improving ECR over the past three years (from 141% in 2021 up to 166% now).

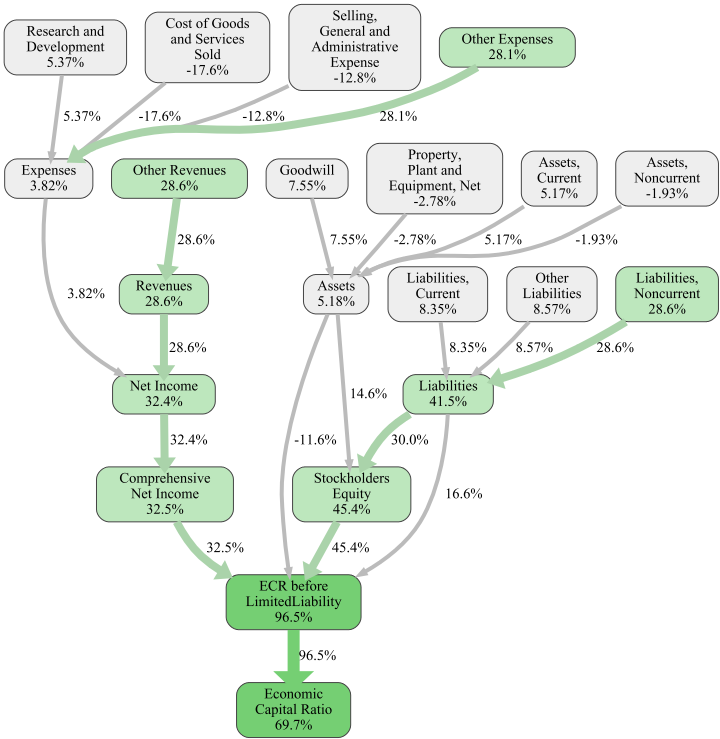

RealRate identifies Stockholders’ Equity (+45% points) as Dorman’s top strength, similar to Gentex (indicating above-average equity capitalization). Cost of Goods Sold is Dorman’s chief weakness (-18% points), though to a lesser degree than Gentex’s. In 2024, Dorman’s cost of sales was $1.20 billion – again a significant chunk of revenue, but Dorman managed to pass through enough costs to keep margins reasonable. Dorman also benefited from other revenue streams (+28.6%), possibly new product lines or price increases, which gave it a green boost in the model (Figure 4). With a 166% ECR (about 70 points above average), Dorman has firmly re-established itself among the industry’s financially strongest firms. Its trajectory suggests cautious optimism: effective cost management and a focus on equity strength have paid off. “We analyzed all variables,” the RealRate report notes, “and Dorman’s greatest strength is Stockholders Equity… greatest weakness is Cost of Goods Sold”. In other words, shoring up margins will be key if Dorman wants to climb further, but its foundation is robust.

Figure 4: Dorman Products’ financial effect profile. Like Gentex, Dorman benefits from a hefty equity cushion (+45.4%, green) and solid sales, while its cost of goods (-17.6%, light orange) and operating expenses (-12.8%) create drags. The company’s ECR (166%) is ~70% above the market average, underscoring a well-balanced performance.

Trends Over Time: Stability, Surges, and Surprises

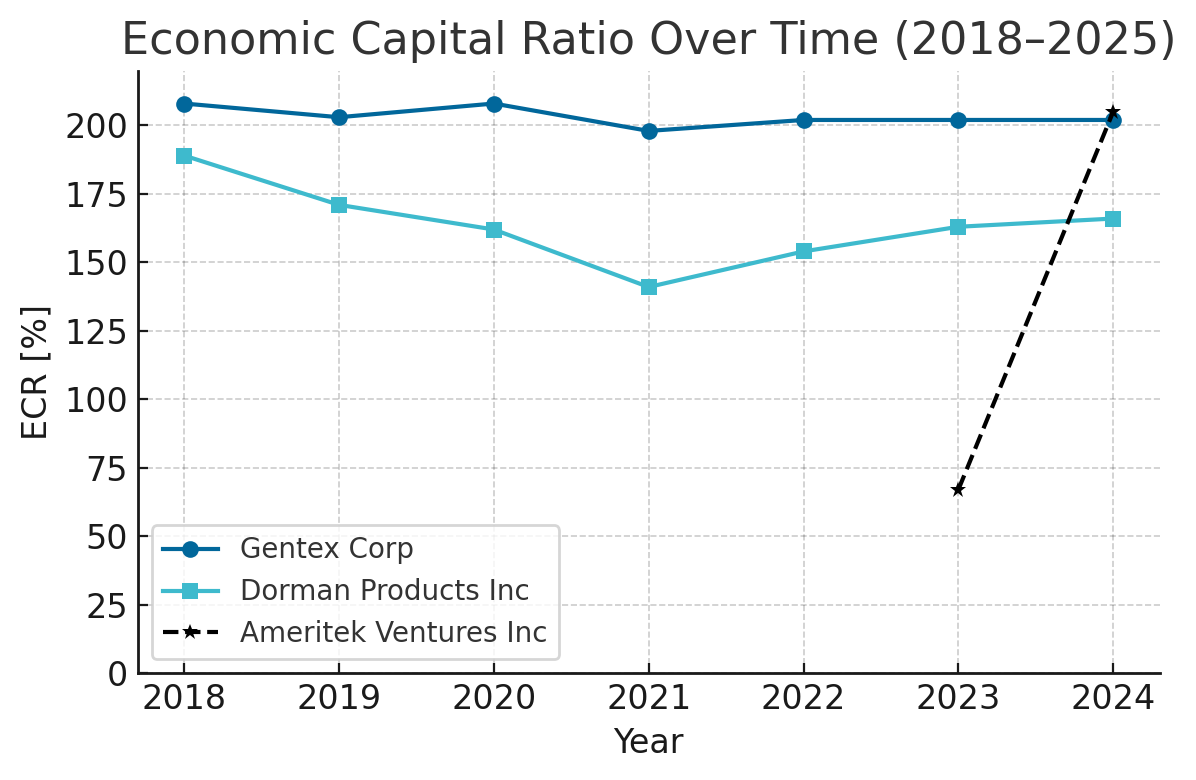

The 2025 rankings reflect both long-term stability and sudden swings. Gentex and Dorman exemplify stability: Gentex’s ECR has hovered around 200% for the past six years, keeping it at or near #1 throughout. Dorman’s ECR, while lower, followed a predictable cycle – peaking around 190% in 2018, dipping to ~140% in 2021 during pandemic disruptions, then recovering to 166% in 2024 as conditions improved. These trajectories (blue lines in Figure 5) show that established players usually move gradually in rank. Ameritek, however, is a bolt from the blue. Until 2023, it didn’t even register in the top 40. Then an outsized profit in 2024 sent its ECR from 67% to 205%, as depicted by the black dashed line shooting upward in Figure 5. Such volatility is rare – and indeed, Ameritek’s jump is the largest year-over-year rank change RealRate has recorded in this sector (a 42-position climb).

Figure 5: Economic Capital Ratio (ECR) trends for the top 3 companies, 2018–2024. Gentex (dark blue) has maintained ~200% ECR with minor fluctuations, mirroring its consistently high rank. Dorman (light blue) dipped in 2020–2021 then rebounded. Ameritek (dashed black) was absent from rankings until a meteoric rise between 2023 and 2024 (from 67% to 205% ECR). This illustrates the usual stability of large firms versus the occasional explosive newcomer.

Beyond the top 3, several notable moves occurred across the ranking:

- Phoenix Motor Inc (an EV startup) leapt from rank 55 to rank 22, improving its ECR by ~33 points. This suggests a major capital injection or improved financials as it scales up production.

- The Blue Bird Corporation (school bus manufacturer) jumped from rank 39 to rank 12 in 2023 after restructuring, though it did not appear in the top 15 for 2024 as its momentum leveled off.

- Federal Signal Corp, known for emergency vehicles and equipment, climbed from rank 15 to rank 6, thanks to steadily rising ECR (from ~135% to 155%).

- Visteon Corp (automotive electronics) also rose from rank 14 to rank 7, reflecting improving profitability in the OEM supply chain.

- On the downside, Worksport Ltd (truck accessories) plummeted from rank 7 in 2022 to rank 26 in 2023 and further to 41 in 2024. Its ECR fell from a peak ~165% to under 70%, possibly as one-time gains faded and core losses resurfaced.

- Envirotech Vehicles Inc wins the volatility prize: it swung from rank 2 in 2021 to rank 61 in 2022, then up to rank 17 in 2023. Such wild oscillations (rank –42, +59, -44 over consecutive years) were driven by erratic finances – a reminder that high risk often accompanies small-cap innovators.

These shifts underscore that financial fortunes can change quickly in the motor sector, especially for emerging electric vehicle and specialty firms. External factors – supply chain constraints, commodity prices, technological breakthroughs – can dramatically affect costs and revenues, and thus ECR scores. Established firms tend to be steadier, but they aren’t immune to change either, as seen with Dorman’s resurgence and Ford’s and GM’s continued struggles (both legacy automakers remained in the lower half of the ranking, with ECRs under 90% and ranks in the 20s or lower).

The Big Picture: Industry Averages and Outlook

RealRate’s Economic Capital Ratio methodology shines a light on the overall financial health of the U.S. motor industry. For 2024, the average ECR was ~97% – essentially on par with assets, indicating that in aggregate the sector is fairly valued and adequately capitalized. However, that average masks a wide dispersion: about a quarter of the companies boast ECRs above 150% (extremely strong balance sheets), while several languish below 50% (highly leveraged or unprofitable). The standard deviation of ECR is roughly 50 percentage points, reflecting the gap between cash-rich winners and struggling laggards. In practical terms, big suppliers and niche innovators dominate the top, whereas many smaller firms and even some big-volume manufacturers (with heavy debt or thinner margins) end up in the lower ranks.

From a balance sheet perspective, the top 3 exemplify prudent financial structure. Gentex and Dorman each have shareholders’ equity making up 75–90% of total assets, which insulates them in downturns. In contrast, some lower-ranked firms (e.g. startup EV makers) rely more on debt or repeated equity infusions, keeping their ECR low. Profitability is the other key piece: companies that convert sales into profits efficiently tend to pull ahead. Gentex’s 17% net profit margin and Dorman’s ~9.5% are decent, but the likes of Tesla (ranked 9) have been improving margins and thus climbing the rankings year by year. Meanwhile, firms with chronic losses or razor-thin margins can see their ECR stagnate or fall.

Encouragingly, the overall industry financials are improving compared to a few years ago. Average ECR ticked up slightly, and more companies improved their score than worsened it in 2024. This reflects post-pandemic recovery: supply chains eased and vehicle demand remained strong, lifting revenues for many auto parts manufacturers. The U.S. motor vehicle sector as a whole is enormous, and its recent growth is evident in these financial metrics. With U.S. light vehicle sales back to 15.9 million units in 2024 and robust demand for aftermarket parts, even smaller players had opportunities to strengthen their balance sheets.

Looking ahead, the 2025 marketing year brings both optimism and uncertainty. Electric vehicle startups like Lucid and Rivian are now on the map (ranks #23 and #32, respectively), potentially disrupting traditional hierarchies if they achieve sustained profitability. Supply costs and inflation remain a concern – high input costs hurt everyone’s ECR, as seen by cost of goods sold being a common weak point. And a one-hit wonder like Ameritek will be watched closely: can it justify its top billing with repeat performance, or will it regress to the mean?

What is clear from RealRate’s rating model is that financial resilience matters more than sheer size. Companies that skillfully manage their capital – keeping debt low and equity high – and maintain healthy profit streams will score well and attract investors, regardless of their market share. 2025’s rankings vividly illustrate this principle. An underdog with savvy financials can indeed outrun the giants. The race is on, and as the U.S. motor industry shifts into a high-tech, electric future, expect the leaderboard to continue evolving. One thing is certain: the engine of competition is running hotter than ever.