The results for RealRate’s 2024 U.S. State Banks Industry rankings are here, showcasing the top companies based on their financial strength!

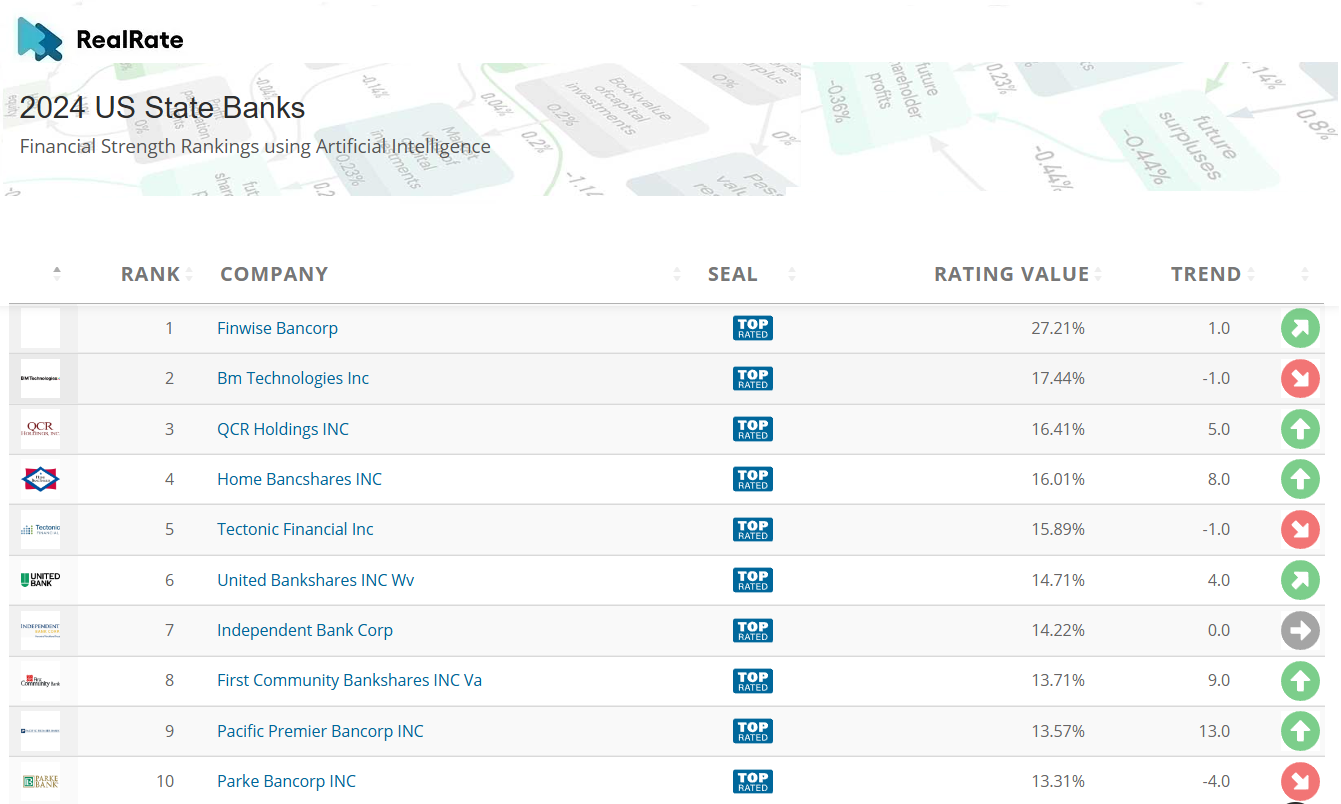

The Top 10 U.S. State Banks are as follows:

Source: https://realrate.ai/ranking-area/2024-us-state-banks/

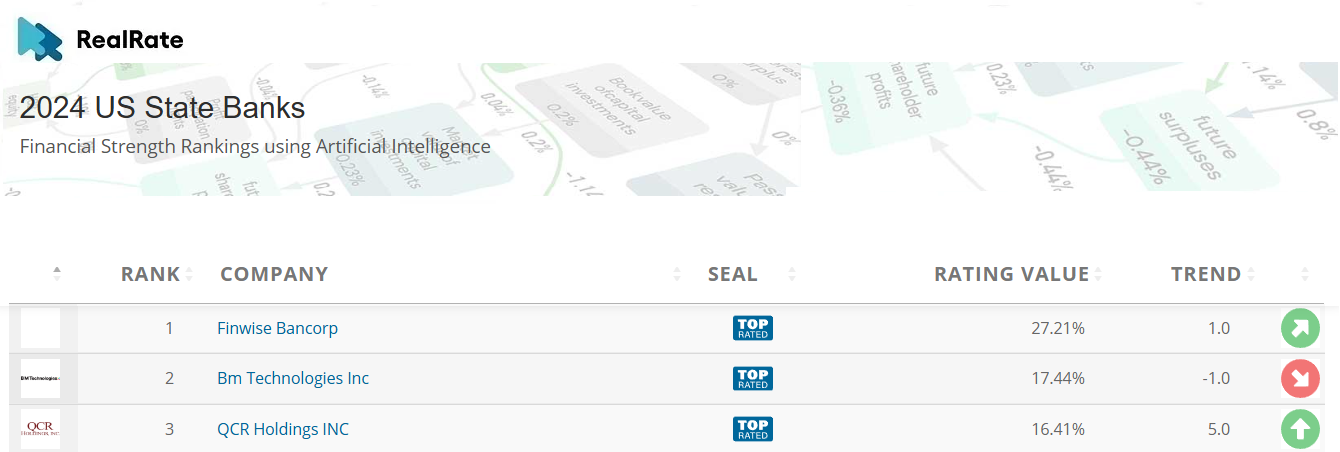

The top 3 U.S. State Banks in order are Finwise Bancorp, BM Technologies Inc., and QCR Holdings Inc.

They had Economic Capital Ratio figures of 27%, 17%, and 16%, respectively.

Finwise Bancorp and QCR Holdings Inc. achieved notable success, with their Economic Capital Ratio (ECR) scores increasing by 26 and 22 percentage points respectively, driven by significant growth in variable other liabilities. Meanwhile, in 2024, BM Technologies Inc. Economic Capital Ratio dropped to 17%, down from 80% in 2023. The company’s strongest contributor, “Other Revenues,” added 139 percentage points, while its greatest challenge, “Other Liabilities,” reduced the ratio by 309 points, highlighting both strengths and areas for improvement.

Finwise Bancorp achieved a remarkable milestone this year, climbing from second place last year to claim the top spot—a truly fantastic accomplishment. BM Technologies Inc. moved down to second place, while QCR Holdings Inc. made an impressive leap, rising five positions to secure third place. Congratulations to all the companies on their achievements!

Source: https://realrate.ai/ranking-area/2024-us-state-banks/

From a total of 139 U.S. State Banks, 34 received our coveted ‘Top-Rated’ award.

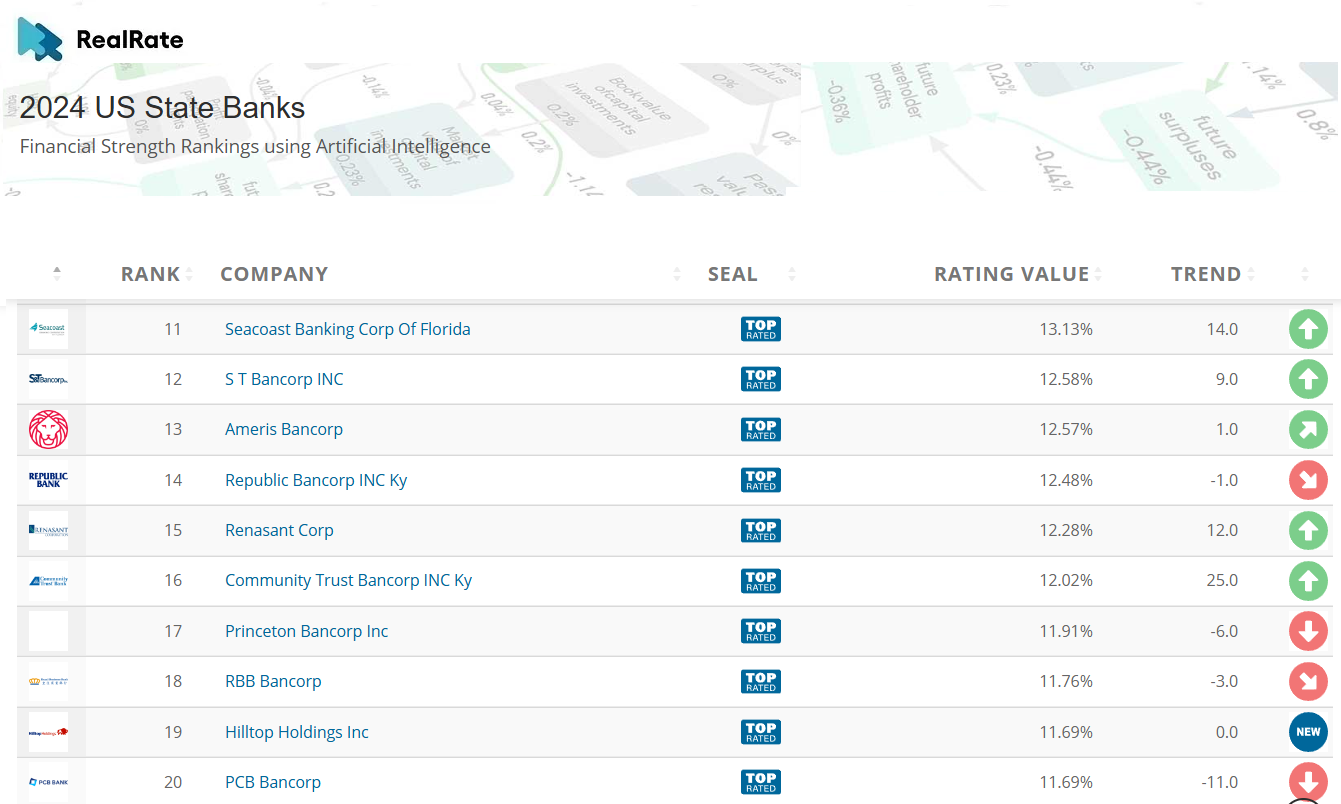

The next 10 U.S. State Banks are as follows:

Source: https://realrate.ai/ranking-area/2024-us-state-banks/

State banks in the U.S. play a pivotal role in local economies by supporting small businesses, offering community-focused financial services, and driving regional development. With advancements in technology, these banks are increasingly adopting smart solutions, such as AI-driven credit analysis and digital banking platforms, to enhance customer experience and operational efficiency.

In 2024, state-chartered banks reported $250 billion in revenue, a 4% increase from the previous year, per the FDIC. Their adaptability drives this steady growth. State banks have long been the backbone of local economies, and with smart strategies in place, they are well-positioned to continue driving growth and prosperity for generations to come. As of 2025, these banks show resilience and growth amid economic challenges.

At RealRate, we are proud to deliver fair and independent ratings that combine expert knowledge with cutting-edge artificial intelligence.

Our innovative approach enables us to compute the Economic Capital Ratio with precision and transparency.

We maintain complete objectivity by relying solely on audited public data. Our ratings are not only fair but also explainable, ensuring clarity and eliminating any conflicts of interest.