Who’s Up, Who’s Down, and How Arista, Apple, and A10 Networks Dominated the Financial Rankings in 2025

Top hardware firms combine booming profits with strong balance sheets as smaller players shake up rankings.

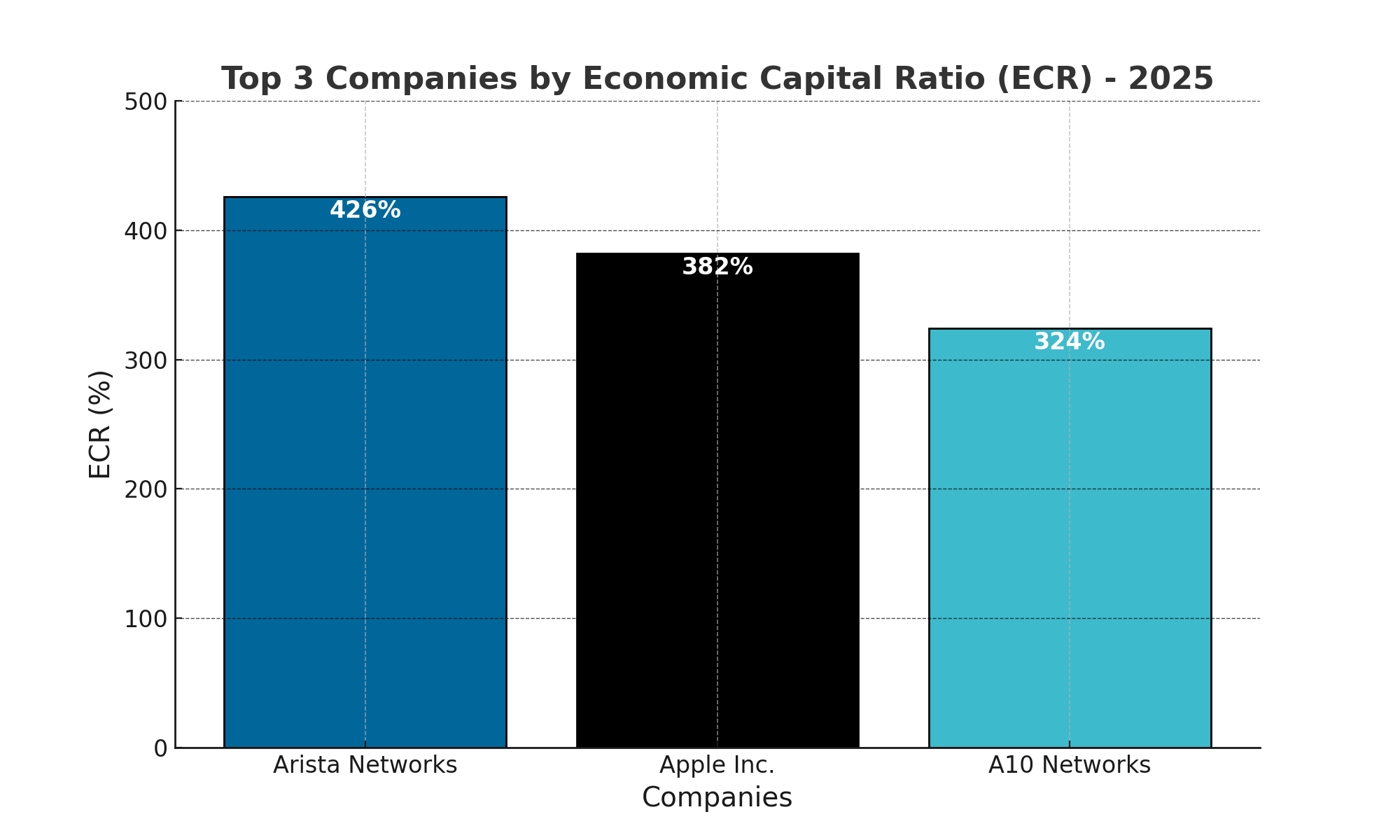

The U.S. computer industry – spanning giants like Apple and Dell alongside niche tech manufacturers – generated hundreds of billions in revenue in 2024. Apple alone posted $391 billion in sales, with Dell and HP contributing tens of billions each. RealRate’s latest 2025 ratings reveal which companies boast the healthiest finances via the Economic Capital Ratio (ECR), a comprehensive metric of balance sheet strength and profitability. We analyze the top three companies and industry trends from RealRate’s data.

Top Performers: Profiles & Financials

1. Arista Networks Inc (Rank 1) – Arista tops the industry for the third straight year, riding on stellar profitability and a solid balance sheet. The cloud networking company has about $14.04 billion in assets vs. $4.05 billion in liabilities, leaving nearly $9.99 billion in stockholders’ equity. In 2024 it earned $7.00 billion in revenues and $2.85 billion in net income – an outstanding 41% net margin. Arista’s ECR of 426% indicates its economic capital is over four times the industry average. According to RealRate’s analysis, Arista’s greatest strength is its net income, which boosts its ECR by an astonishing +232 percentage points above the market average. This reflects extraordinary profitability relative to peers. Its main weakness is having relatively high current assets (cash, inventory, etc.), which actually reduces its ECR by 106 points vs. the average (a sign that Arista holds more low-yield assets than competitors, slightly dragging its efficiency). In short, massive earnings power outweighed any minor balance sheet slack, keeping Arista at the top.

2. Apple Inc (Rank 2)– Consumer electronics titan Apple reclaimed the #2 spot with an ECR of 382%, up from 3rd last year. Apple’s sheer scale is evident – it carries $364.98 billion in assets and $308.03 billion in liabilities, for a healthy equity base around $56.95 billion. In 2024 Apple booked $391.0 billion in revenue and $93.74 billion in net income – by far the largest profits in the sector. RealRate attributes Apple’s financial edge largely to “Comprehensive Net Income”, a broad measure of total earnings that for Apple is 205 percentage points above the market average impact. In other words, Apple’s ability to generate enormous profit (including one-time and other income) hugely boosts its ECR. The greatest weakness for Apple is its Cost of Goods Sold (COGS) – its massive production and component costs – which drag its ECR down by 154 percentage points compared to competitors. This reflects Apple’s heavy manufacturing expenses (the flip side of its revenue scale). Even so, with a 382% ECR Apple’s balance of high equity and record earnings places it firmly among the industry’s elite. Its one-notch rank climb underscores Apple’s improved financial position versus last year, despite slightly lower ECR than its 2023 value (388%).

3. A10 Networks Inc (Rank 3)– A10 Networks,a smaller networking hardware firm, is 2025’s breakthrough entrant to the top three. With an ECR of 324%, A10 jumped from 6th to 3rd place on RealRate’s list. The company’s absolute size is modest – $432.8 million in assets and $201.0 million in liabilities, leaving $231.8 million equity. 2024 revenues were $261.7 million with $50.1 million net income, a robust ~19% profit margin. A10’s ECR surge reflects rapid improvement in its finances. RealRate highlights net income as A10’s biggest strength, contributing +146 percentage points to its ECR above the industry average – a testament to A10’s strong profitability growth (it turned a healthy profit relative to its size). The biggest factor holding its ECR back was Administrative and Marketing Expenses, which were higher than average and reduced A10’s ECR by 28 points. By controlling costs and sustaining solid earnings, A10 was able to vault into the top tier. Its rise exemplifies how mid-size companies can rapidly climb the rankings with improved balance sheets – just a year earlier, A10’s ECR was 313% and ranked #6, whereas now it’s firmly in third place.

Historical Trends for the Leaders

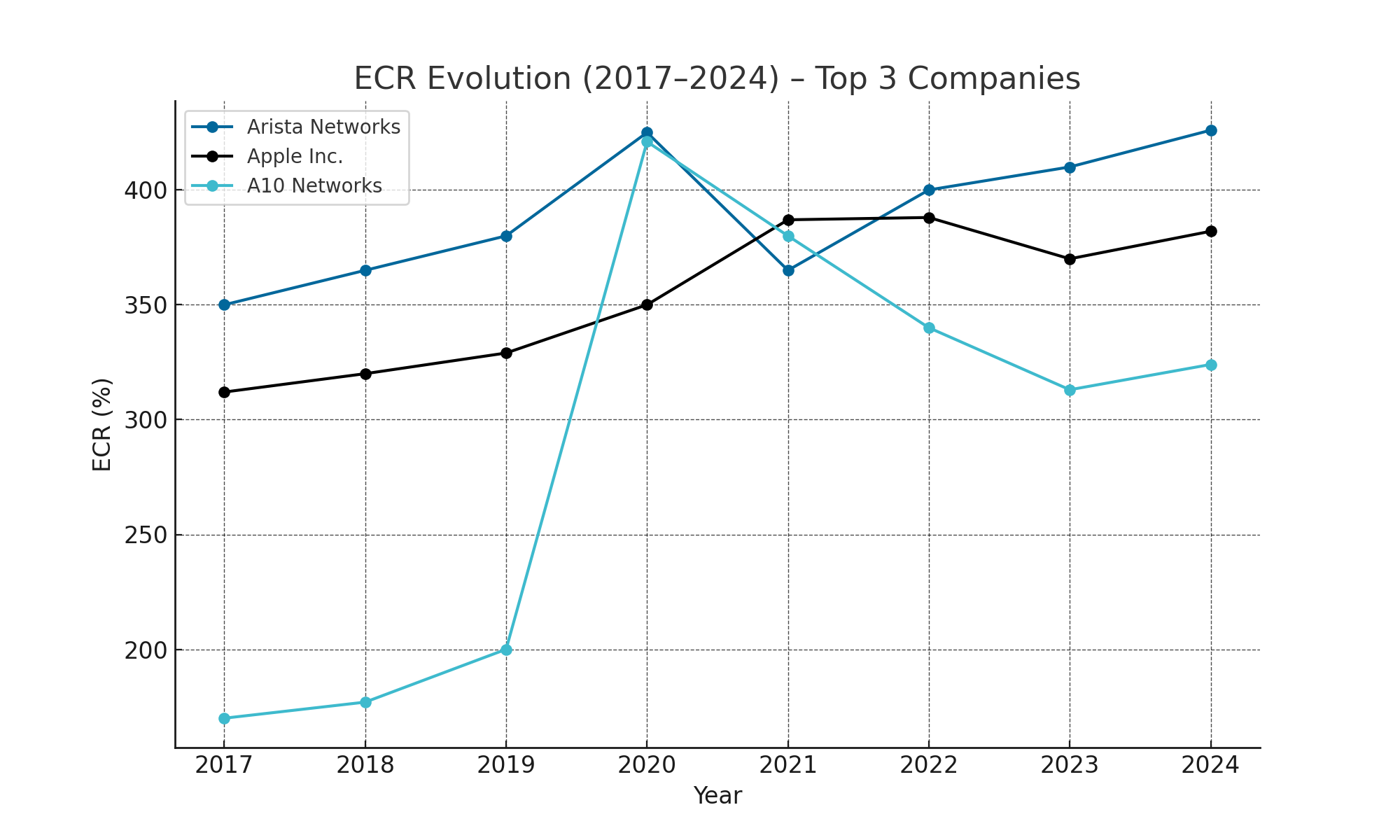

(Figure 1: Evolution of Economic Capital Ratio for Top 3 Companies, 2017–2024. Arista Networks (dark blue) maintained a high ECR, Apple (black) dipped then rose, and A10 Networks (light blue) surged especially after 2020.)

The year-by-year ECR trends for the top 3 companies reflect shifting fortunes. Arista Networks has consistently been high-ECR, hovering in the mid-300%–400% range since the late 2010s. It briefly fell from 425% to 365% in 2020 but rebounded to the 426% range in 2024, keeping it #1. Apple Inc saw a dip in the mid-2010s (ECR bottoming out at 312% in 2017) as its balance sheet leveraged, then a steady rise. Apple’s ECR jumped from 329% in 2020 to 387% in 2021 (as it amassed cash during peak growth), and it remains elevated at 382% in 2024. A10 Networks shows the most dramatic trajectory: its ECR was relatively low (~170%–177%) in 2017–2019, then leapt to 421% in 2021 as the company improved profitability, before normalizing to 324% in 2024. This propelled A10’s rank from #11 in 2020 to #3 now. These patterns illustrate how strong earnings and prudent balance sheet management translate into higher ECR scores over time.

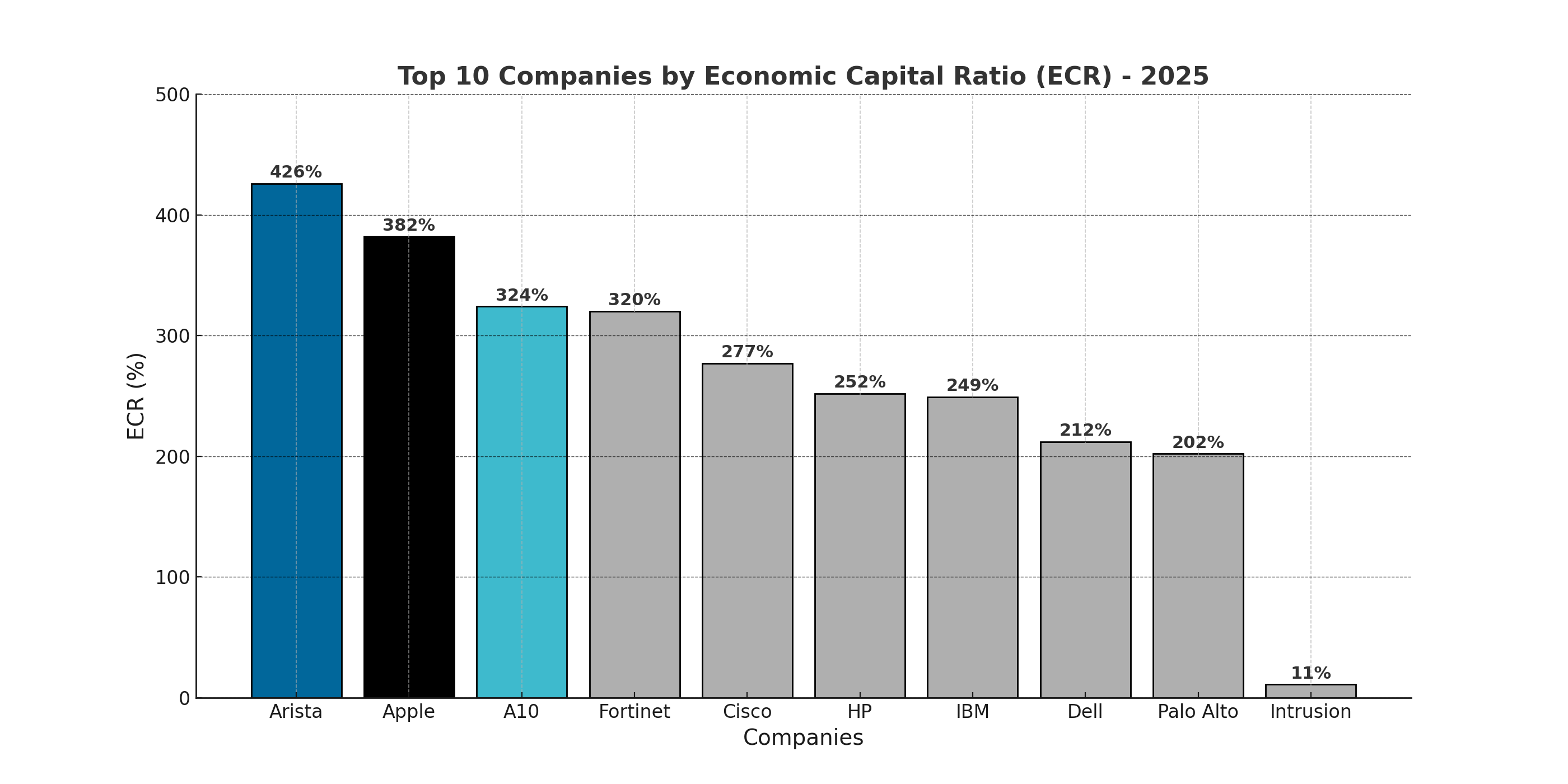

The Top 10 companies are as follows:

Notable Movers and Industry Shifts

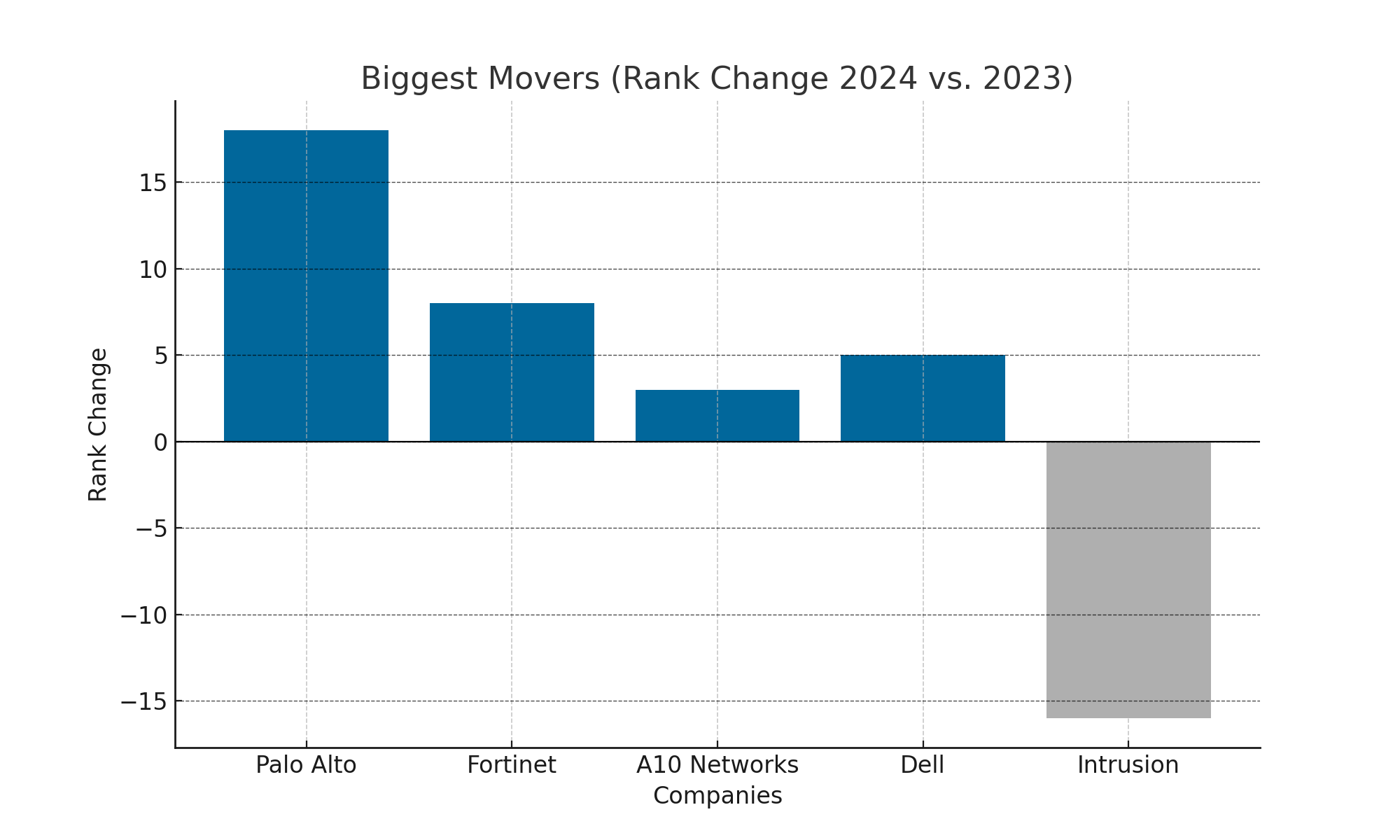

Beyond the top three, RealRate’s data reveals several big movers in rank and ECR:

- Fortinet Inc – The cybersecurity firm climbed to Rank 4 (ECR 324%) in 2025 from rank 12 just two years prior. Its ECR rose from ~277% to 324%, reflecting improved capital ratios and earnings. Fortinet’s upward trajectory nearly tied it with A10 for the #3 spot.

- Palo Alto Networks Inc – Perhaps the most striking jump, Palo Alto vaulted from Rank 24 in 2022 to Rank 6 in 2024, as its ECR exploded from ~178% to 302%. This dramatic +18 rank swing was driven by a turnaround to strong profitability. Palo Alto is a prime example of a mid-cap company rapidly strengthening its financial footing.

- Intrusion Inc – A small security firm, Intrusion has been extremely volatile. It ranked #1 in 2018–19 with off-the-charts ECR (peaking at 911% in 2019), then plummeted to rank 32 by 2021 as its ECR collapsed to essentially 0%. Now in 2025 it has stabilized at Rank 16 with an 11% ECR – far lower than peers but a positive turnaround from near insolvency. Intrusion’s wild ride shows how quickly fortunes can change for smaller companies – a few weak quarters erased its early advantage.

- Dell Technologies Inc – PC maker Dell returned to the rankings at Rank 14 (ECR 212%) after being absent in 2023 (due to data timing or restructuring). Dell’s ECR is below the 241% industry average, reflecting its heavy debt load from past mergers. RealRate finds Dell’s biggest weakness is its cost of goods sold, which slashed its ECR by a huge 277 percentage pointsrealrate-archive.comrealrate-archive.com (Dell’s low-margin hardware business weighs on its capital ratio). Still, Dell’s re-entry indicates slightly improved finances versus its prior state.

- HP Inc and IBM – These veteran giants remain mid-pack. HP Inc is ranked #9 (252% ECR) and IBM #11 (249% ECR), both relatively stable. Their ECRs are close to the average, as large liabilities (pensions, debt) offset their substantial equity. Neither saw big rank changes this year.

On the downside, a few smaller companies dropped out of the 2025 rankings due to data or financial issues. For example, BIO-key International, ranked 15th in 2023, is not ranked in 2024 (its ECR fell to effectively zero). RealRate typically excludes firms with negative or missing equity from the ranking count. This culling of weak players helped trim the field to 17 ranked companies in 2025.

Overall, the industry’s Economic Capital Ratio average is 241% – meaning on average, companies have about 2.4× more “economic capital” than the baseline requirement. However, the standard deviation is high (~115% ECR), signaling a wide gap between cash-rich, low-debt leaders and those barely in the black. In fact, ECR values range from roughly 0% (distressed firms) to over 400% (top performers). This spread underscores a bifurcation in the industry: a handful of extremely strong companies carry the sector’s financial resilience, while a tail of smaller firms struggle with thin equity.

Despite economic headwinds in 2024, the average ECR ticked up by ~10 percentage points year-on-year based on companies present in both years. In other words, the industry’s financial health improved modestly on average. Many firms either deleveraged or grew equity through profits. For example, Apple’s ECR rose ~+12 points vs 2023, Fortinet’s jumped +34, and even cash-intensive hardware makers like Cisco and HP managed to maintain solid ratios (Cisco’s 277% ECR, though down from 318%realrate-archive.com, is still robust). This trend suggests that, overall, U.S. computer companies entered 2025 on stronger financial footing, helped by sustained demand and profits during 2024.

Drivers of High ECR and Industry Insights

What factors separate the leaders from the laggards ? The data offers clues by quantifying how each financial variable deviates from the industry norm for a given company:

- For top-ranked firms, profitability metrics are the key differentiators. As noted, Arista, Apple, and A10 all benefit from outsized net income or comprehensive income contributions (ranging +146 to +232% above average). High retained earnings bolster equity and ECR. Revenue growth alone, however, is not enough – it must translate into profits. Apple, for instance, has enormous revenue, but it’s the quality of those earnings (strong comprehensive net income) that boosts its ECR mostrealrate-archive.com.

- Cost structure and efficiency also play a pivotal role. Apple’s and Dell’s heavy cost of goods sold burden their scoresrealrate-archive.comrealrate-archive.com, whereas companies with leaner cost bases (software-leaning firms or those with higher service margins) fare better in ECR. A10’s relatively high SG&A (marketing/admin expenses) slightly hurt its rating, whereas Arista’s expenses are more in check. Essentially, firms that manage expenses and overhead better than peers see a higher ECR, all else equal.

- Balance sheet composition can help or hurt. RealRate’s analysis penalizes excess idle assets. Arista’s large current asset reserves (likely cash and receivables) actually count against it to some degreerealrate-archive.com. Conversely, companies deploying assets effectively (or with more non-current assets like equipment that directly drive revenue) don’t incur that penalty. Goodwill and other intangibles have mixed effects: they increase assets but not equity; for most top companies, goodwill is minimal, whereas those with big acquisitions (e.g., Dell’s goodwill write-offs) see lower ECR. The “Limited Liability” adjustment in RealRate’s rankings also caps the benefit of extremely high equity for some firms, normalizing ECR – Arista’s ECR before this cap is 319% but after is 426%, indicating an adjustment.

In summary, the **2025 RealRate rankings highlight that U.S. computer hardware companies with strong profits, moderate liabilities, and controlled costs come out on top. High ECR scores like those of Arista and Apple signal a fortress-like financial position – ample equity buffers, far above what the average competitor has. Lower ECR scores, as seen in smaller firms, often reflect either slim earnings (or losses) or heavy debt loads.

Industry Outlook

RealRate’s data paints an overall positive picture for the industry’s financial stability. The average ECR of 241% means the typical computer company’s capital strength is well above baseline, and it improved from the prior year. The top 3 firms (Arista, Apple, A10) have pulled ahead by leveraging booming demand (cloud networking, consumer tech, cybersecurity) into financial robustness. Meanwhile, the shake-up just below them – with Fortinet and Palo Alto ascending – suggests competition is alive and well, driven by innovation and prudent management.

However, the wide ECR dispersion signals potential vulnerabilities: a few firms at the bottom (Intrusion, Dror Ortho Design, etc.) have extremely low capital ratios, meaning any downturn could put them at risk. Mid-tier players like Dell and HP, while stable, must contend with legacy costs that keep their ECRs near average.

In the coming year, investors and stakeholders will be watching whether these trends continue. Will Arista extend its reign with continued high margins? Can Apple maintain its financial might amid headwinds? And will new challengers like A10 and Palo Alto climb further or slip back? RealRate’s AI-driven ratings offer an objective lens on these questions, distilling complex financials into a single powerful metric. For now, the 2025 results confirm a truth in tech: the winners aren’t just those with popular products, but those with the balance sheets to weather any storm.

Overall Industry Stats (2024 data): The 17 ranked U.S. computer companies averaged an ECR of 241%, with a standard deviation of ~116%, reflecting wide variance in financial strength. On average, companies improved their ECR by ~10 points year-over-year, indicating slight overall strengthening of balance sheets. Total assets of the ranked firms sum into the hundreds of billions of dollars, and aggregate 2024 revenues exceed $700 billion. Net income margins range from negative to over 30%, underscoring the diversity in operational performance within the industry.

Conclusion

The RealRate 2025 ratings underscore which computer industry players are built to last. Arista Networks, Apple, and A10 Networks lead due to exceptional profitability and solid capital positions, while other notable climbers have leveraged improvements in specific areas (Fortinet’s rising profits, Palo Alto’s turnaround). The analysis also highlights the importance of cost management and strategic balance sheet use – even tech titans must mind their fundamentals. As the U.S. computer sector moves forward, these financial dynamics will remain as critical to watch as the latest gadgets and innovations.