J&J Snack Foods, Lifeway Foods, and Tyson Foods emerge as the U.S. food sector’s healthiest performers. Smaller contenders leapfrog industry giants in RealRate’s latest financial strength rankings.

The U.S. food industry has a new pecking order when it comes to financial health. RealRate’s Economic Capital Ratio (ECR) rankings for the marketing year 2025 (based on 2024 financial statements) reveal a surprising shake-up: niche players are outperforming some household-name giants in financial robustness. The ECR is a measure of a company’s economic capital adequacy (higher percentages indicate greater financial strength or “surplus” capital relative to risks). In an analysis of 29 food companies, RealRate’s AI-driven model has identified the Top 3 Food Companies in terms of financial strength – and the results are eye-opening.

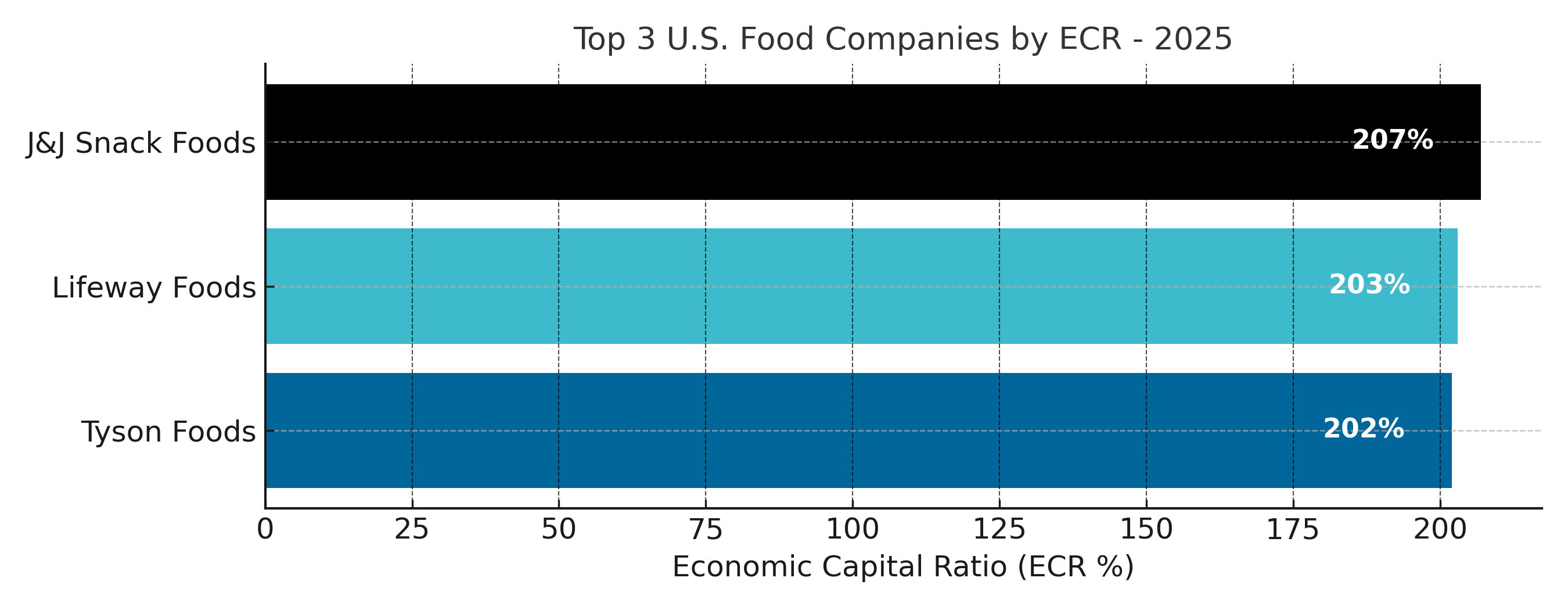

Top 3 Financially Strongest Food Companies in 2025

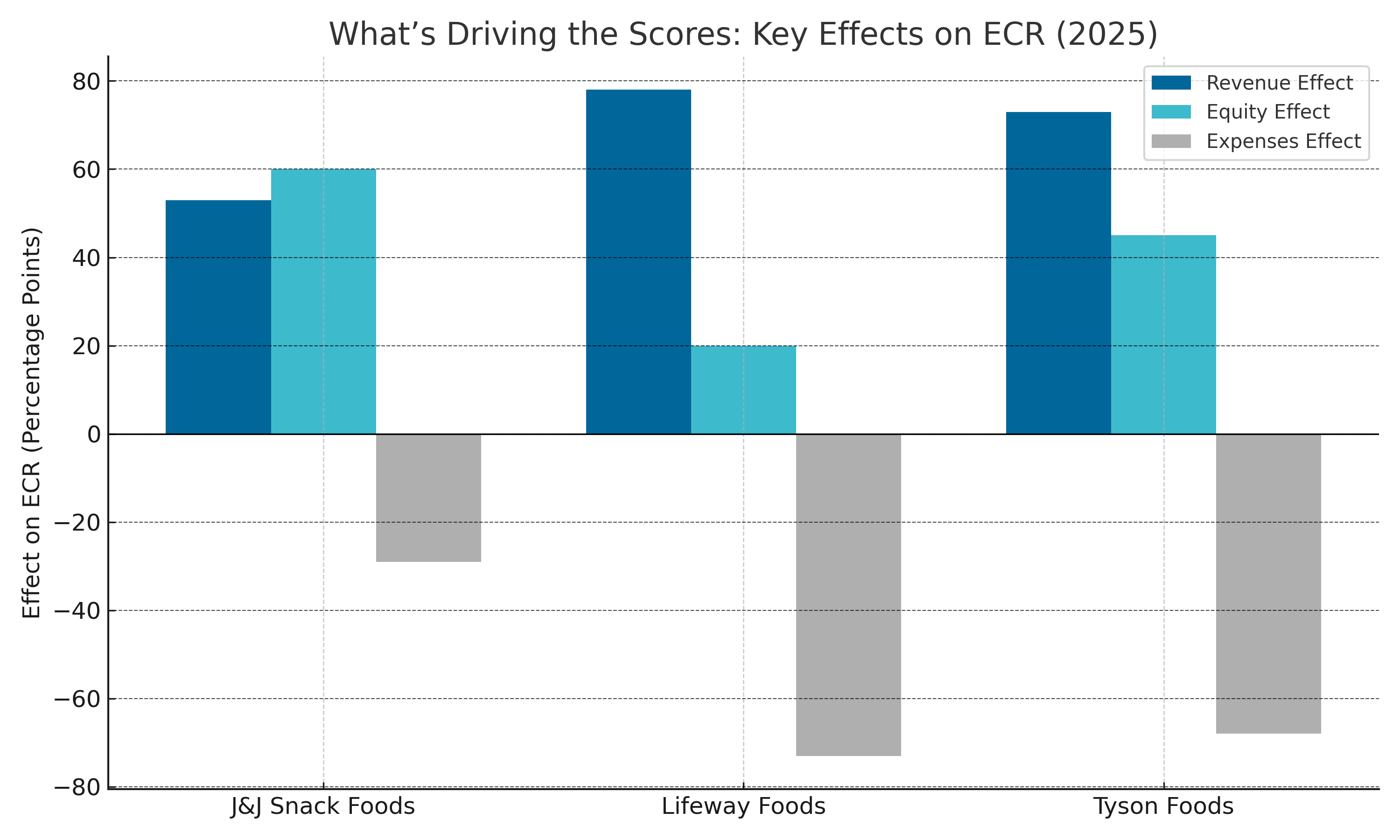

The top three 2025 U.S. food companies for financial soundness are J&J Snack Foods Corp, Lifeway Foods Inc, and Tyson Foods Inc. J&J Snack Foods leads with a 207% ECR, meaning it has roughly twice the needed capital – a sign of exceptional financial cushion. Lifeway Foods, a much smaller dairy company, is close behind at 203%, and meat giant Tyson Foods follows with 202%. These percentages indicate substantial financial strength; for context, the industry average ECR is 157%. In other words, the top 3 are 50+ percentage points above the industry’s average financial strength, highlighting how far ahead they are in terms of capital adequacy.

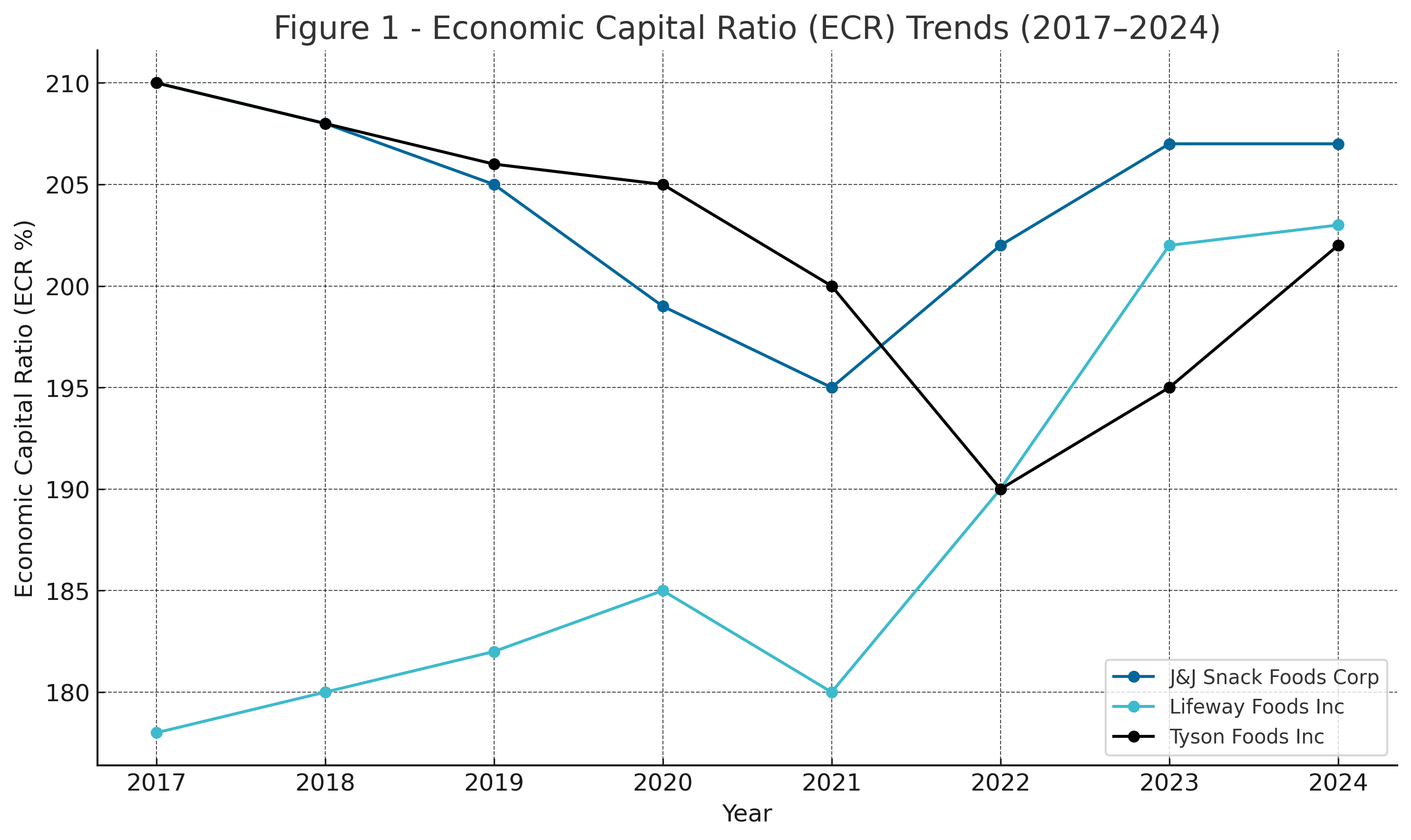

“Figure 1: Economic Capital Ratio (ECR) trends (2017–2024) for the top 3 U.S. food companies. Each company’s ECR – a measure of capital strength – is plotted by year. J&J Snack Foods (dark blue) consistently maintained an ECR around 200% or higher, Tyson Foods (black) showed fluctuating yet solid ECR near 205% until a dip in 2023, and Lifeway Foods (light blue) surged dramatically by 2023–2024 after a period of lower ECR in the upper 170% range.”

As Figure 1 indicates, J&J Snack Foods Corp has been consistently robust. Its ECR has hovered in the 200–215% range for most of the past decade, dipping slightly in 2020–2021 but climbing back to ~207% in 2024. Tyson Foods Inc, a much larger enterprise, also maintained ECR levels above 200% in prior years, though it experienced a noticeable drop in 2023 (to ~190%) before rebounding to 202% in 2024. The most dramatic story is Lifeway Foods Inc: for years, this probiotics and dairy-based beverages producer had ECR in the 170–190% range (still healthy, but not top-tier). However, by 2023 Lifeway’s ECR skyrocketed to ~202%, from 180% two years prior. This propelled Lifeway upward in the rankings, signaling vastly improved financial footing.

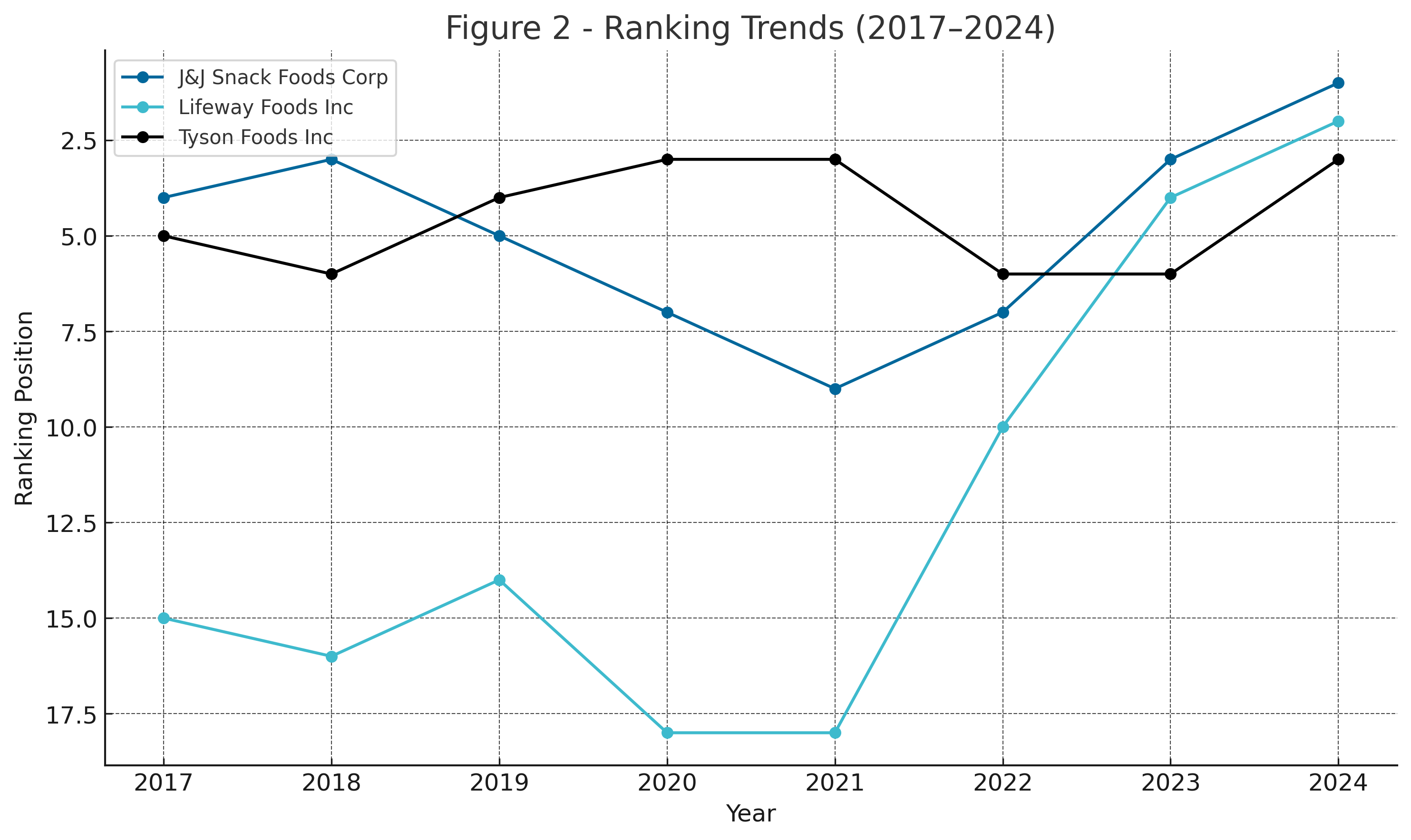

“Figure 2: Rank trends (2017–2024) for the top 3 U.S. food companies. Lower numerical ranks indicate better financial strength (1st = strongest). J&J Snack Foods (dark blue) and Tyson Foods (black) consistently maintained strong positions, regularly appearing among the top 5 and occasionally exchanging ranks. Lifeway Foods (light blue) notably improved its ranking from mid-teens before 2021, rapidly ascending into the top 5 by 2023 and ultimately securing 2nd place by 2024.”

Figure 2 tells the tale of these rank movements. J&J Snack Foods has been a stalwart: it was ranked #4 in 2017 and #3 in 2018, and despite some slippage to 7th–9th place in 2020–2021, it rebounded to #3 in 2023 and finally claimed the #1 spot in 2024. Tyson Foods has similarly been a steady top contender – it was #5 in 2018, rose to #3 by 2022, briefly dropped to 6th in 2023, and is back up to #3 in 2024. The real surprise is Lifeway Foods: for much of the past decade Lifeway was a second-tier player (ranked 10th to 18th range). In 2021 it sat at 18th, but by 2023 Lifeway had leaped to 4th, and now in 2024 it’s firmly in 2nd place. This meteoric rise reflects Lifeway’s significant strengthening of its balance sheet and risk profile in recent years.

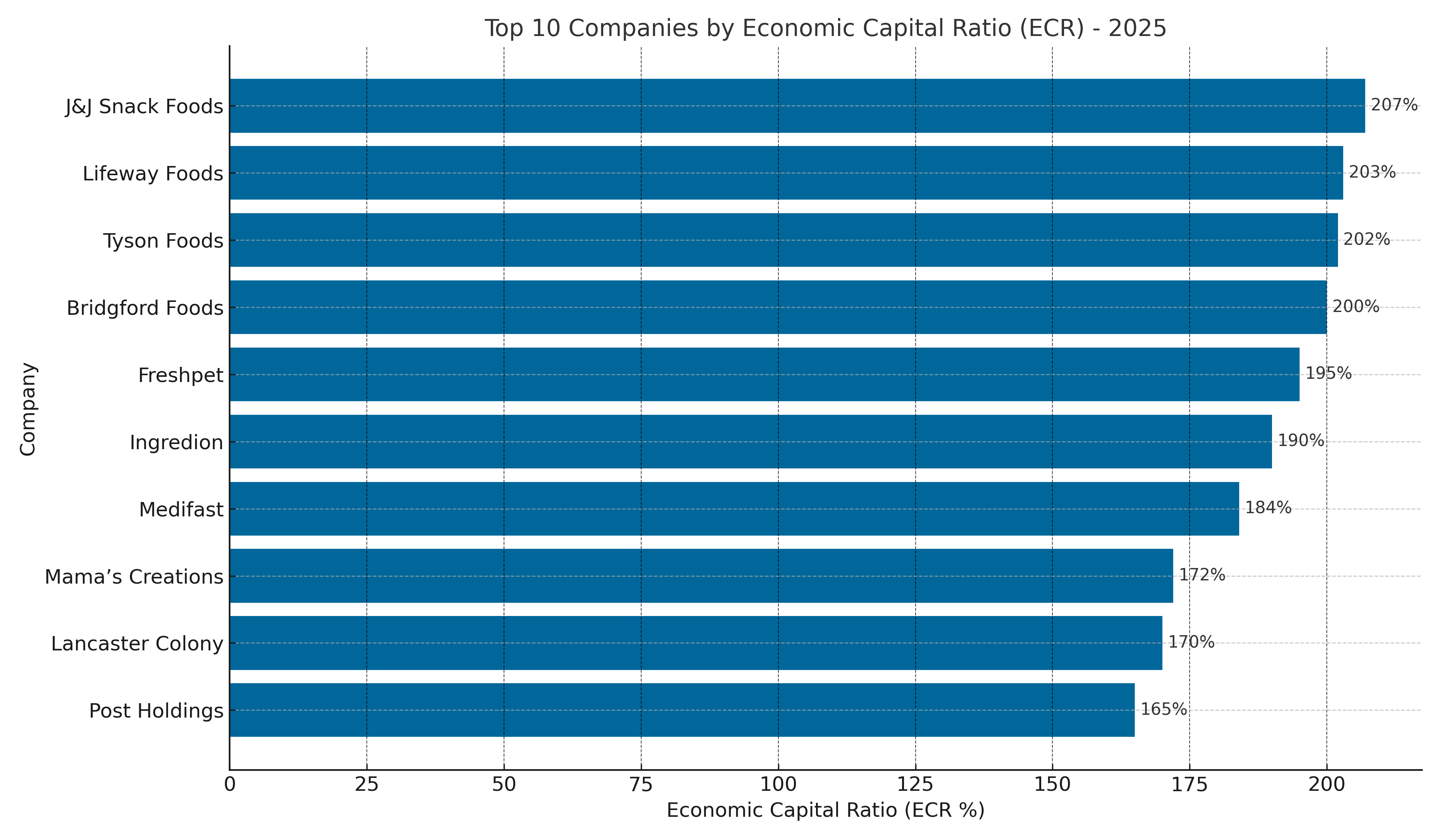

Top 10 US Food Companies are as follows:

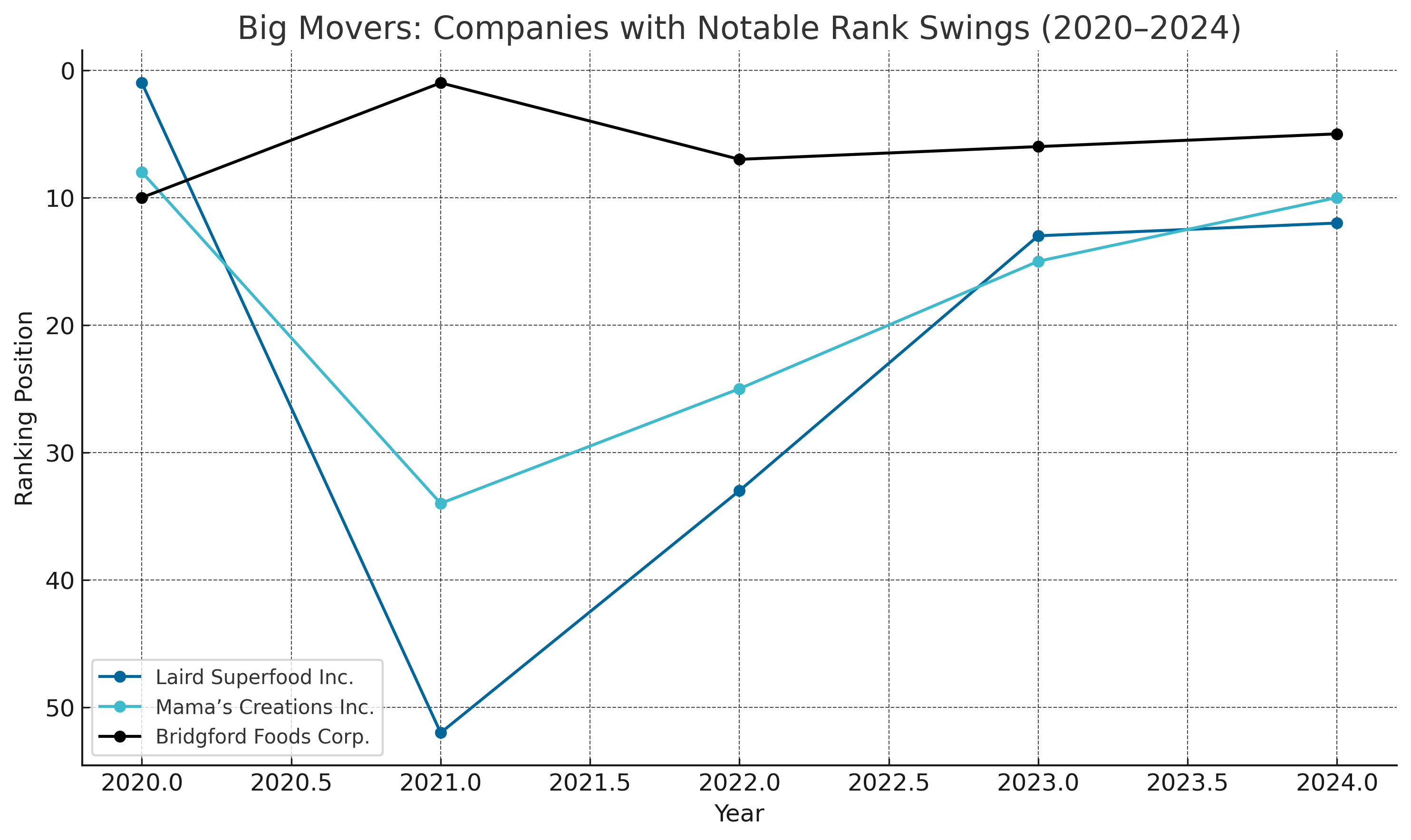

Big Movers: Companies with Notable Rank Swings

Several companies in the U.S. food industry experienced dramatic rank fluctuations in recent years. Laird Superfood Inc. notably plunged from the #1 spot in 2020 down to #52 in 2021, due to significant financial setbacks, but recovered partially to #13 by 2023. Mama’s Creations Inc. also swung widely, jumping into the top 10 in 2021, falling sharply to #34 in 2022, then rebounding to #10 in 2024. Even stable firms like Bridgford Foods Corp. and Medifast Inc. saw notable shifts, highlighting volatility tied to strategic decisions, operational efficiency, and market conditions.

Industry Outlook: Growth, Challenges, and Context

The U.S. food industry, valued at over $1.4 trillion annually, is navigating opportunities like plant-based products and sustainability trends alongside challenges such as inflation and supply chain disruptions. Financially stable companies, indicated by higher ECRs, have greater flexibility to adapt and invest in innovation. Size alone does not dictate financial strength—smaller, agile companies often outperform larger ones burdened by debt and acquisition-related intangibles. Going forward, companies managing their balance sheets effectively will be best positioned for sustained growth amidst evolving market dynamics.

In conclusion, the RealRate 2025 rankings offer a clear message: financial fitness is about quality, not quantity. Agile mid-cap firms like J&J Snack Foods and Lifeway Foods can outshine much larger competitors in financial health. Tyson Foods proves that even a giant can attain excellence in capital management. Meanwhile, significant rank swings remind us that today’s leader could be tomorrow’s turnaround story if complacency sets in. For stakeholders – from investors to customers – these rankings provide a unique lens on which companies are built for the long haul. As the U.S. food industry navigates a post-pandemic world and evolving consumer appetites, the companies with rock-solid finances (and the strategic flexibility that comes with that strength) will be best positioned to thrive. In the business of food, it turns out you not only are what you eat – you are also what your balance sheet says you are.

Ranking Video: