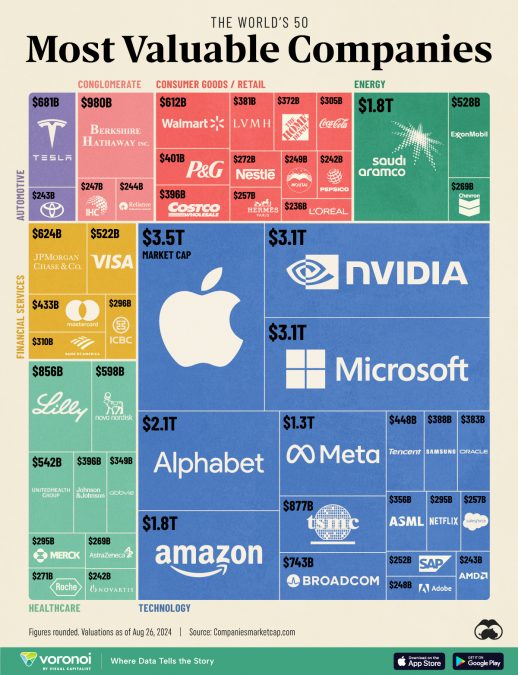

The most avid of RealRate news followers will remember that back in March this year we wrote an article on Nvidia’s rise to the top of the business world, largely in part to the boom in AI and the clammer for the company’s precious graphics chips.

Well, Nvidia may have slipped back to 2nd position in this time ($3.111 billion market cap, behind Apple’s $3.454 billion but ahead of Microsoft’s $3,073 billion), but they are still in a very healthy position financially.

Indeed, the American chipmaker announced only yesterday second-quarter revenue of $30 billion, more than double the amount from the same period last year. Net income for the fiscal second quarter reached $16.6 billion, also more than twice its value compared to the previous year.

Both figures surpassed analysts’ expectations compiled by Visible Alpha. However, growth slowed compared to earlier quarters, leading to a decline in shares during extended trading on Wednesday after the results were released.

Although these results are impressive, Nvidia only appears 30th out of 59 companies in RealRate’s 2024 U.S. Semiconductor ranking. They are not even one of the 14 Top-Rated companies.

Why is this?

Well, RealRate uses AI to deliver fair and independent ratings, bringing together expert knowledge with this innovative artificial intelligence.

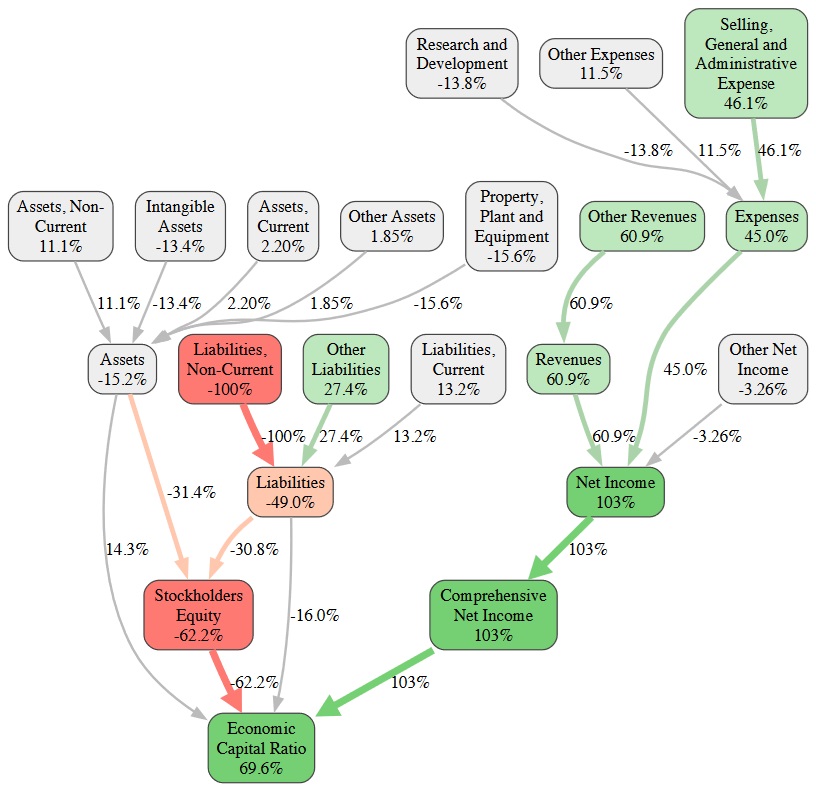

We use both of these to compute the Economic Capital Ratio figure, and it is this figure which determines a company’s ranking. This key figure measures the market value of the company in relation to all of its assets. So, we adjust for size. There is no bonus for being big. All that matters is the relative structure of its balance sheet and profit and loss statement.

Let us have a look at our famous causal graph to identify Nvidia’s strengths and weaknesses.

Source: https://realrate.ai/rankings/

Its biggest strength compared to their competitors is its Comprehensive Net Income, increasing the Economic Capital Ratio by 104 percentage points. As you can see, this can be traced back to its high Net Income which again is due to high Revenues as well as low Selling and General and Administrative Expenses. On the negative side, Nvidia’s Stockholders’ Equity is comparatively low due to its high Non-Current Liabilities.

So, from a purely fundamental point of view Nvidia’s balance sheet structure is not exceptional. Of course, its unbelievable growth has not been captured by this approach (yet).

We hope you like this quite different view on the data. Our approach helps you to understand an annual report within just two minutes. And the AI black box becomes a white one using RealRate’s causal approach.

At RealRate, we are unbiased and work only with audited public data. We are not only fair but also explainable and have no conflicts of interest.

Image Source: https://www.visualcapitalist.com/ranked-the-50-most-valuable-companies-in-the-world-in-2024/