Mecklenburgische Kranken occupies 1st place in the ranking for the first time. In previous years it was ranked 4th and 2nd, so there has been a steady improvement. With an economic equity ratio (economic equity to total assets) of 51.4%, it is well ahead of runner-up and last year’s winner R+V Kranken (ecological equity ratio 24.7%). The third place on the podium is secured by ENVIVAS Kranken (ecological equity ratio 22%).

This year again confirms the observation that size alone does not lead to high financial strength. Numerous industry giants are below the market average: Allianz (22nd), ERGO (28th), AXA (29th), Generali (31st), and DKV (32nd).

A total of 32 German health insurers were analyzed in terms of their financial strength. Two parameters are central to high financial strength: first, HGB equity, and second, underwriting profitability in the form of risk and other results. In addition, portfolio stability and investment income also play an important role.

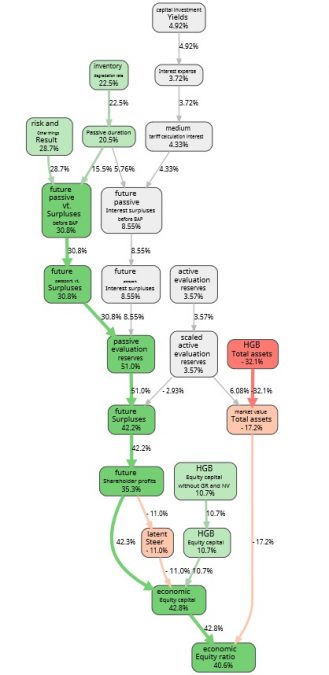

The RealRate valuation model does not work with fixed weights but determines the fair economic enterprise value using a holistic valuation approach. As the chart shows, the numerous pieces of information from the balance sheet and income statement are combined step by step until they lead to the enterprise value, the economic equity.

The strength of Mecklenburgische starts with the very strong risk and other result. In combination with the high portfolio stability (low portfolio erosion rate), this leads to high expected surpluses. Policyholders also benefit from this due to the surplus participation.

The greatest strength of Mecklenburgische Kranken compared with the market average is the valuation reserves on the liabilities side, which increase the economic equity ratio by 51 percentage points. The economic equity ratio, as shown in the ranking table, is 51%, 41 percentage points above the market average of 11%. A comparison with previous years shows that the improvement in valuation reserves on the liabilities side in particular contributed to Mecklenburgische Kranken’s rise. The high margins in underwriting and reserving set Mecklenburgische apart from its competitors.

The complete ranking is available at:

https://realrate.ai/ranking-area/2023-de-health/

The methodology used in “explainable artificial intelligence using the example of ratings of German life insurance companies”, https://elibrary.duncker-humblot.com/article/70819/erklarbare-kunstliche-intelligenz-am-beispiel-von-ratings-deutscher-lebensversicherungsunternehmen

The insurance journal is currently also reporting on this ranking: “These private health insurers are particularly financially strong”, https://www.versicherungsjournal.de/markt-und-politik/diese-privaten-krankenversicherer-sind-besonders-finanzstark-148914